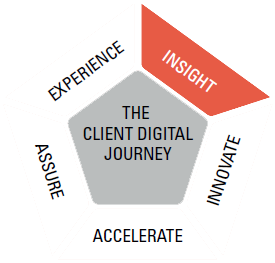

Insight

AI-led insights will show

your customers what

to buy next

Data is the lifeblood of the enterprise that aspires to be digital. It is that strategic asset that helps the business learn about evolving opportunities, hidden threats, changing customer expectations and the competitive landscape, in context and in time to respond meaningfully. This, in turn, helps to automate the supply chain, drive continuous innovation, and create micro-moments-based customer experience. Artificial intelligence (AI) powers the core of this data-driven enterprise and creates signals that then act on the business to bring transformational value. When this is enabled in a do-it-yourself culture, everyone, at any given time, is able to move quickly in the right direction to defend, differentiate and even reimagine the business.

We help our clients adopt this approach to ubiquitously creating value from data.

We move them away from the conventional use case or point‑solution-led approach, towards the path to building industrialized capabilities to monetize data. We begin by creating an integrated blueprint of opportunities – unique to their businesses – for data-led value creation. Thereon we chart the roadmap to incrementally build the capabilities they need to deliver on the blueprint. This involves :

- Modernizing the core to prepare for the digital transformation

- Building systems that interpret data cognitively to discover new signals and connect the unconnected

- Leveraging AI to nurture a learnable and adaptable enterprise that evolves at digital speed

Modernizing entails releasing data and insights hidden in the legacy landscape and creating a flexible mesh of foundational services. This foundation can then be broken down into components that can be dynamically organized in several ways and automated to deliver against an evolving context. This also often necessitates divesting or modernizing the legacy systems that lie at the core of the enterprise. For example, recently, we worked with a retail mortgage bank, to advance their ability to generate credit scores for potential customers and process applications in real time. We re‑engineered their credit acquisition decision engine and also transformed their legacy mainframe environment to improve its agility. Today, the bank generates applicant credit scores in less than 50 milliseconds.

Having released data from the core, the next task is to digitize the data supply chain and turn it into an asset that can be interpreted cognitively and leveraged for making data-led decisions across the enterprise. We do this for several of our clients in the retailing business. We work to make sense of their structured and unstructured data around consumer actions, response to promotions, SmartLabel scans, product affinities, customer propensities, along with price and promotion sensitivities. We then use machine learning models to improve the recommendation logic for their real-time product promotions.

We put to use several AI models to solve business problems in an expert-assist, near-fully-automated mode. This allows for continuous learning and continuous improvement to be factored into both validated and new models. A case in point is how this is delivering value for our clients in the financial services business. We deploy AI techniques to detect anomalies in data values and transaction volumes that point to suspicious events and then alert decision-makers to potentially fraudulent activities. We even study these patterns to predict incidents and enable just-in-time prevention of irregularities.

With this approach, enterprises can build a fabric for data to become the new internet, connecting all the dots that matter, the driver of all enterprise decisions, and the advantage that everybody has equal access to. With that, it will not be data that differentiates the winning enterprises from the also-rans. It will be people – amplified by this data, to be able to make connections unseen before, to find problems unarticulated before, and to build solutions that solve the unsolvable, through collaborative relationships that benefit customers in ways unexplored.

“ Within ABN AMRO, we believe that we can generate true value from data by delivering innovative analytics capabilities and enabling access to high-quality data. We have demonstrated the first tangible results that created such enthusiasm that we decided to overhaul our entire data management ecosystem. We are implementing modern and metadata-driven data distribution technologies and are adopting AI capabilities from public cloud providers. ”