Financials

Corporate governance report

Our corporate governance philosophy

Good corporate governance is about maximizing shareholder value on a sustainable basis while ensuring fairness to all stakeholders: customers, vendor-partners, investors, employees, government and society.

– N. R. Narayana Murthy

We are committed to defining, following and practising the highest level of corporate governance across all our business functions. Our corporate governance is a reflection of our value system encompassing our culture, policies, and relationships with our stakeholders. Integrity and transparency are key to our corporate governance practices and performance and ensure that we retain and gain the trust of our stakeholders at all times.

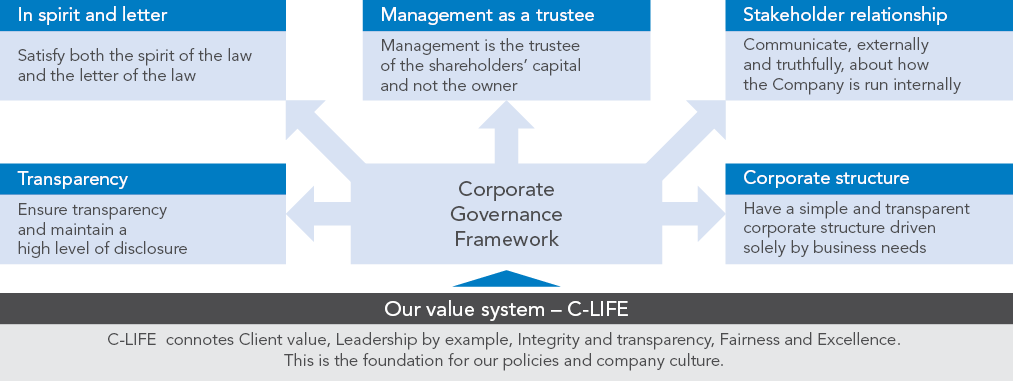

Corporate governance framework

The driving principles of our corporate governance framework are encapsulated in the following diagram:

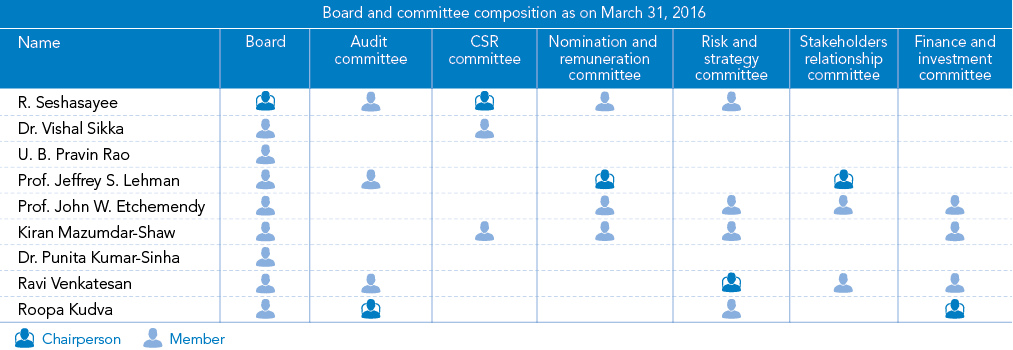

This framework ensures effective engagement with our stakeholders and helps us to be guided by our core values, and at the same time allows us to do more and be more for our stakeholders. Our corporate governance framework ensures that we make timely disclosures and share accurate information regarding our financials and performance, as well as disclosures related to the leadership and governance of Infosys (‘the Company’). We believe that an active, well-informed and independent board is necessary to ensure the highest standards of corporate governance. At Infosys, the Board of Directors (‘the Board’) is at the core of our corporate governance practice. The Board thus oversees the Management’s functions and protects the long-term interests of our stakeholders. As on March 31, 2016, the Board consists of nine members of which seven are independent directors. An independent director is nominated as the chairperson of each of the Board committees, namely audit, nomination and remuneration, stakeholder relationship, risk and strategy, finance and investment and corporate social responsibility committees.

Compliance with global guidelines and standards

We comply with a broad selection of key governance principles and regulations. For example, the Cadbury Report in the U.K. in 1992 was a significant event in modern corporate governance. The report recommended the arrangement of company boards and accounting systems to reduce corporate governance risks and failures. The enactment of the Sarbanes-Oxley Act, 2002, resulted in the senior management individually certifying the accuracy of their company’s financial information. The Dodd-Frank Wall Street Reform and Consumer Protection Act sought to build a safer, more stable financial system to set the foundation for sound economic growth and job safety.

The Securities and Exchange Board of India (SEBI) has notified SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (LODR) on September 2, 2015, replacing the earlier listing agreement (w.e.f. December 1, 2015) and is aimed to consolidate and streamline the provisions of earlier listing agreements for different segments of the capital market viz. equity, debentures, debt instruments, etc. The LODR regulations have incorporated the principles for corporate governance in line with the Organisation for Economic Co-operation and Development (OECD) principles and provide broad principles for periodic disclosures by listed entities in line with the International Organization of Securities Commissions (IOSCO) principles.

As part of our commitment to follow global best practices, we substantially comply with the Euroshareholders Corporate Governance Guidelines 2000 and the recommendations of the Conference Board Commission on Public Trusts and Private Enterprises in the U.S. We also adhere to the United Nations Global Compact (UNGC) and the OECD principles.

Corporate governance guidelines

Over the years, the Board has developed corporate governance guidelines to help fulfill our corporate responsibility towards our stakeholders. These guidelines ensure that the Board will have the necessary authority and processes to review and evaluate our operations when required. Further, these guidelines allow the Board to make decisions that are independent of the Management. The Board may change these guidelines regularly to achieve our stated objectives.

A. Board composition

Size and composition of the Board

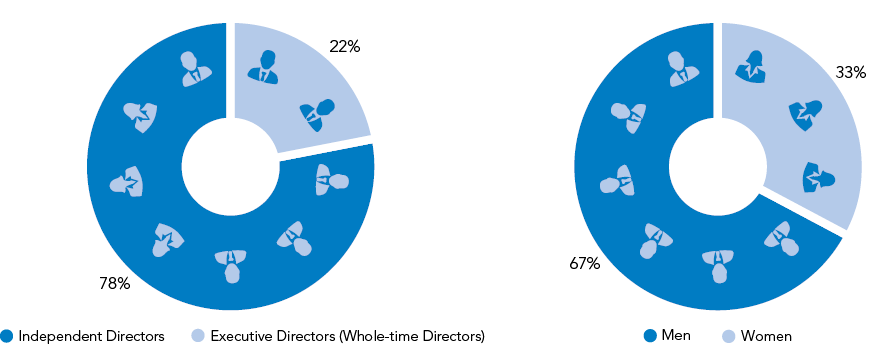

We believe that our Board needs to have an appropriate mix of executive and independent directors to maintain its independence, and separate its functions of governance and management. Listing regulations mandate that for a company with a non-executive chairman, at least one-third of the board should be independent directors. On March 31, 2016, our Board consists of nine members, two of whom are executive or whole-time directors, while the remaining seven are independent directors, constituting 78% of the Board’s strength — more than the requirements of the Companies Act, 2013 and the SEBI Listing Regulations. Three out of nine Board members or 33% of the Board are women. Five of our Board members (56%) are Indians, while four (44%) are foreign nationals. The Board periodically evaluates the need for change in its composition and size.

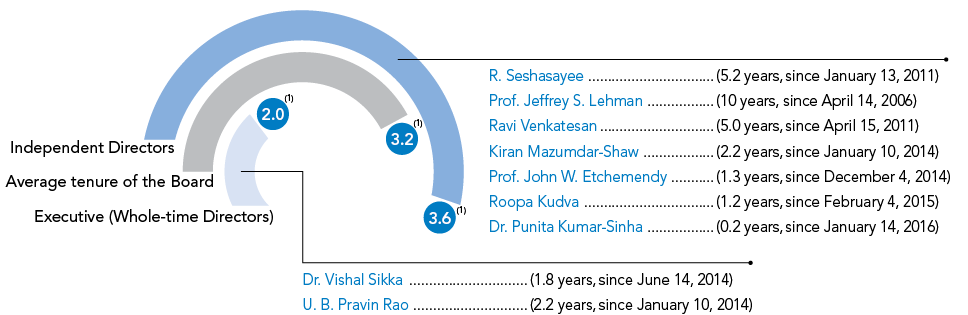

The average tenure of members on our Board is approximately 3.2 years as of March 31, 2016. The average tenure of executive directors (whole-time directors) is two years and that of independent directors is 3.6 years. In February 2016, the Board, after evaluating, proposed the re-appointment of Prof. Jeffrey S. Lehman because his continued service was deemed necessary considering the Company’s transition to new leadership. The Board felt that Prof. Lehman’s tenure complements the tenures of the other Board members, and as a director who has seen the Company under the management of promoters and non-promoters, he bridges the gap between the past and current perspectives.

The average tenure of Board members as on March 31, 2016 was as follows:

(1) Average tenure in years

Chairman of the Board

K. V. Kamath stepped down as Chairman and Independent Director of the Company effective June 5, 2015 consequent to his appointment as the President of the New Development Bank promoted by BRICS nations. R. Seshasayee, an independent director, took over as the Chairman of the Board effective June 5, 2015.

Responsibilities of the Chairman, the Chief Executive Officer and Managing Director

The Company has appointed a non-executive chairman of the Board (‘the Chairman’) – R. Seshasayee and a chief executive officer and managing director (the CEO and MD) – Dr. Vishal Sikka.

The responsibilities and authority of these officials are as follows:

The Chairman is the leader of the Board. As Chairman, he is responsible for fostering and promoting the integrity of the Board while nurturing a culture where the Board works harmoniously for the long-term benefit of the Company and all its stakeholders. The Chairman is primarily responsible for ensuring that the Board provides effective governance to the Company. In doing so, the Chairman presides over meetings of the Board and of the shareholders of the Company.

The Chairman takes a lead role in managing the Board and facilitating effective communication among directors. He is responsible for matters pertaining to governance, including the organization, composition and effectiveness of the Board and its committees, and the performance of individual directors in fulfilling their responsibilities. The Chairman provides independent leadership to the Board, identifies guidelines for the conduct and performance of directors, and oversees the management of the Board’s administrative activities such as meetings, schedules, agendas, communication and documentation.

The Chairman actively works with the nomination and remuneration committee to plan the Board and Board committees’ composition, induct directors to the Board, plan for director succession, participate in the Board effectiveness evaluation process and meet with individual directors to provide constructive feedback and advice.

The CEO and MD is responsible for corporate strategy, brand equity, planning, external contacts and all matters related to the management of the Company. He is also responsible for achieving annual and long-term business targets.

Role of the Board of Directors

The primary role of the Board is that of trusteeship to protect and enhance shareholder value through strategic direction to the Company. As trustees, the Board has fiduciary responsibility to ensure that the Company has clear goals aligned to shareholder value and its growth. The Board exercises its duties with care, skill and diligence and exercises independent judgment. The Board sets strategic goals and seeks accountability for their fulfillment. The Board also directs and exercises appropriate control to ensure that the Company is managed in a manner that fulfills stakeholders’ aspirations and societal expectations.

Definition of independent directors

The Companies Act, 2013 and the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 defines an ‘independent director’ as a person who is not a promoter or employee or one of the key managerial personnel of the Company or its subsidiaries. The laws also state that the person should not have a material pecuniary relationship or transactions with the Company or its subsidiaries, apart from receiving remuneration as an independent director. We abide by these definitions of independent director in addition to the definitions of an independent director as laid down in the New York Stock Exchange (NYSE) rules and U.S. securities laws by virtue of our listing on the NYSE in the U.S.

Board membership criteria

The nomination and remuneration committee works with the entire Board to determine the appropriate characteristics, skills and experience required for the Board as a whole and for individual members. Members are expected to possess the required qualifications, integrity, expertise and experience for the position. They should also possess deep expertise and insights in sectors / areas relevant to the Company, and ability to contribute to the Company’s growth.

The age limit for a managing director / executive director is 60 years while the age limit for an independent director is 70 years. A director’s term may be extended at the discretion of the committee beyond the age of 60 or 70 years with shareholder approval by passing a special resolution based on the explanatory statement annexed to the Notice for such motion indicating the justification for extension of appointment beyond 60 or 70 years as the case may be.

The Board members are expected to rigorously prepare for, attend and participate in all Board and applicable committee meetings. Each member is expected to ensure that their other current and planned future commitments do not materially interfere with their responsibilities with us.

Selection of new directors

The Board is responsible for the selection of new directors. The Board delegates the screening and selection process to the nomination and remuneration committee, which consists exclusively of independent directors. The nomination and remuneration committee makes recommendations to the Board on the induction of new directors.

Training of Board members

All new non-executive directors inducted to the Board are introduced to our Company culture through orientation sessions. Current executive directors and senior management provide an overview of our operations, and familiarize the new non-executive directors with them. They are also introduced to our organization structure, our services, group structure and subsidiaries, constitution, Board procedures, matters reserved for the Board, and our major risks and risk management strategy.

The Board’s policy is to have separate meetings regularly with independent directors to update them on all business-related issues and new initiatives. At such meetings, the executive directors and other members of the senior management share points of view and leadership thoughts on relevant issues.

We also facilitate the continual educational requirements of our directors. Each director is entitled to a training fee of US $5,000 per year. Support is provided for independent directors if they choose to attend educational programs in the areas of Board / corporate governance.

Independent directors of the Board are familiarized through three kinds of engagements:

Deep dives and immersion sessions

Deep dives and immersion sessions are conducted by senior executives on their respective business units. The business unit can be an industry vertical or a service offering unit. Key aspects that are covered in these sessions include:

- Industry / market and technology trends

- Competition

- The Company’s performance

- Strategic bets and their progress

- Future outlook

Strategy retreat

A strategy retreat is conducted for all the Board members every year and includes participation by senior business executives. This session helps Board members familiarize themselves with the strategy and business of the Company.

STRAP

Our annual strategy and planning event, STRAP, is usually a two-day event. Along with the Board members, almost all senior executives from business and support functions are invited to this event. At STRAP, a detailed view of the strategy is presented by all business and support units. The objective of STRAP is to communicate the strategy and make the organization aware about it.

These are the three specific mechanisms through which Board members are familiarized with the Company culture and operations. Apart from these, there could be additional meetings or sessions on demand on specific topics. All directors attend the familiarization programs as these are scheduled to coincide with the Board meeting calendar to give them an opportunity to attend.

The details of training programs attended by independent directors during fiscal 2016 are as follows:

in hours

|

Deep dives and immersion sessions |

Strategy retreat and STRAP |

Total |

||||

|

Design Thinking |

Industry / market and technology trends |

Competition and future outlook |

Quality |

|||

|

R. Seshasayee |

3.5 |

4 |

1.5 |

1.5 |

24 |

34.5 |

|

Prof. Jeffrey S. Lehman |

3.5 |

4 |

1.5 |

1.5 |

24 |

34.5 |

|

Prof. John W. Etchemendy |

3.5 |

4 |

1.5 |

1.5 |

24 |

34.5 |

|

Kiran Mazumdar-Shaw |

3.5 |

4 |

1.5 |

1.5 |

24 |

34.5 |

|

Dr. Punita Kumar-Sinha (1) |

– |

– |

1.5 |

1.5 |

24 |

27.0 |

|

Ravi Venkatesan |

3.5 |

4 |

1.5 |

1.5 |

24 |

34.5 |

|

Roopa Kudva |

3.5 |

4 |

1.5 |

1.5 |

24 |

34.5 |

|

Total hours |

234.0 |

|||||

(1) For the period January 14, 2016 to March 31, 2016

Membership term

The Board constantly evaluates the contribution of the members and periodically shares updates with the shareholders about re-appointments consistent with applicable statutes. The current law in India mandates the retirement of two-third of the non-independent directors (who are liable to retire by rotation) every year, and qualifies the retiring members for re-appointment. Executive directors are appointed by the shareholders for a maximum period of five years, but are eligible for re-appointment upon completion of their term. An independent director shall hold office for a term of up to five consecutive years on the Board of the Company and will be eligible for re-appointment on the passing of a special resolution by the Company.

Board member evaluation

One of the key functions of the Board is to monitor and review the Board evaluation framework. The Board works with the nomination and remuneration committee to lay down the evaluation criteria for the performance of executive / non-executive / independent directors through a peer evaluation, excluding the director being evaluated through a Board effectiveness survey. The questionnaire of the survey is a key part of the process of reviewing the functioning and effectiveness of the Board and for identifying possible paths for improvement. Each Board member is requested to evaluate the effectiveness of the Board dynamics and relationships, information flow, decision-making of the directors, relationship with stakeholders, Company performance and strategy, and the effectiveness of the whole Board and its various committees. Feedback on each director is encouraged to be provided as part of the survey. The evaluation for fiscal 2016 has been completed.

Independent directors have three key roles – governance, control and guidance. Some of the performance indicators based on which the independent directors are evaluated include:

- The ability to contribute to and monitor our corporate governance practices

- The ability to contribute by introducing international best practices to address business challenges and risks

- Active participation in long-term strategic planning

- Commitment to the fulfillment of a director’s obligations and fiduciary responsibilities; these include participation in Board and committee meetings.

Succession planning

The nomination and remuneration committee works with the Board on the leadership succession plan, and prepares contingency plans for succession in case of any exigencies.

Board compensation policy

The nomination and remuneration committee determines and recommends to the Board the compensation payable to directors. All Board-level compensation is approved by the shareholders and disclosed separately in the financial statements. Remuneration for the executive directors consists of a fixed component and a variable component. The committee makes a half-yearly appraisal of the performance of the executive directors based on a detailed performance matrix. The annual compensation of the executive directors is approved by the committee and placed before the shareholders at the shareholders’ meeting / postal ballot.

The CEO and MD of the Company is entitled to an annual variable, which is subject to the achievement of certain fiscal milestones by the Company, as determined by the Board (in its sole discretion). The Board may reserve the authority to set such milestones on a GAAP or non-GAAP basis. The Chief Operating Officer of the Company is entitled to receive payables at such intervals as decided by the Board.

The compensation payable to the independent directors is limited to a fixed amount per year as determined and approved by the Board, the sum of which does not exceed 1% of our net profits for the year, calculated as per the provisions of the Companies Act, 2013. The performance of the independent directors is reviewed by the Board on an annual basis.

Remuneration paid to directors in fiscal 2016

in ₹ crore except share data

|

Name of the director |

Fixed salary |

Bonus / incentives |

Commission |

Total |

Stock options / RSUs |

No. of equity shares held |

|||

|

Basic salary |

Perquisites / allowances |

Retiral benefits |

Total fixed salary |

||||||

|

Whole-time directors |

|||||||||

|

Dr. Vishal Sikka (1) |

5.96 |

– |

0.33 |

6.29 |

42.44 |

– |

48.73 |

(5) 1,24,061 |

10,824 |

|

U. B. Pravin Rao |

0.89 |

2.55 |

0.16 |

3.60 |

5.68 |

– |

9.28 |

– |

5,55,520 |

|

Independent directors |

|||||||||

|

R. Seshasayee |

– |

– |

– |

– |

– |

1.84 |

1.84 |

– |

248 |

|

Carol M. Browner (3) |

– |

– |

– |

– |

– |

0.68 |

0.68 |

– |

– |

|

Prof. Jeffrey S. Lehman |

– |

– |

– |

– |

– |

1.33 |

1.33 |

– |

– |

|

Prof. John W. Etchemendy |

– |

– |

– |

– |

– |

1.05 |

1.05 |

– |

– |

|

K. V. Kamath (2) |

– |

– |

– |

– |

– |

0.39 |

0.39 |

– |

– |

|

Kiran Mazumdar-Shaw |

– |

– |

– |

– |

– |

0.87 |

0.87 |

– |

800 |

|

Dr. Punita Kumar-Sinha (4) |

– |

– |

– |

– |

– |

0.20 |

0.20 |

– |

– |

|

Ravi Venkatesan |

– |

– |

– |

– |

– |

1.04 |

1.04 |

– |

– |

|

Roopa Kudva |

– |

– |

– |

– |

– |

0.99 |

0.99 |

– |

– |

On accrual basis

(1) Includes payment of variable pay amounting to ₹ 14 crore for the year ended March 31, 2015 to the CEO as decided by the nomination and remuneration committee in its meeting held on June 22, 2015, in line with the compensation plan approved by the shareholders. Further, includes provision for variable pay amounting to US $4.33 million (approximately ₹ 29 crore) for the year ended March 31, 2016 to the CEO. The shareholders in the EGM dated July 30, 2014 had approved a variable pay of US $4.18 million (approximately ₹ 28 crore at current exchange rate) at a target level and also authorized the Board to alter and vary the terms of remuneration. Accordingly, the Board, based on the recommendations of the nomination and remuneration committee approved on April 15, 2016, US $4.33 million (approximately ₹ 29 crore) as variable pay for the year ended March 31, 2016.

(2) For the period April 1, 2015 to June 5, 2015

(3) For the period April 1, 2015 to November 23, 2015

(4) For the period January 14, 2016 to March 31, 2016

(5) On recommendation of the nomination and remuneration committee, during fiscal 2016, Dr. Vishal Sikka was granted RSUs valued at US $2 million on the grant date at an exercise price at par value. The RSUs will vest over a period of four years from the date of grant in the proportions specified in the award agreement (Refer to Note 2.1 of the Standalone financial statements).

Service contracts, notice period, severance fees

We have entered into agreements with our executive directors, Dr. Vishal Sikka, the CEO and MD, and U. B. Pravin Rao, our COO.

Dr. Vishal Sikka’s executive employment agreement was replaced with a new executive employment agreement, through postal ballot approved by the shareholders on March 31, 2016. This agreement was effective April 1, 2016 and expires on March 31, 2021. The Board and its nomination and remuneration committee have approved the following compensation:

- Base pay: An annual base salary of US $1,000,000 to be paid in accordance with the Company’s normal practices and subject to withholding taxes;

- Variable pay: Annual performance-based variable pay at a target level of US $3,000,000 less applicable tax and subject to the Company’s achievement of fiscal year performance targets set by the Board as described in the postal ballot;

- Stock compensation: Eligible to receive an annual grant of 1) US $2,000,000 of fair value in RSUs which vest over time (‘time-based RSUs’), subject to continued service, and 2) US $5,000,000 in performance-based equity and stock options upon achievement of certain performance targets as described in the postal ballot;

- Employee benefits and paid vacation as applicable to other whole-time directors of the Company;

- Minimum and maximum remuneration: Should Dr. Sikka fail to achieve minimum performance targets, his remuneration as proposed will fall to US $3,000,000 annually, consisting of US $1,000,000 of base salary and US $2,000,000 of time-based RSUs. If Dr. Sikka’s performance targets are exceeded, the performance-based payments for variable components of his compensation (variable pay and performance equity) will be capped at 150% of the target compensation for such variable components.

We have agreed with Dr. Sikka to provide each other with 90 days’ notice of termination as applicable. Dr. Sikka may be entitled to severance benefits depending on the circumstances of his termination of employment.

During fiscal 2015, we entered into a restricted stock unit award agreement with Dr. Vishal Sikka, our CEO and MD. Pursuant to the Restricted Stock Unit Award Agreement, Dr. Sikka was granted 27,067 restricted stock units (the equivalent of 1,08,268 RSUs after adjustment for the bonus issues). The RSUs vest over a period of four years subject to Dr. Sikka’s continued employment and upon achieving certain performance indicators set by the Board or the nomination and remuneration committee from time to time.

The Board in its meeting held on June 22, 2015, on recommendation of the nomination and remuneration committee, further granted 1,24,061 RSUs to Dr. Vishal Sikka. These RSUs are vesting over a period of four years from the date of the grant in the proportions specified in the award agreement. The RSUs will vest subject to the achievement of certain key performance indicators as set forth in the award agreement for each applicable year of the vesting tranche and continued employment through each vesting date.

The award granted to Dr. Vishal Sikka on June 22, 2015 was modified by the nomination and remuneration committee on April 14, 2016. There is no modification or change in the total number of RSUs granted or the vesting period (which is four years). The modifications relate to the criteria of vesting for each of the years. Based on the modification, the first tranche of the RSUs will vest subject to achievement of certain key performance indicators for the year ended March 31, 2016. Subsequent vesting of RSUs for each of the remaining years would be subject to continued employment.

None of our directors except Dr. Vishal Sikka is eligible for any severance pay.

Pravin Rao’s employment agreement provides for a monthly salary, bonuses, and benefits including vacation, medical reimbursements and gratuity contributions. The agreement with him has a five-year term and either party may terminate the agreement with six months’ notice or as mutually agreed between the parties. There are no benefits payable upon termination of this agreement.

We have also entered into agreements to indemnify our directors and officers for claims brought under U.S. laws to the fullest extent permitted by Indian law. These agreements, among other things, indemnify our directors and officers for certain expenses, judgments, fines and settlement amounts incurred by any such person in any action or proceeding, including any action by or in the right of Infosys Limited, arising out of such persons’ services as our director or officer.

Non-executive / independent directors’ remuneration

Shareholders at the 34th Annual General Meeting held on June 22, 2015 approved a sum not exceeding 1% per annum of the net profits of the Company calculated in accordance with the provisions of Section 198 of the Act, to be paid and distributed among some or all of the directors of the Company (other than the managing director and whole-time directors) in a manner decided by the Board of Directors and this payment will be made with respect to the profits of the Company for each year.

We have paid ₹ 8.39 crore to our Independent Directors for the year ended March 31, 2016.

The aggregate amount was arrived at using the following criteria:

|

Particulars |

in ₹ crore |

in US $ |

|

Fixed Board fee |

0.50 |

75,000 |

|

Board attendance fee (1) |

0.17 |

25,000 |

|

Non-executive chairman fee |

0.99 |

150,000 |

|

Chairperson – audit committee |

0.20 |

30,000 |

|

Members – audit committee |

0.13 |

20,000 |

|

Chairperson – other committees |

0.13 |

20,000 |

|

Members – other committees |

0.07 |

10,000 |

|

Travel fee (per meeting) (2) |

0.07 |

10,000 |

|

Incidental fees (per meeting) (3) |

0.01 |

1,000 |

1 US $ = ₹ 66.26 as on March 31, 2016

(1) The Company normally has five regular Board meetings in a year. Independent directors are expected to attend the four quarterly Board meetings and the Annual General Meeting (AGM).

(2) For directors based overseas, the travel fee shown is per Board meeting. This is based on the fact that additional travel time of two days will have to be accommodated for independent directors to attend Board meetings in India.

(3) For directors based overseas, incidental fees shown is per Board meeting. The incidental fees are paid to non-executive directors for expenses incurred during their travel to attend Board meetings in India.

The Board believes that the above compensation structure is commensurate with global best practices in terms of remunerating non-executive / independent directors of a company of similar size, and adequately compensates for the time and contribution made by our non-executive / independent directors.

Memberships in other boards

An executive director may, with the prior consent of the chairman of the Board, serve on the board of two other business entities, provided that such business entities are not in direct competition with our operations. Executive directors are also allowed to serve on the boards of corporate or government bodies whose interests are germane to the future of the IT and software business or the key economic institutions of the nation, or whose prime objective is to benefit society. Independent directors are not expected to serve on the boards of competing companies. There are no other limitations except those imposed by law and good corporate governance practices.

The composition of the Board, and directorships held, as on March 31, 2016 are as follows:

|

Name of the director |

Designation |

Age |

India-listed companies (1) |

All companies around the world (2) |

Committee memberships (3) |

Chairperson of committees (3) |

|

Whole-time directors |

||||||

|

Dr. Vishal Sikka |

Chief Executive Officer and Managing Director |

48 |

– |

1 |

– |

– |

|

U. B. Pravin Rao |

Chief Operating Officer and Whole-time Director |

54 |

– |

4 |

– |

– |

|

Independent directors |

||||||

|

R. Seshasayee |

Chairman of the Board |

67 |

2 |

6 |

2 |

– |

|

Prof. Jeffrey S. Lehman |

Independent director |

59 |

– |

2 |

1 |

1 |

|

Prof. John W. Etchemendy |

Independent director |

63 |

– |

1 |

1 |

– |

|

Kiran Mazumdar-Shaw |

Independent director |

63 |

4 |

17 |

– |

– |

|

Dr. Punita Kumar-Sinha |

Independent director |

53 |

5 |

11 |

4 |

1 |

|

Ravi Venkatesan |

Independent director |

53 |

1 |

3 |

2 |

– |

|

Roopa Kudva |

Independent director |

52 |

– |

5 |

1 |

2 |

There are no inter-se relationships between our Board members.

(1) Excluding directorship in Infosys Limited and its subsidiaries

(2) Directorship in companies around the world (listed, unlisted and private limited companies), including Infosys Limited and its subsidiaries

(3) As required by Clause 26 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, the disclosure includes membership / chairpersonship of the audit committee and stakeholders relationship committee in Indian public companies (listed and unlisted).

B. Board meetings

Scheduling and selection of agenda items for Board meetings

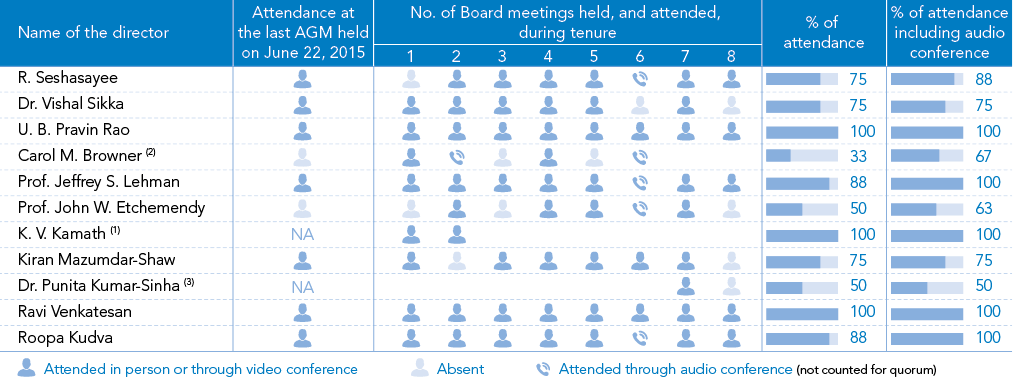

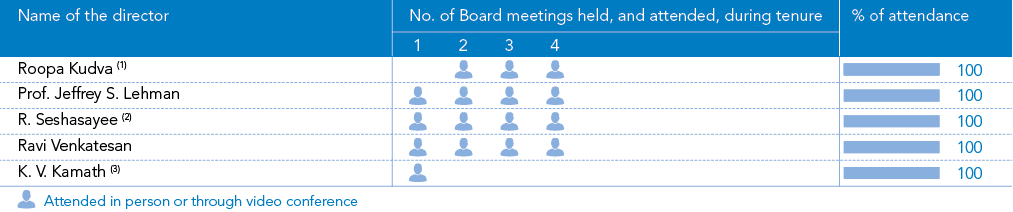

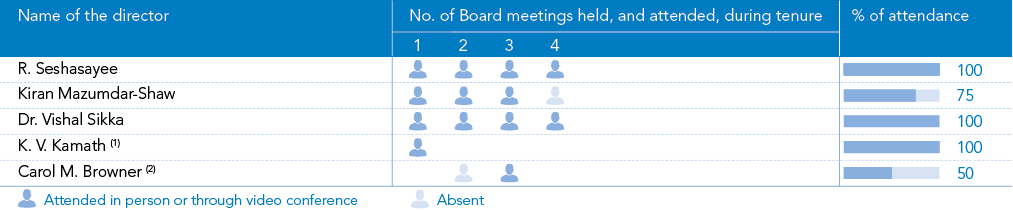

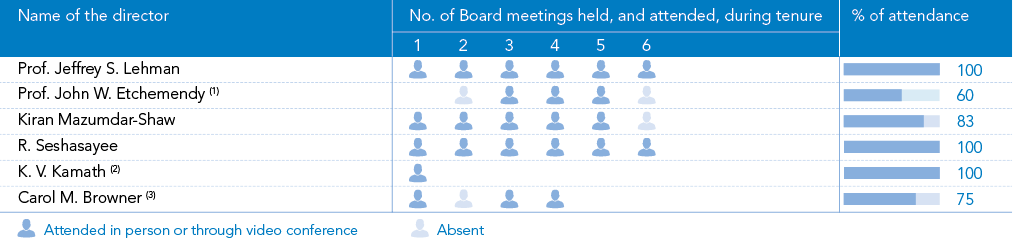

The dates of Board meetings for the next fiscal are decided in advance and published in the Annual Report as part of Shareholder information. The non-executive chairman of the Board and the Company Secretary draft the agenda for each meeting, along with explanatory notes, in consultation with the CEO and MD, and distribute these in advance to the directors. Every Board member can suggest the inclusion of additional items in the agenda. The Board meets at least once a quarter to review the quarterly results and other items on the agenda, and also on the occasion of the AGM. Additional meetings are held when necessary. Independent directors are expected to attend at least four Board meetings in a year. However, with the Board being represented by independent directors from various parts of the world, it may not be possible for each one of them to be physically present at all the meetings. Hence, we use video / teleconferencing facilities to enable their participation. Committees of the Board usually meet the day before the formal Board meeting, or whenever the need arises for transacting business. Eight Board meetings were held during the year ended March 31, 2016. These were held on April 24, 2015, June 5, 2015, June 22, 2015, July 21, 2015, October 12, 2015, October 19, 2015, January 14, 2016 and February 24, 2016.

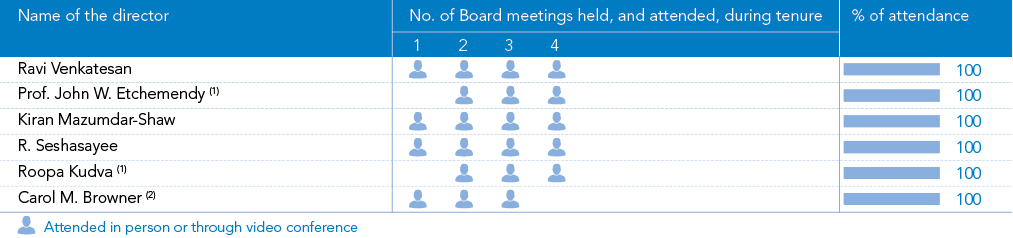

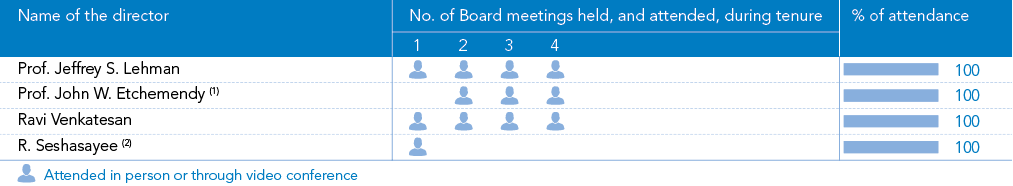

Attendance of directors during fiscal 2016

(1) For the period April 1, 2015 to June 5, 2015

(2) For the period April 1, 2015 to November 23, 2015

(3) For the period January 14, 2016 to March 31, 2016

Availability of information to Board members

The Board has unrestricted access to all Company-related information, including that of our employees. At Board meetings, managers and representatives who can provide additional insights into the items being discussed are invited. Regular updates provided to the Board include:

- Annual operating plans and budgets, capital budgets and updates

- Quarterly results of our operating divisions or business segments

- Minutes of meetings of audit, nomination and remuneration, risk and strategy, stakeholders relationship, finance and investment, and corporate social responsibility committees, and abstracts of circular resolutions passed

- The Board meeting minutes of the subsidiaries

- General notices of interest received from directors

- Dividend data

- Information on recruitment and remuneration of senior officers below the Board level, including appointment or removal of the Chief Financial Officer and Company Secretary, if any

- Materially important litigations, show cause, demand, prosecution and penalty notices

- Fatal or serious accidents, dangerous occurrences, and issues related to material effluents or pollution

- Any materially relevant defaults in financial obligations to and by us

- Any issue that involves possible public or product liability claims of a substantial nature

- Details of joint ventures, acquisitions of companies, or collaboration agreements

- Transactions that involve substantial payments toward goodwill, brand equity or Intellectual Property (IP)

- Any significant development involving human resource management

- Sale of a material nature, or of investments, subsidiaries and assets, which are not part of the normal course of business

- Details of foreign exchange exposure and the steps taken by the Management to limit risks of adverse exchange rate movement

- Non-compliance with any regulatory, statutory or listing requirements, as well as shareholder services, such as non-payment of dividend and delays in share transfer

- Quarterly compliance reports and investor grievance reports

- Discussion with independent directors

Independent directors meeting

Schedule IV of the Companies Act, 2013 and the Rules under it mandate that the independent directors of the Company hold at least one meeting in a year, without the attendance of non-independent directors and members of the Management. It is recommended that all the independent directors of the Company be present at such meetings. These meetings are expected to review the performance of the non-independent directors and the Board as a whole, as well as the performance of the chairman of the Board, taking into account the views of the executive directors and non-executive directors; assess the quality, quantity and timeliness of the flow of information between the Management and the Board that is necessary for it to effectively and reasonably perform its duties.

Even before the Companies Act, 2013 came into effect, our Board’s policy required our independent directors to hold quarterly meetings attended exclusively by the independent directors. At such meetings, the independent directors discuss, among other matters, the performance of the Company and risks faced by it, the flow of information to the Board, competition, strategy, leadership strengths and weaknesses, governance, compliance, Board movements, human resource matters and performance of the executive members of the Board, including the Chairman.

Materially significant related party transactions

There have been no materially significant related party transactions, monetary transactions or relationships between the Company and its directors, the Management, subsidiaries or relatives, except for those disclosed in the Board’s report. Detailed information on materially significant related party transactions is enclosed as Annexure 2 to the Board’s report.

C. Board committees

Currently, the Board has six committees: audit committee, corporate social responsibility (CSR) committee, nomination and remuneration committee, risk and strategy committee, stakeholders relationship committee, and finance and investment committee. All committees except the CSR committee consist entirely of independent directors.

The Board, in consultation with the nomination and remuneration committee, is responsible for assigning and fixing terms of service for committee members. It delegates these powers to the nomination and remuneration committee.

The non-executive chairman of the Board, in consultation with the Company Secretary and the committee chairperson, determines the frequency and duration of the committee meetings. Normally, all the committees meet four times a year. Recommendations of the committees are submitted to the entire Board for approval.

The quorum for meetings is either two members or one-third of the total number of members of the committee, whichever is higher.

1. Audit committee

Our audit committee comprised four independent directors as on March 31, 2016:

- Roopa Kudva, Chairperson and Financial Expert

- Prof. Jeffrey S. Lehman

- R. Seshasayee

- Ravi Venkatesan

Roopa Kudva was appointed as a member of the audit committee effective April 24, 2015 and on July 21, 2015 she took over as the chairperson from R. Seshasayee.

K. V. Kamath ceased to be a member of the audit committee effective June 5, 2015.

The Company Secretary acts as the secretary to the audit committee.

The primary objective of the audit committee is to monitor and provide an effective supervision of the Management’s financial reporting process, to ensure accurate and timely disclosures, with the highest levels of transparency, integrity and quality of financial reporting. The audit committee oversees the work carried out in the financial reporting process by the Management, the internal auditors and the independent auditors, and notes the processes and safeguards employed by each of them. The audit committee has the ultimate authority and responsibility to select, evaluate and, where appropriate, replace the independent auditors in accordance with the law. All possible measures must be taken by the audit committee to ensure the objectivity and independence of the independent auditors.

In India, we are listed on the BSE Limited (BSE) and the National Stock Exchange of India Limited (NSE). We are also listed on the New York Stock Exchange (NYSE), Euronext Paris, and the Euronext London stock exchanges. In India, Regulation 18 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 and in the U.S., the Blue Ribbon Committee set up by the U.S. Securities and Exchange Commission (SEC) mandate that listed companies adopt an appropriate audit committee charter. This recommendation has also been adopted by the NYSE.

All recommendations made by the audit committee during the year were accepted by the Board. The audit committee charter containing exhaustive terms of reference is available on our website (https://www.infosys.com/investors/corporate-governance/Documents/audit-committee-charter.pdf).

Audit committee attendance

The audit committee held four meetings during the year ended March 31, 2016. These were held on April 23, 2015, July 20, 2015, October 11, 2015 and January 13, 2016. The attendance details of the audit committee meetings are as follows:

(1) Appointed as a member of the audit committee effective April 24, 2015 and on July 21, 2015 appointed as the chairperson.

(2) Ceased to be chairperson of the committee effective July 21, 2015

(3) Ceased to be a member of the committee effective June 5, 2015

Audit committee report for the year ended March 31, 2016

Each member of the committee is an independent director, according to the definition laid down in the audit committee charter, Section 149 of the Companies Act, 2013 and Regulation 18 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, and NYSE requirements.

The Management is responsible for the Company’s internal control over financial reporting and the financial reporting process. The independent auditors are responsible for performing an independent audit of the Company’s financial statements in accordance with the Generally Accepted Auditing Principles, and for issuing a report thereon. The committee’s responsibility is to monitor these processes. The committee is also responsible for overseeing the processes related to financial reporting and information dissemination. This is to ensure that the financial statements are true, fair, sufficient and credible. In addition, the committee recommends to the Board the remuneration, appointment and terms of appointment of the Company’s internal and independent auditors.

In this context, the committee discussed the overall scope and plans for the independent audit with the Company’s auditors. The Management shared the Company’s financial statements prepared in accordance with the Indian GAAP and International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board with the committee. The committee discussed with the auditors, in the absence of the Management (whenever necessary), regarding the Company’s audited financial statements, including the auditors’ judgment about the quality, not just the applicability, of the accounting principles, the reasonableness of significant judgment and the clarity of disclosures in the financial statements.

The committee also discussed other matters required by the Statement on Auditing Standards No. 114, as amended (AICPA, Professional Standards, Volume 1. AU Section 380) – the auditors’ communication with those charged with governance, and by the Sarbanes-Oxley Act 2002, with the auditors.

Relying on the review and discussions conducted with the Management and the independent auditors, the committee believes that the Company’s financial statements are fairly presented in conformity with Indian GAAP and IFRS.

The committee has also reviewed the internal control over financial reporting put in place to ensure that the accounts of the Company are properly maintained and that the accounting transactions are in accordance with prevailing laws and regulations. In conducting such reviews, the committee found no material discrepancy or weakness in the Company’s internal control over financial reporting.

The committee also reviewed the financial policies of the Company and expressed its satisfaction with the same.

The Company’s auditors provided written disclosures and a letter for applicable requirements of the Public Company Accounting Oversight Board to the committee. This is regarding the auditors’ communication with the committee concerning independence, based on which the committee discussed the auditors’ independence with both the Management and the auditors. After the review, the committee expressed its satisfaction on the independence of both the internal and the independent auditors. The committee also considered whether any non-audit services provided by the independent audit firm could impair such auditors’ independence, and concluded that there were no such services provided.

The committee has confirmed compliance of the Board to the NYSE and Euronext London and Euronext Paris exchange rules on composition of the committee and independence of the committee members, disclosures relating to non-independent members, financial literacy and financial expertise of members, and a review of the audit committee charter.

Based on the committee’s discussion with the Management and the auditors, its review of the representations of the Management and the report of the auditors, the committee has recommended the following to the Board:

- The audited financial statements prepared in accordance with Indian GAAP of Infosys Limited for the year ended March 31, 2016 be accepted by the Board as a true and fair statement of the financial status of the Company.

- The audited Consolidated financial statements prepared in accordance with Indian GAAP of Infosys Limited and its subsidiaries for the year ended March 31, 2016, be accepted by the Board as a true and fair statement of the financial status of the Group.

- The audited Consolidated financial statements prepared in Indian rupee in accordance with IFRS of Infosys Limited and its subsidiaries for the year ended March 31, 2016, be accepted by the Board as a true and fair statement of the financial status of the Group.

- The audited Consolidated financial statements prepared in US dollar in accordance with IFRS of Infosys Limited and its subsidiaries for the year ended March 31, 2016, upon adoption by this committee, be accepted by the Board as a true and fair statement of the financial status of the Group and included in the Company’s Annual Report on Form 20-F, to be filed with the Securities and Exchange Commission (SEC).

- The ratification of the re-appointment of B S R & Co. LLP, Chartered Accountants, as the statutory auditors of the Company, to audit standalone (Indian GAAP) financial statements and consolidated (Indian GAAP and IFRS) financial statements to hold office from the conclusion of the ensuing AGM to the conclusion of the next AGM. The committee has also recommended to the Board the appointment of KPMG, India, as independent auditors of the Company for the IFRS (US$) financial statements, for the fiscal ending March 31, 2017.

- The appointment of Ernst & Young, as the internal auditors of the Company for the fiscal ending March 31, 2017, to review various operations of the Company, and determination and approval of the fee payable to them. The committee has also issued a letter in line with recommendation No. 9 of the Blue Ribbon Committee on audit committee effectiveness, which is to be provided in the financial statements prepared in accordance with IFRS in the Annual Report on Form 20-F.

- The appointment of Parameshwar G. Hegde of Hegde & Hegde, Company Secretaries, as secretarial auditor for the fiscal year ending March 31, 2017 to conduct the secretarial audit as prescribed under Section 204 and other applicable sections of the Companies Act, 2013.

The Company has established a mechanism for directors and employees to report concerns about unethical behavior, actual or suspected fraud, or violation of our Code of Conduct and Ethics. It also provides for adequate safeguards against the victimization of employees who avail of the mechanism, and allows direct access to the chairperson of the audit committee in exceptional cases. We further affirm that no director or employee has been denied access to the audit committee during fiscal 2016. The Whistleblower Policy is available on our website (http://www.infosys.com/investors/corporate-governance/policies.html).

In conclusion, the committee is sufficiently satisfied that it has complied with its responsibilities as outlined in the audit committee charter. The charter is available on our website (https://www.infosys.com/investors/corporate-governance/Documents/audit-committee-charter.pdf).

|

Sd/- |

|

|

Bangalore April 15, 2016 |

Roopa Kudva Chairperson |

2. Corporate social responsibility (CSR) committee

Our CSR committee comprised two independent directors and the CEO and MD as members as on March 31, 2016:

- R. Seshasayee, Chairperson

- Kiran Mazumdar-Shaw

- Dr. Vishal Sikka

Carol M. Browner was appointed a member of the CSR committee effective April 24, 2015 and ceased to be a member effective November 23, 2015.

K. V. Kamath ceased to be a member of the CSR committee effective June 5, 2015.

While aiming to generate maximum profit for our shareholders through the year, we also keep a steadfast eye on our social and environmental responsibilities, to fulfill the needs and expectations of the larger society that we are part of. Our CSR is not limited to philanthropy, but encompasses holistic community development, institution-building and sustainability-related initiatives.

The CSR committee was set up to formulate and monitor the CSR policy of the Company. The CSR committee adopted a policy that intends to strive for economic development that positively impacts the society at large with a minimal resource footprint; and to be responsible for the Company’s actions and encourage a positive impact through its activities on the environment, communities and stakeholders.

The CSR committee is also responsible for overseeing the activities / functioning of the Infosys Foundation in identifying the areas of CSR activities, programs and execution of initiatives as per pre-defined guidelines. The Foundation, in turn, guides the CSR committee in reporting the progress of deployed initiatives, and making appropriate disclosures (internal / external) on a periodic basis.

The CSR committee charter and the CSR policy of the Company are available on our website (http://www.infosys.com/investors/corporate-governance/policies.html).

CSR committee attendance

The committee held four meetings during the year ended March 31, 2016. These were held on April 23, 2015, July 20, 2015, October 11, 2015 and January 15, 2016. The attendance details of the committee meetings are as follows:

(1) Ceased to be a member of the committee effective June 5, 2015

(2) Appointed as a member of the committee effective April 24, 2015 and ceased to be a member effective November 23, 2015

Corporate social responsibility committee report for the year ended March 31, 2016

The CSR report, as required under the Companies Act, 2013 for the year ended March 31, 2016 is attached as Annexure 7 to the Board’s report.

3. Nomination and remuneration committee

Our nomination and remuneration committee comprised four independent directors as on March 31, 2016:

- Prof. Jeffrey S. Lehman, Chairperson

- Prof. John W. Etchemendy

- Kiran Mazumdar-Shaw

- R. Seshasayee

Prof. John W. Etchemendy was appointed a member of the nomination and remuneration committee effective April 24, 2015.

While K. V. Kamath ceased to be a member of the nomination and remuneration committee effective June 5, 2015, Carol M. Browner ceased to be a member effective November 23, 2015.

The purpose of the committee is to screen and to review individuals qualified to serve as executive directors, non-executive directors and independent directors, consistent with criteria approved by the Board, and to recommend, for approval by the Board, nominees for election at the AGM. It also designs, benchmarks and continuously reviews the compensation program for our CEO and MD, senior executives and the Board against the achievement of measurable performance goals, and structures senior executive compensation to ensure it is competitive in the global markets in which we operate to attract and retain the best talent.

The committee makes recommendations to the Board on candidates for (i) nomination for election or re-election by the shareholders; and (ii) any Board vacancies that are to be filled. It may act on its own in identifying potential candidates, inside or outside the Company, or may act upon proposals submitted by the Chairman of the Board. The nomination and remuneration committee annually reviews and approves for the CEO and MD, the executive directors and executive officers: (a) the annual base salary; (b) the annual incentive bonus, including the specific performance-based goals and amount; (c) equity compensation; (d) employment agreements, severance arrangements, and change in control agreements / provisions; and (e) any other benefits, compensation or arrangements.

It reviews and discusses all matters pertaining to candidates and evaluates the candidates. The nomination and remuneration committee coordinates and oversees the annual self-evaluation of the Board and of individual directors. It also reviews the performance of all the executive directors on a half-yearly basis or at such intervals as may be necessary on the basis of the detailed performance parameters set for each executive director at the beginning of the year. The nomination and remuneration committee may also regularly evaluate the usefulness of such performance parameters, and make necessary amendments.

The nomination and remuneration committee charter and policy are available on our website (https://www.infosys.com/investors/corporate-governance/Documents/nomination-remuneration-committee-charter.pdf).

Nomination and remuneration committee attendance

The committee held six meetings during the year ended March 31, 2016. These were held on April 23, 2015, June 22, 2015, July 20, 2015, October 11, 2015, January 13, 2016 and February 24, 2016. The attendance details of the committee meetings are as follows:

(1) Appointed as a member of the committee effective April 24, 2015

(2) Ceased to be a member of the committee effective June 5, 2015

(3) Ceased to be a member of the committee effective November 23, 2015

Nomination and remuneration committee report for the year ended March 31, 2016

The committee believes that recruitment, motivation and retention of outstanding senior leadership are crucial to promoting a robust future for the Company. Therefore, the committee has adopted a detailed process to ensure that the Board selects, motivates, and retains the right candidates for senior leadership positions in keeping with the policy devised on Board diversity.

During the year, the committee recommended the re-appointment of Dr. Vishal Sikka as CEO and MD on new terms and conditions, effective from April 1, 2016, until March 31, 2021. In recommending Dr. Sikka’s re-appointment, the committee discussed the outstanding initiatives taken by Dr. Sikka towards restoring the Company as industry leader, which have already begun to show results. The committee also noted that the Management, under the leadership of Dr. Sikka, has drawn up goals for revenue, margins, and revenue per person for the financial year 2020-21 which are expected to be achieved progressively over the next five years. The committee was of the view that Dr. Sikka’s leadership will be essential to achieving these goals and, therefore, recommended that Dr. Sikka’s contract of employment be replaced with a new contract aligned to these goals, as well as to shareholder value creation.

During the year, the committee also nominated Dr. Punita Kumar-Sinha to the Board. Dr. Kumar-Sinha has focused on investment management and financial markets during her 27-year career. She spearheaded some of the first foreign investments into the Indian equity markets in the early 1990s. Currently, she is the Founder and Managing Partner, Pacific Paradigm Advisors, an independent investment advisory and management firm focused on Asia.

Dr. Kumar-Sinha is also a senior advisor and serves as an independent director for several companies. Prior to founding Pacific Paradigm Advisors, she was a Senior Managing Director of Blackstone and the Chief Investment Officer of Blackstone Asia Advisors. Dr. Kumar-Sinha was also the Senior Portfolio Manager and CIO for The India Fund (NYSE:IFN), the largest India Fund in the US, for almost 15 years, The Asia Tigers Fund (NYSE:GRR), and The Asia Opportunities Fund. At Blackstone Asia Advisors, Dr. Kumar-Sinha led the business and managed teams in the U.S., India, and Hong Kong. Prior to joining Blackstone, Dr. Kumar-Sinha was a Managing Director and Senior Portfolio Manager at Oppenheimer Asset Management Inc., and CIBC World Markets, where she helped open one of the first India advisory offices for a foreign firm. She also worked at Batterymarch (a Legg Mason company), Standish Ayer & Wood (a BNY Mellon company), JP Morgan and IFC / World Bank.

Dr. Kumar-Sinha has been frequently featured in the media, including: The Financial Times, The New York Times, The Wall Street Journal, Barron’s, Forbes, CNN, CNBC, Fox News, Star News, Bloomberg, ET Now and The Economic Times. She has also anchored a TV series on ET Now on various global economies, key Indian policy issues and their impact on capital markets. Dr. Kumar-Sinha has been a speaker at many forums and many of her contributions at seminars and conferences have projected the potential and prospects of Asia as an investment destination.

Dr. Kumar-Sinha has a Ph.D. and a Masters in Finance from the Wharton School, University of Pennsylvania. She received her undergraduate degree in chemical engineering with distinction from the Indian Institute of Technology, New Delhi. She has an MBA and is also a CFA Charter holder. Dr. Kumar-Sinha is a member of the CFA Institute, the Boston Security Analysts Society and the Council on Foreign Relations. She is a Charter member and was a Board member of TIE-Boston. Dr. Kumar-Sinha has been awarded the Distinguished Alumni Award from IIT Delhi.

The committee recommended the re-appointment of Prof. Jeffrey S. Lehman as independent director. Prof. Lehman was due for retirement from his first term as independent director after the notification of the new Companies Act, 2013 on April 13, 2016. Based on his skills, experience, knowledge, and performance evaluation, it was proposed that Prof. Lehman be re-appointed for another term of two years from April 14, 2016 to April 13, 2018, as an independent director. Prof. Lehman was excused from all discussions and votes associated with his nomination.

During the year, the committee discussed the retirement of the Board according to statutory requirements. As per the provisions under the Companies Act, 2013, independent directors are not liable to retire by rotation. As such, none of the independent directors will retire at the ensuing AGM. Further, following the provisions of the Companies Act, 2013, Dr. Vishal Sikka will retire in the ensuing AGM. The committee considered his performance and recommended that the shareholders may consider the necessary resolutions for the re-appointment of Dr. Sikka.

During the year, the committee recommended and approved the 2015 Stock Incentive Compensation Plan (‘the 2015 Plan’) and grant of stock incentives to eligible employees of the Company and its subsidiaries. The stock incentives are proposed to be issued under the 2015 Plan. The purpose of the 2015 Plan is to:

- Attract, motivate, and retain talented and critical employees;

- Encourage employees to align individual performance with Company objectives; and

- Reward employee performance with ownership.

The 2015 Plan provides for grant stock incentives to eligible employees such as restricted stock units (RSUs) and stock options (together ‘Stock Incentives’). Subject to applicable law and conditions for exercise, eligible employees are entitled to receive equity shares, American Depositary Receipts (ADRs) or cash on exercise of the Stock Incentives. The Stock Incentives vest over a period of four years from the date of the grant, or such other period as decided by the committee. The 2015 Plan shall be administered by the committee which is designated as the ‘Compensation Committee’ for the administration and superintendence of the 2015 Plan. Each Stock Incentive shall be evidenced by an award agreement specifying terms and conditions including whether the eligible employees will get equity shares of the Company, ADRs of the Company, or cash on exercise of the Stock Incentives.

During the year, the committee under the guidance of the Board also formulated the criteria and framework for the performance evaluation of every Director on the Board, including the executive and independent directors and identified ongoing training and education programs to ensure that the non-executive directors are provided with adequate information regarding the business, the industry, and their legal responsibilities and duties.

|

Sd/- |

|

|

Bangalore April 15, 2016 |

Prof. Jeffrey S. Lehman Chairperson |

4. Risk and strategy committee

Our risk and strategy committee comprised five independent directors as on March 31, 2016:

- Ravi Venkatesan, Chairperson

- Prof. John W. Etchemendy

- Kiran Mazumdar-Shaw

- R. Seshasayee

- Roopa Kudva

Roopa Kudva and Prof. John W. Etchemendy were appointed as members of the risk and strategy committee effective April 24, 2015. Carol M. Browner ceased to be a member effective November 23, 2015.

The purpose of the risk and strategy committee is to assist the Board in fulfilling its corporate governance duties by overseeing the responsibilities with regard to the identification, evaluation and mitigation of operational, strategic and environmental risks. The risk and strategy committee has the overall responsibility of monitoring and approving the risk policies and associated practices of the Company. It is also responsible for reviewing and approving risk disclosure statements in public documents or disclosures.

The risk and strategy committee charter is available on our website (http://www.infosys.com/investors/corporate-governance/policies.html). Further, the risk and strategy framework of the Company is part of the Risk Management report section of the Annual Report.

Risk and strategy committee attendance

The risk and strategy committee held four meetings during the year ended March 31, 2016. These were held on April 23, 2015, July 20, 2015, October 11, 2015 and January 13, 2016. The attendance details of the risk and strategy committee meetings are as follows:

(1) Appointed as a member of the committee effective April 24, 2015

(2) Ceased to be a member of the committee effective November 23, 2015

Risk and strategy committee report for the year ended March 31, 2016

The committee reviewed the Company’s risk management practices and activities on a quarterly basis. This included a review of risks to the achievement of key business objectives covering growth, profitability, talent aspects, operational excellence and actions taken to address these risks.

Further, the trend lines of top risks in terms of exposure, risk levels, potential impact and progress of mitigation plans were reviewed along with key operational risks. According to the scheduled annual calendar, the committee reviewed risk management in the areas of competitive position in key market segments, business momentum relative to competition, talent supply chain and engagement, information security, high-risk projects, contracts management and financial risks. The committee also reviewed and discussed priorities of risk mitigation. The members of the committee conducted deep dive exercises in the areas of quality, talent and cyber-security.

The committee shared regular updates with the Board regarding all aspects of risk management. While acknowledging the competitive and dynamic nature of the business environment, the committee believes that the Infosys risk framework, along with risk assessment, monitoring, mitigation and reporting practices, is adequate to effectively manage the foreseeable material risks. In conclusion, the committee is sufficiently satisfied that it has complied with its responsibilities as outlined in the risk and strategy committee charter.

|

Sd/- |

|

|

Bangalore April 15, 2016 |

Ravi Venkatesan Chairperson |

5. Stakeholders relationship committee

The stakeholders relationship committee has the mandate to review and redress shareholder grievances.

Our stakeholders relationship committee comprised three independent directors as on March 31, 2016:

- Prof. Jeffrey S. Lehman, Chairperson

- Prof. John W. Etchemendy

- Ravi Venkatesan

R. Seshasayee ceased to be a member of the stakeholders relationship committee effective April 24, 2015.

Prof. John W. Etchemendy was appointed as member of the stakeholders relationship committee effective April 24, 2015.

The Board appointed A. G. S. Manikantha as the Compliance Officer for SEBI listing regulations with effect from December 1, 2015.

Stakeholders relationship committee attendance

The stakeholders relationship committee held four meetings during the year ended March 31, 2016. These were held on April 24, 2015, July 20, 2015, October 12, 2015 and January 13, 2016. The attendance details of the stakeholders relationship committee meetings are as follows:

(1) Appointed as a member of the committee effective April 24, 2015

(2) Ceased to be a member of the committee effective April 24, 2015

Stakeholders relationship committee report for the year ended March 31, 2016

The committee expresses satisfaction with the Company’s performance in dealing with investor grievances and its share transfer system.

The details of the complaints resolved during the fiscal ended March 31, 2016 are as follows:

|

Nature of complaints |

Received |

Resolved |

Closing |

|

Dividend / Annual Report related |

594 |

594 |

NIL |

It has also been noted that the shareholding in dematerialized mode as on March 31, 2016 was 99.79% (99.78% as of March 31, 2015).

|

Bangalore April 15, 2016 |

Sd/- Prof. Jeffrey S. Lehman Chairperson |

6. Finance and investment committee

The Board constituted the finance and investment committee to assist it in overseeing acquisitions and investments made by the Company and provide oversight on key investment policies of the Company.

The finance and investment committee comprises independent members of the Board and has a minimum of three members. The charter states that the chairperson, in consultation with other committee members, would set the agenda for and preside at the meetings. A quorum for the transaction of business at any meeting of the finance and investment committee consists of a majority of committee members, and decision is made by a majority of those present at the meeting.

The finance and investment committee comprised four independent directors as on March 31, 2016:

- Roopa Kudva, Chairperson

- Prof. John W. Etchemendy

- Kiran Mazumdar-Shaw

- Ravi Venkatesan

The finance and investment committee is responsible for:

- Discussing, reviewing and approving the overall acquisition and investment strategy of the Company in terms of broad business objectives to be met, overall fund allocation and areas of focus for investments and acquisitions

- Considering and approving proposals for acquisitions and investments up to certain threshold amounts of exposure as approved by the Board

- Periodically reviewing the status of acquisitions and investments in terms of business objectives met, status of integration of acquired companies, risk mitigation and financial returns

- Periodically reviewing the treasury policy of the Company, including investment of surplus funds and foreign currency operations

- Conducting an annual self-review of its own effectiveness

- Updating the Board on a periodic basis about the committee’s deliberations and decisions

The finance and investment committee has direct access to, and open communications with, the senior leaders of the Company. It may also retain independent consultants on a need basis and determine a suitable compensation for them.

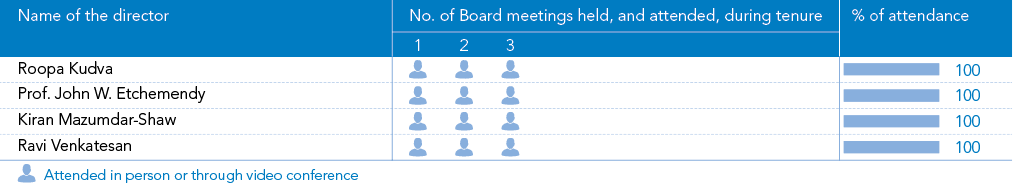

Finance and investment committee attendance

The finance and investment committee held three meetings during the fiscal ended March 31, 2016. These were held on July 20, 2015, October 11, 2015 and January 13, 2016. The attendance details of the finance and investment committee meetings are as follows:

Finance and investment committee report for the year ended March 31, 2016

During the year, the committee discussed, reviewed and approved the overall acquisition and investment strategy of the Company in terms of broad business objectives to be met, overall fund allocation and areas of focus for investments and acquisitions. It also considered and approved the proposals for acquisitions and investments up to certain threshold amounts of exposure as approved by the Board. The status of acquisitions and investments was reviewed, with a focus on the business objectives met, integration of acquired companies, risk mitigation and financial returns. The committee was also briefed about, and approved, the Infosys Innovation Fund set up to help start-ups by providing early-stage capital, product validation, customer introductions and joint go-to-market scale.

The committee also took stock of its overall effectiveness and updated the Board on the deliberations and decisions taken during the year.

The committee had direct access to, and open communications with the senior leaders of the Company. It may also retain independent consultants on a need basis and determine the suitable compensation for such consultants.

|

Sd/- |

|

|

Bangalore April 15, 2016 |

Roopa Kudva Chairperson |

D. Management review and responsibility

Formal evaluation of officers

The nomination and remuneration committee of the Board approves the compensation and benefits for all executive Board members. A committee headed by our CEO and MD reviews, evaluates and decides the annual compensation of our officers from the level of the Vice President upwards.

The non-executive Chairman, the CEO and MD, the COO and Whole-time Director and the CFO represent the Company in interactions with investors, the media and various governments. In addition, the CEO and MD, and the COO and Whole-time Director manages interactions with clients and employees.

Risk management

We have an integrated approach to managing risks inherent in various aspects of our business. The Risk Management report forms part of this Annual Report.

Management’s discussion and analysis

A detailed report on our Management’s discussion and analysis forms part of this Annual Report.

E. Shareholders

Disclosures regarding the appointment or re-appointment of directors

As per the provisions of the Companies Act, 2013, Dr. Vishal Sikka will retire in the ensuing AGM and being eligible, seek re-appointment. The Board recommends his re-appointment.

The Companies Act, 2013 provides for the appointment of independent directors. Sub-section (10) of Section 149 of the Companies Act, 2013 (effective April 1, 2014) provides that independent directors shall hold office for a term of up to five consecutive years on the board of a company; and shall be eligible for re-appointment on the passing of a special resolution by the shareholders of the Company. Accordingly, all independent directors were appointed by the shareholders either at the general meeting or through postal ballot as required under Section 149(10).

Further, Section 149(11) states that no independent director shall be eligible to serve on the board for more than two consecutive terms of five years. Section 149(13) states that the provisions of retirement by rotation as defined in sub-sections (6) and (7) of Section 152 of the Act shall not apply to such independent directors. None of the independent directors will retire at the ensuing AGM.

Communication to the shareholders

The quarterly report, along with additional information and official news releases, are posted on our website, www.infosys.com. The reports contain select financial data extracted from the audited Consolidated financial statements under the IFRS (INR), and unaudited Consolidated financial statements under the IFRS (USD). Moreover, the quarterly / annual results and official news releases are generally published in The Economic Times, The Times of India, Business Standard, Business Line, Financial Express and Udayavani (a regional daily published from Bangalore). Quarterly and annual financial statements, along with segmental information, are also posted on our website,

www.infosys.com. Earnings calls with analysts and investors are broadcast live on our website and their transcripts are also published on the website. The proceedings of the AGM are webcast live for shareholders across the world. The AGM presentations, transcripts and video archives are available on our website, www.infosys.com.

Further, Form 20-F filed with the Securities and Exchange Commission also contains detailed disclosures and is available on our website,

www.infosys.com.

Investor grievance and share transfer

We have a Board-level stakeholders relationship committee to examine and redress complaints by shareholders and investors. The status of complaints and share transfers is reported to the entire Board. The details of shares transferred and the nature of complaints are provided in the Shareholder information section of the Annual Report. For shares transferred in physical form, the Company provides adequate notice to the seller before registering the transfer of shares. The stakeholders relationship committee will meet as often as required to approve share transfers. For matters regarding shares transferred in physical form, share certificates, dividends, and change of address, shareholders should communicate with Karvy Computershare Private Limited, our registrar and share-transfer agent. Their address is published in the Shareholder information section of the Annual Report.

Share transactions are simpler and faster in electronic form. After a confirmation of a sale / purchase transaction from the broker, shareholders should approach the depository participant with a request to debit or credit the account for the transaction. The depository participant will immediately arrange to complete the transaction by updating the account. There is no need for a separate communication to the Company to register the transfer.

Details of non-compliance

No penalty has been imposed by any stock exchange, SEBI or SEC, nor has there been any instance of non-compliance with any legal requirements, or on matters relating to the capital market over the last three years.

Auditors’ certificate on corporate governance

As required by Schedule V of the SEBI (Listing Obligations and Disclosure Requirements) Regulation, 2015, the Auditors’ certificate on corporate governance is annexed to the Board’s report.

In addition to the certificate by the auditors, the Practicing Company Secretary has also issued a certificate on corporate governance as part of the secretarial audit.

CEO and CFO certification

As required by SEBI (Listing Obligations and Disclosure Requirements) Regulation, 2015, the CEO and CFO certification is provided in this Annual Report.

Code of conduct

In compliance with Regulation 26(3) of the SEBI (Listing Obligations and Disclosure Requirements) Regulation, 2015 and the Companies Act, 2013, the Company has framed and adopted a Code of Conduct and Ethics (‘the Code’). The Code is applicable to the members of the Board, the executive officers and all employees of the Company and its subsidiaries. The Code is available on our website, www.infosys.com.

All members of the Board, the executive officers and senior financial officers have affirmed compliance to the Code as on March 31, 2016.

A declaration to this effect, signed by the CEO and MD and the CFO, forms part of the CEO and CFO certification.

Prevention of insider trading

The Company has adopted an Insider Trading Policy to regulate, monitor and report trading by insiders under the SEBI (Prohibition of Insider Trading) Regulations, 2015. This policy also includes practices and procedures for fair disclosure of unpublished price-sensitive information, initial and continual disclosure. The Company has automated the declarations and disclosures to identified designated employees, and the Board reviews the policy on a need basis. The policy is available on our website (https://www.infosys.com/investors/corporate-governance/policies.html).

General body meetings

The details of the last three Annual and / or Extraordinary General Meetings are as follows:

|

Year ended |

Date and time |

Venue |

Special resolution passed |

|

March 31, 2013 |

June 15, 2013, at 3 p.m. IST |

Christ University Auditorium,

|

None |

|

August 3, 2013 at 3 p.m. IST (1) |

Christ University Auditorium,

|

None |

|

|

March 31, 2014 |

June 14, 2014 at 3 p.m. IST |

Christ University Auditorium,

|

Contract to sell, lease, transfer, assign or otherwise dispose of the whole or part of the ‘Products, Platforms and Solutions (PPS)’ business and undertaking of the Company to EdgeVerve Systems Limited |

|

July 30, 2014 at 3 p.m. IST (1) |

Christ University Auditorium,

|

None |

|

|

March 31, 2015 |