Corporate governance report

Our corporate governance philosophy

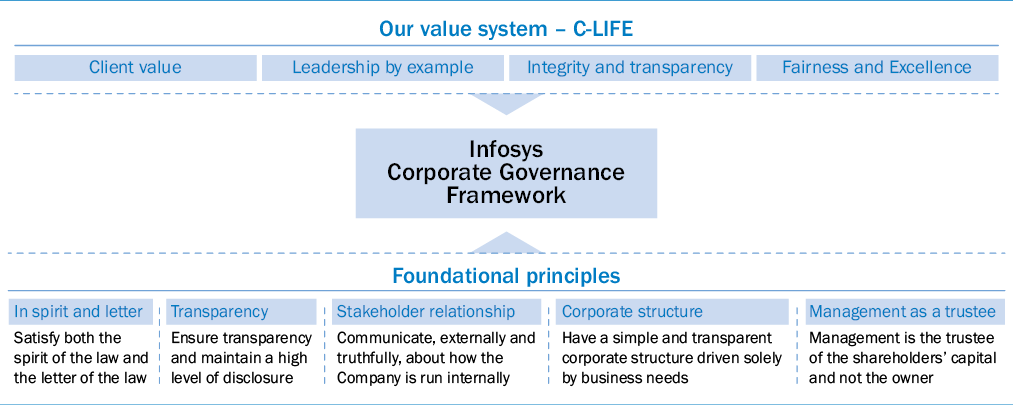

Our corporate governance is a reflection of our value system encompassing our culture, policies, and relationships with our stakeholders. Integrity and transparency are key to our corporate governance practices to ensure that we gain and retain the trust of our stakeholders at all times.

Corporate governance framework

Our corporate governance framework is guided by our core values – C-LIFE – and is based on the following principles :

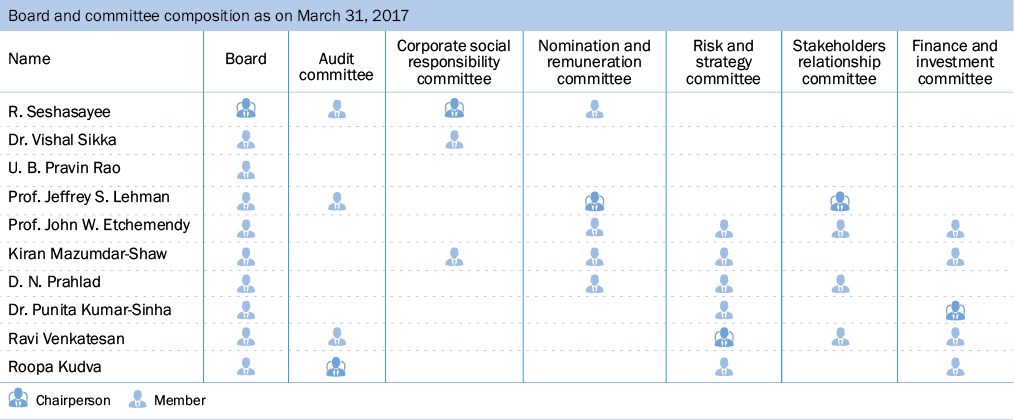

Our corporate governance framework ensures that we make timely disclosures and share accurate information regarding our financials and performance, as well as disclosures related to the leadership and governance of Infosys (‘the Company’). We believe that an active, well-informed and independent board is necessary to ensure the highest standards of corporate governance. At Infosys, the Board of Directors (‘the Board’) is at the core of our corporate governance practice. The Board oversees the Management’s functions and protects the long-term interests of our stakeholders. As on March 31, 2017, the Board comprised 10 members, of which eight members are independent directors. An independent director is nominated as the chairperson of each of the Board committees, namely audit, nomination and remuneration, stakeholders relationship, risk and strategy, finance and investment, and corporate social responsibility committees. On April 13, 2017, the Board constituted an additional committee of the Board, named committee of directors, which is also headed by an independent director.

Compliance with global guidelines and standards

We comply with global best practices in corporate governance. Starting with the landmark Cadbury Report in the U.K. in 1992, the enactment of the Sarbanes-Oxley Act, 2002, and Consumer Protection Act, we have been following and complying with the best practices of corporate governance over the years.

The Securities and Exchange Board of India (SEBI) has notified SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (‘the Listing Regulations’) on September 2, 2015. The Listing Regulations have incorporated the principles for corporate governance in line with the Organisation for Economic Co-operation and Development (OECD) principles and provide broad principles for periodic disclosures by listed entities in line with the International Organization of Securities Commissions (IOSCO) principles.

We substantially comply with the Euroshareholders Corporate Governance Guidelines, 2000 and the recommendations of the Conference Board Commission on Public Trusts and Private Enterprises in the U.S. We also adhere to the United Nations Global Compact (UNGC) and the OECD principles.

Corporate governance guidelines

The Board has defined a set of corporate governance best practices and guidelines to help fulfill our corporate responsibility towards our stakeholders. These guidelines ensure that the Board will have the necessary authority and processes to review and evaluate our operations as and when required. Further, these guidelines allow the Board to make decisions that are independent of the Management. The Board may change these guidelines regularly to achieve our stated objectives. The guidelines can be accessed from our website, at https://www.infosys.com/investors/corporate-governance/Documents/corporate-governance-guidelines.pdf.

A. Board composition

Size and composition of the Board

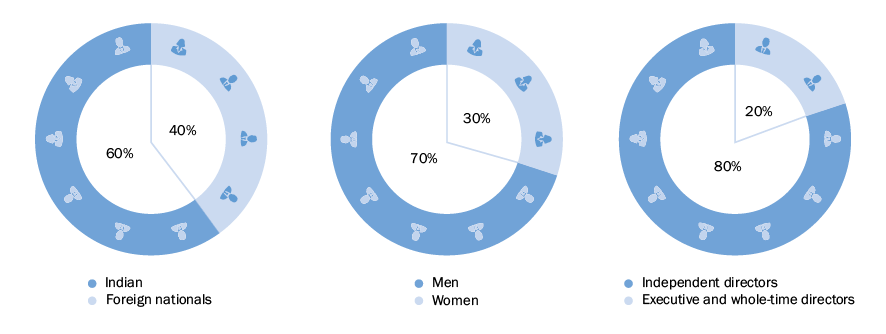

We believe that our Board needs to have an appropriate mix of executive and independent directors to maintain its independence, and separate its functions of governance and management. Listing regulations mandate that for a company with a non-executive chairman, at least one-third of the Board should be independent directors. As on March 31, 2017, our Board comprised 10 members, two of whom were executive or whole-time directors, while the remaining eight members were independent directors, constituting 80% of the Board’s strength – more than the requirements of the Companies Act, 2013 and the Listing Regulations. Three out of 10 Board members or 30% of the Board are women. Six of our Board members (60%) are Indians, while four (40%) are foreign nationals. The Board periodically evaluates the need for change in its composition and size.

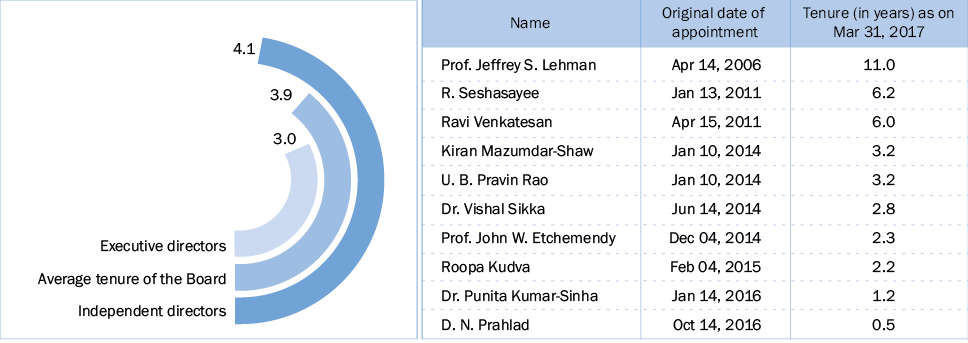

The average tenure of members on our Board is 3.9 years as of March 31, 2017. The average tenure of executive directors (whole-time directors) is 3.0 years and that of independent directors is 4.1 years.

The average tenure of Board members in years as on March 31, 2017 was as follows :

Chairmen of the Board

R. Seshasayee, an independent director, is the Chairman of the Board. Ravi Venkatesan, an independent director, is the Co-Chairman of the Board, with effect from April 13, 2017.

Responsibilities of the Chairmen, and the Chief Executive Officer and Managing Director

The Company has appointed R. Seshasayee as the non-executive Chairman of the Board (‘the Chairman’), Ravi Venkatesan, Independent Director, as the Co-Chairman of the Board, and Dr. Vishal Sikka as the Chief Executive Officer and Managing Director (CEO & MD).

The responsibilities and authority of these officials are as follows :

The Chairman and Co-Chairman (‘Chairmen’) are the leaders of the Board. As Chairmen, they are responsible for fostering and promoting the integrity of the Board while nurturing a culture where the Board works harmoniously for the long-term benefit of the Company and all its stakeholders. The Chairmen are primarily responsible for ensuring that the Board provides effective governance to the Company. In doing so, the Chairman will preside over meetings of the Board and of the shareholders of the Company.

The Chairmen will take a lead role in managing the Board and facilitate effective communication among directors. They are responsible for matters pertaining to governance, including the organization, composition and effectiveness of the Board and its committees, and the performance of individual directors in fulfilling their responsibilities. The Chairmen will provide independent leadership to the Board, identify guidelines for the conduct and performance of directors, and oversee the management of the Board’s administrative activities, such as meetings, schedules, agenda, communication and documentation.

The Chairmen will actively work with the nomination and remuneration committee to plan the composition of the Board and Board committees, induct directors to the Board, plan for director succession, participate in the Board effectiveness evaluation process and meet with individual directors to provide constructive feedback and advice.

The CEO & MD is responsible for corporate strategy, brand equity, planning, external contacts and all matters related to the management of the Company. He is also responsible for achieving annual and long-term business targets and acquisitions.

Role of the Board of Directors

The primary role of the Board is that of trusteeship to protect and enhance shareholder value through strategic direction to the Company. As trustees, the Board has fiduciary responsibility to ensure that the Company has clear goals aligned to shareholder value and its growth. The Board exercises its duties with care, skill and diligence and exercises independent judgment. It sets strategic goals and seeks accountability for their fulfillment. It also directs and exercises appropriate control to ensure that the Company is managed in a manner that fulfills stakeholders’ aspirations and societal expectations.

Definition of independent directors

The Companies Act, 2013 and the Listing Regulations define an ‘independent director’ as a person who is not a promoter or employee or one of the key managerial personnel (KMP) of the Company or its subsidiaries. The laws also state that the person should not have a material pecuniary relationship or transactions with the Company or its subsidiaries, apart from receiving remuneration as an independent director. We abide by these definitions of independent director in addition to the definitions of an independent director as laid down in the New York Stock Exchange (NYSE) listed company manual, Sarbanes-Oxley Act and U.S. securities laws by virtue of our listing on the NYSE in the U.S.

Board membership criteria

The nomination and remuneration committee works with the entire Board to determine the appropriate characteristics, skills and experience required for the Board as a whole and for individual members. Members are expected to possess the required qualifications, integrity, expertise and experience for the position. They should also possess deep expertise and insights in sectors / areas relevant to the Company, and ability to contribute to the Company’s growth.

The age limit for a managing director / executive director is 60 years, while the age limit for an independent director is 70 years. A director’s term may be extended at the discretion of the committee beyond the age of 60 or 70 years with shareholders’ approval by passing a special resolution, based on the explanatory statement annexed to the Notice for such motion indicating the justification for the extension of appointment beyond 60 or 70 years as the case may be.

Selection of new directors

The Board is responsible for the selection of new directors. The Board delegates the screening and selection process to the nomination and remuneration committee, which consists exclusively of independent directors. The committee, based on defined criteria, makes recommendations to the Board on the induction of new directors.

Training of Board members

All new non-executive directors inducted to the Board are introduced to our Company culture through orientation sessions. Current executive directors and senior management provide an overview of our operations, and familiarize the new non-executive directors on matters related to our values and commitments. They are also introduced to our organization structure, our services, Group structure and subsidiaries, constitution, Board procedures, matters reserved for the Board, and our major risks and risk management strategy. The details of the training program are available on our website at https://www.infosys.com/investors/corporate-governance.

The Board’s policy is to have separate meetings regularly with independent directors to update them on all business-related issues and new initiatives. At such meetings, the executive directors and other members of the senior management share points of view and leadership thoughts on relevant issues.

We also facilitate the continual educational requirements of our directors. Each director is entitled to a training fee of US $5,000 per year. Support is provided for independent directors if they choose to attend educational programs in the areas of Board / corporate governance.

Independent directors of the Board are familiarized through three kinds of engagements :

Deep dives and immersion sessions : Deep dives and immersion sessions are conducted by senior executives on their respective business units. The business unit can be an industry vertical or a service offering unit. Key aspects that are covered in these sessions include :

- Industry / market and technology trends

- Competition

- The Company’s performance

- Strategic bets and their progress

- Future outlook

Strategy retreat : As part of our annual strategy planning process, we organize a strategy retreat with the Board of Directors to deliberate on various topics related to strategic alternatives, progress of ongoing strategic initiatives, risks to strategy execution and the need for new strategic programs required to achieve the Company’s long-term objectives. Cross-functional teams develop each strategic theme, and each team is mentored by one or more Board members. This serves the dual purpose of providing a platform for Board members to bring their expertise to the projects, while also providing an opportunity for them to understand detailed aspects of execution and challenges relating to the specific theme. During this fiscal, the key themes discussed included service automation, software-enabled service offerings, design-led consulting, enablement of client-facing teams, cost optimization and capital allocation.

STRAP : Our annual strategy and planning event, STRAP, brings together the top leadership of the Company and the Board to discuss, debate and decide key aspects of strategy execution, especially as it relates to the next fiscal. This year, the event was held in the first week of March at the Company’s leadership institute in Mysuru, India. Over two days, leadership teams presented their plans, debated the feasibility of actions and objectives, and set up operational goals for the next fiscal. During the event, members of the Board of Directors had the opportunity to interact with multiple levels of leadership, both formally and informally, through networking sessions.

The above are specific mechanisms through which members of the Board are familiarized with the Company culture and operations. Apart from these, there could be additional meetings or sessions on demand on specific topics. All directors attend the familiarization programs as these are scheduled to coincide with the Board meeting calendar to give them an opportunity to attend.

Membership term

The Board constantly evaluates the contribution of members and periodically shares updates with the shareholders about reappointments consistent with applicable statutes. The current law in India mandates the retirement of two-third of the non-independent directors (who are liable to retire by rotation) every year, and qualifies the retiring members for reappointment. Executive directors are appointed by the shareholders for a maximum period of five years, but are eligible for reappointment upon completion of their term. An independent director shall hold office for a term of up to five consecutive years on the Board of the Company and will be eligible for reappointment on the passing of a special resolution by the shareholders.

Board member evaluation

One of the key functions of the Board is to monitor and review the Board evaluation framework. The Board works with the nomination and remuneration committee to lay down the evaluation criteria for the performance of the Chairman, the Board, Board committees, and executive / non-executive / independent directors through a peer evaluation, excluding the director being evaluated.

Independent directors have three key roles – governance, control and guidance. Some of the performance indicators, based on which the independent directors, are evaluated include :

- The ability to contribute to and monitor our corporate governance practices

- The ability to contribute by introducing international best practices to address business challenges and risks

- Active participation in long-term strategic planning

- Commitment to the fulfillment of a director’s obligations and fiduciary responsibilities; these include participation in Board and committee meetings.

To improve the effectiveness of the Board and its committees, as well as that of each individual director, a formal and rigorous Board review is internally undertaken on an annual basis. For fiscal 2017, the Board review process was for the first time externally facilitated and conducted by Egon Zehnder (a leadership advisory firm on board matters). The process took the form of questionnaires followed by structured interviews with independent and executive directors. A group of senior members of the executive team were also interviewed by the representatives of Egon Zehnder.

Succession planning

The nomination and remuneration committee works with the Board on the leadership succession plan, and prepares contingency plans for succession in case of any exigencies.

Board and executive leadership compensation policy

In order to adapt to the changing business context and the highly competitive environment that we operate in, our executive compensation philosophy has evolved to reward long-term sustainable performance. Our Executive Compensation Policy moves away from a predominantly cash-based compensation structure to a Total Rewards structure where a significant portion of the rewards is in the form of stock incentives. The details of executive leadership compensation is available at https://www.infosys.com/investors/reports-filings/Documents/statement-executives-compensation2017.pdf.

The nomination and remuneration committee determines and recommends to the Board the compensation payable to directors. All Board-level compensation is approved by the shareholders and disclosed separately in the financial statements. Remuneration for the executive directors comprises a fixed component and a variable component. The committee makes a periodic appraisal of the performance of the executive directors based on a detailed performance matrix. The annual compensation of the executive directors is approved by the committee and placed before the shareholders at the shareholders’ meeting / postal ballot.

The executive directors of the Company are entitled to an annual / half-yearly variable pay, which is subject to the achievement of certain fiscal milestones by the Company, as determined by the Board. The Board may reserve the authority to set such milestones on a GAAP or non-GAAP basis.

The compensation payable to the independent directors is limited to a fixed amount per year as determined and approved by the Board, the sum of which does not exceed 1% of net profits for the year, calculated as per the provisions of the Companies Act, 2013. The Board reviews the performance of independent directors on an annual basis.

Remuneration to directors in fiscal 2017

in ₹ crore

|

Name of the director |

Fixed salary |

Bonus / incentives |

Perquisites on account of stock options (1) |

Commission |

Total |

||

|

Base salary |

Retiral benefits |

Total fixed salary |

|||||

|

Whole-time directors |

|||||||

|

Dr. Vishal Sikka (3)(4)(5) |

6.71 |

0.28 |

6.99 |

(2) 5.33 |

(1) 3.69 |

– |

16.01 |

|

U. B. Pravin Rao (6) |

4.00 |

0.18 |

4.18 |

3.62 |

– |

– |

7.80 |

|

Independent directors |

|||||||

|

R. Seshasayee |

– |

– |

– |

– |

– |

1.95 |

1.95 |

|

Ravi Venkatesan |

– |

– |

– |

– |

– |

1.04 |

1.04 |

|

Prof. Jeffrey S. Lehman |

– |

– |

– |

– |

– |

1.37 |

1.37 |

|

Prof. John W. Etchemendy |

– |

– |

– |

– |

– |

1.10 |

1.10 |

|

Kiran Mazumdar-Shaw |

– |

– |

– |

– |

– |

0.89 |

0.89 |

|

Roopa Kudva |

– |

– |

– |

– |

– |

1.00 |

1.00 |

|

Dr. Punita Kumar-Sinha |

– |

– |

– |

– |

– |

1.22 |

1.22 |

|

D. N. Prahlad (7) |

– |

– |

– |

– |

– |

0.36 |

0.36 |

Notes : The details in the above table are on accrual basis.

For details on the number of equity shares held by the directors, refer to Annexure 6 to the Board’s report

(1) Remuneration includes only the perquisite value of stock incentives exercised during the period, determined in accordance with the provisions of the Income-tax Act, 1961. Accordingly, the value of stock incentives granted during the period is not included. During fiscal 2017, the CEO exercised 34,062 restricted stock units (RSUs).

(2) Includes US $0.82 million (approximately ₹ 5.33 crore) as variable pay for fiscal 2017, as approved by the nomination and remuneration committee on April 13, 2017.

(3) For fiscal 2017, 1,20,700 time-based RSUs amounting to US $2 million (approximately ₹ 13.42 crore) have been granted on August 1, 2016. These RSUs were issued in equity shares represented by ADSs.

(4) The Board, based on the recommendations of the nomination and remuneration committee, approved on April 13, 2017, performance-based equity and stock options for fiscal 2017, comprising 1,32,483 RSUs amounting to US $1.9 million (approximately ₹ 12.91 crore) and 3,30,525 ESOPs amounting to US $0.96 million (approximately ₹ 6.46 crore). These RSUs and ESOPs will be granted w.e.f. May 2, 2017.

(5) The Board, based on the recommendations of the nomination and remuneration committee, approved on April 13, 2017 the annual time-based vesting grant for fiscal 2018, comprising 1,37,741 RSUs amounting to US $2 million (approximately ₹ 12.97 crore). These RSUs will be granted w.e.f. May 2, 2017.

(6) On March 31, 2017, the shareholders vide a postal ballot approved a revision in the salary of U. B. Pravin Rao, COO and Whole-time Director, w.e.f. November 1, 2016. Based on the fiscal 2016 performance, the nomination and remuneration committee, in its meeting held on October 14, 2016, recommended a grant of 27,250 RSUs and 43,000 ESOPs, amounting to ₹ 4 crore to U. B. Pravin Rao, COO, under the 2015 Plan and the same was approved by the shareholders through a postal ballot on March 31, 2017. These RSUs and ESOPs will be granted w.e.f. May 2, 2017.

(7) For the period October 14, 2016 to March 31, 2017

Employment agreements with Executive directors

Dr. Vishal Sikka, Chief Executive Officer and Managing Director

The shareholders had approved the remuneration to Dr. Vishal Sikka vide a postal ballot concluded on March 31, 2016. Based on the shareholders’ approval, the Company had entered into an executive employment agreement effective April 1, 2016. The executive agreement can be accessed at

https://www.infosys.com/investors/reports-filings/Documents/CEO-executive-employment-agreement2017.pdf

The key details of the agreement are as follows :

- Base pay : An annual base salary of US $1,000,000, to be paid in accordance with the Company’s normal practices and subject to withholding taxes

- Variable pay : Annual performance-based variable pay at a target level of US $3,000,000 less applicable tax and subject to the Company’s achievement of fiscal performance targets set by the Board, as described in the postal ballot

- Stock compensation : Eligible to receive an annual grant of (i) US $2,000,000 of fair value in RSUs which will vest over time (‘time-based RSUs’), subject to continued service and (ii) US $5,000,000 in performance-based equity and stock options, upon the achievement of certain performance targets as described in the postal ballot

- Employee benefits and paid vacation : As applicable to other whole-time directors of the Company

- Minimum and maximum remuneration : Should Dr. Sikka fail to achieve minimum performance targets, his remuneration as proposed will fall to US $3,000,000 annually, consisting of US $1,000,000 of base salary and US $2,000,000 of time-based RSUs. If Dr. Sikka’s performance targets are exceeded, the performance-based payments for variable components of his compensation (variable pay and performance equity) will be capped at 150% of the target compensation for such variable components.

The Company and Dr. Sikka are to provide each other with 90 days’ notice of termination as applicable. Dr. Sikka may be entitled to severance benefits depending on the circumstances of his termination of employment.

- In case of termination for other than Cause, Death, Disability or resignation for Good Reason, he shall receive :

- Continuing payments of severance pay at a rate equal to his base pay rate, as then in effect, for a period of twenty-four (24) months and 24 times the liquidated payout paid in equal installments in accordance with the Company’s payroll practices over a period of 24 months. The severance will be paid, less applicable withholdings, in installments over the severance period with the first payment to commence on the 61st day following his termination of employment (and include any severance payments that otherwise would have been paid within 60 days following termination date), with any remaining payments paid in accordance with the Company’s normal payroll practices for the remainder of the severance period following termination of employment.

- If he elects continuation coverage pursuant to the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended (‘COBRA’), within the time period prescribed pursuant to COBRA for Executive and Executive’s eligible dependents, then the Company will reimburse him for the COBRA premiums for such coverage (at the coverage levels in effect immediately prior to his termination) until the earlier of (A) a period of 18 months from date of termination or (B) the date upon which he and / or his eligible dependents are no longer eligible for COBRA continuation coverage. The reimbursements will be made by the Company to him consistent with the Company’s normal expense reimbursement policy. Notwithstanding the first sentence, if the Company determines, in its sole discretion, that it cannot provide the foregoing benefit without potentially violating, or being subject to an excise tax under applicable law, the Company will, in lieu thereof, provide him a taxable monthly payment, payable on the last day of a given month (except as provided by the following sentence), in an amount equal to the monthly COBRA premium that he would be required to pay to continue the group health coverage for himself and / or his eligible dependents in effect on the termination of employment date (which amount will be based on the premium for the first month of COBRA coverage), which payments will be made regardless of whether he and / or his eligible dependents elect COBRA continuation coverage and will commence on the month following Executive’s termination of employment and will end on the earlier of (a) the date he becomes eligible for similar health and dental benefits pursuant to a benefit plan of a subsequent employer, or (b) the date the Company has paid an amount equal to 18 payments. Any such taxable monthly payments that otherwise would have been paid to him within the 60 days following his termination date instead will be paid on the 61st day following his termination of employment, with any remaining payments paid as provided in the prior sentence. For the avoidance of doubt, the taxable payments, in lieu of COBRA reimbursements, may be used for any purpose, including, but not limited to continuation coverage under COBRA, and will be subject to all applicable tax withholdings.

- Accelerated vesting of each of his then-outstanding equity grants (including RSUs and options). Provided however, if the equity grant has a performance requirement at the time of termination other than continued service, acceleration will be at 100% of the target number of shares subject to the grant. Any accelerated RSU grants will be settled on the 61st day following his termination of employment and any accelerated option grants must be exercised in accordance with the terms of the agreement evidencing the grant.

- In case of termination for Cause or resignation without Good Reason, then (i) all vesting will terminate immediately with respect to his outstanding RSUs, options or other equity awards and all awards will terminate in accordance with the terms thereof, (ii) all payments of compensation by the Company to him will terminate immediately (except as to amounts already earned), and (iii) he will only be eligible for severance benefits in accordance with the Company’s established policies, if any, as then in effect.

- In the event of termination of his employment with the Company, the above-mentioned provisions are intended to be and are exclusive and in lieu of any other rights or remedies to which he or the Company may otherwise be entitled, whether at law, tort or contract, in equity, or as per the Agreement. He will be entitled to no severance or other benefits upon termination of employment with respect to acceleration of award vesting or severance pay other than those benefits expressly set forth.

The details of severance pay and the conditions under which it is payable is described in detail in the executive employment agreement.

U. B. Pravin Rao, Chief Operating Officer and Whole-time Director

The shareholders had approved the remuneration to U. B. Pravin Rao vide a postal ballot concluded on March 31, 2017. Based on the shareholders’ approval, the Company had entered in to the executive employment agreement effective November 1, 2016. The executive employment agreement can be accessed at https://www.infosys.com/investors/reports-filings/Documents/COO-executive-employment-agreement2017.pdf.

The key details of the agreement are as follows.

- Fixed salary : Annual fixed salary of ₹ 4,62,50,000 (comprising primarily basic salary, house rent allowance, medical allowance, leave travel allowances, superannuation allowance, statutory bonus, ex-gratia, personal allowance and others) to be paid periodically in accordance with the Company’s normal payroll practices and subject to tax withholding.

- Variable pay : Annual variable compensation of ₹ 3,87,50,000 at 100% payout (capped at maximum of 120%) on the achievement of annual targets set by the Board or by the committee less applicable tax withholdings to be paid, and payable at such intervals as may be decided by the Board or the committee from time to time.

- Performance-based stock compensation : Based on fiscal 2016 performance, stock compensation of ₹ 4,00,00,000 by way of 27,250 RSUs and 43,000 stock options (based on Black-Scholes valuation) under the 2015 Stock Incentive Compensation Plan. The RSUs and stock options would vest over a period of four years and shall be exercisable within the period as approved by the committee. The exercise price of the RSUs will be equal to the par value of the shares and the exercise price of the stock options would be market price as on the date of grant under the 2015 Stock Incentive Compensation Plan. Stock compensation for periods beyond fiscal 2016 will be granted on achievement of performance conditions, decided by the Board or the committee each year. Such stock compensation shall not exceed ₹ 5,00,00,000 per annum.

- Employee benefits : During the term of his employment, U. B. Pravin Rao will be entitled to participate in the employee benefit plans of the Company, including personal accident insurance, club membership fees, use of Company-provided chauffeur and security services, contribution to retirement benefits such as provident fund, superannuation fund, gratuity, etc. In addition, U. B. Pravin Rao will be entitled to receive severance compensation amounting to nine months’ fixed salary should his employment be terminated without cause.

- Vacation : U. B. Pravin Rao will be entitled to paid vacation in accordance with the Company’s vacation policy applicable to its whole-time directors.

- Expenses : The Company will reimburse U. B. Pravin Rao for, or pay for, actual and reasonable travel, entertainment, security, or other expenses incurred by him pursuant to or in connection with the performance of his duties.

- Minimum remuneration : Further and notwithstanding anything herein, should the Company incur a loss or have inadequate profits in any financial year closing on and after March 31, 2017, during the tenure of U. B. Pravin Rao as a Whole-time Director of the Company, the Company shall pay to U. B. Pravin Rao an aggregate remuneration not exceeding the limits specified under Section II of Part II of Schedule V to the Companies Act, 2013 (including any statutory modifications or re-enactment(s) thereof, for the time being in force), or any other applicable for the time being in force.

The Company agreed with Pravin Rao, in case of termination without Cause by the Company, Pravin Rao shall receive accrued obligations, severance benefits and severance compensation, as defined in the employment contract. Accrued obligations is the sum of unpaid benefits as of the date of termination, comprising accrued salary, accrued benefits and accrued expenses. Severance benefits consist of bonus and options. For bonus, it includes payment of bonus earned for the prevailing bonus cycle till the date of termination and for options, it includes any outstanding equity awards as governed by the terms of the plan, agreements evidencing the awards and the plans under which the awards were granted. Severance compensation is a lump sum cash amount (less all applicable withholdings) equal to nine months of his fixed salary then in effect, subject to the execution of a waiver and release agreement in a form acceptable to the Company that shall be received on the 60th day following the date of termination.

In case of termination for Cause – he shall be entitled to accrued obligations, and the Company shall have no obligation to provide any of the severance benefits or severance compensation.

The details of severance pay and the conditions under which it is payable is described in detail in the executive employment agreement.

Indemnification agreements

We have also entered into agreements to indemnify our directors and officers for claims brought under U.S. laws to the fullest extent permitted by Indian law. These agreements, among other things, indemnify our directors and officers for certain expenses, judgments, fines and settlement amounts incurred by any such person in any action or proceeding, including any action by or in the right of Infosys Limited, arising out of such persons’ services as our director or officer.

Non-executive / independent directors’ remuneration

Shareholders, at the 34th Annual General Meeting (AGM) held on June 22, 2015, approved a sum not exceeding 1% of the net profits of the Company per annum calculated in accordance with the provisions of Section 198 of the Act, to be paid and distributed among some or all of the directors of the Company (other than the Managing Director and whole-time directors) in a manner decided by the Board. This payment will be made with respect to the profits of the Company for each year.

We have paid ₹ 8.93 crore to our independent directors for the year ended March 31, 2017. The aggregate amount was arrived at using the following criteria :

|

Particulars |

in ₹ crore |

in US $ |

|

Fixed Board fee |

0.49 |

75,000 |

|

Board attendance fee (1) |

0.16 |

25,000 |

|

Non-executive chairman fee |

0.97 |

150,000 |

|

Chairperson – audit committee |

0.19 |

30,000 |

|

Members – audit committee |

0.13 |

20,000 |

|

Chairperson – other committees |

0.13 |

20,000 |

|

Members – other committees |

0.06 |

10,000 |

|

Travel fee (per meeting) (2) |

0.06 |

10,000 |

|

Incidental fees (per meeting) (3) |

0.01 |

1,000 |

Notes : 1 US $ = ₹ 64.85 as on March 31, 2017

(1) The Company normally has five regular Board meetings in a year. Independent directors are expected to attend the four quarterly Board meetings and the AGM.

(2) For directors based overseas, the travel fee shown is per Board meeting. This is based on the fact that additional travel time of two days will have to be accommodated for independent directors to attend Board meetings in India.

(3) For directors based overseas, incidental fees shown is per Board meeting. This fee is paid to non-executive directors for expenses incurred during their travel to attend Board meetings in India.

The Board believes that the above compensation structure is commensurate with global best practices in terms of remunerating non-executive / independent directors of a company of similar size, and adequately compensates for the time and contribution made by our non-executive / independent directors.

Memberships in other boards

An executive director may, with the prior consent of the Chairman of the Board, serve on the Board of two other business entities, provided that such business entities are not in direct competition with our operations. Executive directors are also allowed to serve on the boards of corporate or government bodies whose interests are germane to the future of the IT and software business or the key economic institutions of the nation, or whose prime objective is to benefit society. Independent directors are not expected to serve on the boards of competing companies. There are no other limitations except those imposed by law and good corporate governance practices.

The composition of the Board, and directorships held, as on March 31, 2017 are as follows :

|

Name of the director |

Designation |

Age |

India-listed companies (1) |

All companies around the world (2) |

Committee memberships (3) |

Chairperson of committees (3) |

|

Whole-time directors |

|

|

|

|

|

|

|

Dr. Vishal Sikka |

Chief Executive Officer and Managing Director |

49 |

– |

2 |

– |

– |

|

U. B. Pravin Rao |

Chief Operating Officer and Whole-time Director |

55 |

– |

3 |

1 |

– |

|

Independent directors |

|

|

|

|

|

|

|

R. Seshasayee |

Chairman of the Board |

68 |

2 |

6 |

2 |

– |

|

Ravi Venkatesan (4) |

Co-Chairman and Independent Director |

54 |

1 |

2 |

2 |

– |

|

Prof. Jeffrey S. Lehman |

Independent Director |

60 |

– |

3 |

1 |

1 |

|

Prof. John W. Etchemendy |

Independent Director |

64 |

– |

1 |

1 |

– |

|

Kiran Mazumdar-Shaw |

Independent Director |

64 |

4 |

16 |

– |

– |

|

D. N. Prahlad |

Independent Director |

61 |

– |

7 |

1 |

1 |

|

Dr. Punita Kumar-Sinha |

Independent Director |

54 |

5 |

11 |

4 |

2 |

|

Roopa Kudva |

Independent Director |

53 |

– |

3 |

– |

1 |

Notes : There are no inter-se relationships between our Board members.

(1) Excluding directorship in Infosys Limited and its subsidiaries

(2) Directorship in companies around the world (listed, unlisted and private limited companies), including Infosys Limited and its subsidiaries

(3) As required by Regulation 26 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, the disclosure includes membership / chairpersonship of the audit committee and stakeholders relationship committee in Indian public companies (listed and unlisted).

(4) Appointed as Co-Chairman of the Board effective April 13, 2017

B. Board meetings

Scheduling and selection of agenda items for Board meetings

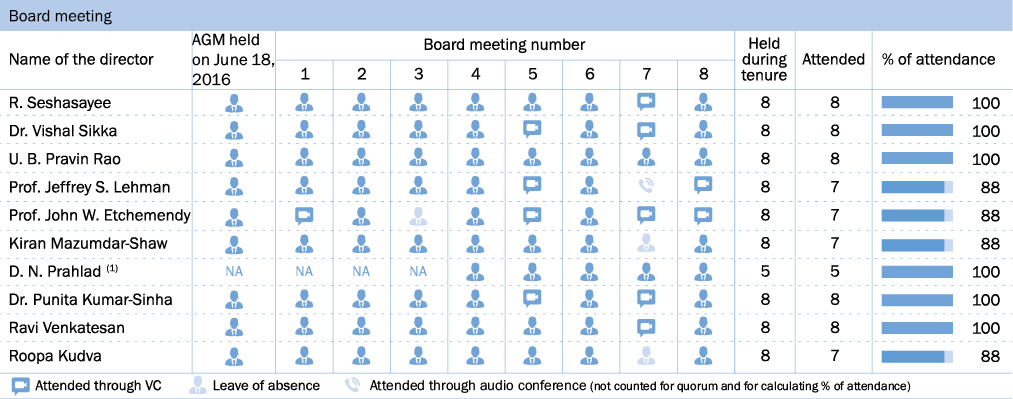

The dates of Board meetings for the next fiscal are decided in advance and published in the Annual Report as part of Shareholder information. The non-executive Chairman of the Board and the Company Secretary draft the agenda for each meeting, along with explanatory notes, in consultation with the CEO & MD, and distribute these in advance to the directors. Every Board member can suggest the inclusion of additional items in the agenda. The Board meets at least once a quarter to review the quarterly results and other items on the agenda, and also on the occasion of the AGM. Additional meetings are held when necessary. Independent directors are expected to attend at least four Board meetings in a year. However, with the Board being represented by independent directors from various parts of the world, it may not be possible for each one of them to be physically present at all the meetings. Hence, we use video / teleconferencing facilities to enable their participation. Committees of the Board usually meet the day before the formal Board meeting, or whenever the need arises for transacting business. The Board members are expected to rigorously prepare for, attend and participate in all Board and applicable committee meetings. Each member is expected to ensure that their other current and planned future commitments do not materially interfere with their responsibilities with us. Eight Board meetings were held during the year ended March 31, 2017. These were held on April 15, 2016; June 18, 2016; July 15, 2016; October 14, 2016; December 5, 2016; January 13, 2017; February 23, 2017; and March 9, 2017.

Attendance of directors during fiscal 2017

(1) Appointed as director effective October 14, 2016

Availability of information to Board members

The Board has unrestricted access to all Company-related information, including that of our employees. At Board meetings, managers and representatives who can provide additional insights into the items being discussed are invited. Information is provided to the Board members on a continuous basis for their review, inputs and approval periodically. Strategic and operating plans are presented to the Board in addition to the quarterly and annual financial statements. Specific cases of acquisitions, important managerial decisions, material positive / negative developments and statutory matters are presented to the committees of the Board and later, with the recommendation of the committees, to the Board for its approval. As a process, information to directors is submitted along with the agenda well in advance of Board meetings. Inputs and feedback of Board members are taken and considered while preparing the agenda and documents for the Board meeting. Deep dive and immersion sessions are conducted by senior executives in their respective business units. At these meetings, directors can provide their inputs and suggestions on various strategic and operational matters.

Meeting of independent directors

Schedule IV of the Companies Act, 2013 and the Rules thereunder mandate that the independent directors of the Company hold at least one meeting in a year, without the attendance of non-independent directors and members of the Management.

Even before the Companies Act, 2013 came into effect, our Board’s policy mandated quarterly meetings attended exclusively by the independent directors. At such meetings, the independent directors discuss, among other matters, the performance of the Company and risks faced by it, the flow of information to the Board, competition, strategy, leadership strengths and weaknesses, governance, compliance, Board movements, human resource matters and performance of the executive members of the Board, including the Chairman.

Materially significant related party transactions

There have been no materially significant related party transactions, monetary transactions or relationships between the Company and its directors, the Management, subsidiaries or relatives, except for those disclosed in the Board’s report. Detailed information on materially significant related party transactions is enclosed as Annexure 2 to the Board’s report.

C. Board committees

Currently, the Board has seven committees : audit committee, corporate social responsibility (CSR) committee, nomination and remuneration committee, risk and strategy committee, stakeholders relationship committee, finance and investment committee and committee of directors. The committee of directors was constituted effective April 13, 2017, with R. Seshasayee as the Chairperson and Ravi Venkatesan and D. N. Prahlad as members. All committees except the CSR committee consist entirely of independent directors.

The Board, in consultation with the nomination and remuneration committee, is responsible for assigning and fixing terms of service for committee members. It delegates these powers to the nomination and remuneration committee.

The non-executive chairman of the Board, in consultation with the Company Secretary and the committee chairperson, determines the frequency and duration of the committee meetings. Normally, all the committees meet four times a year. The recommendations of the committees are submitted to the entire Board for approval. During the year, all recommendations of the committees were approved by the Board.

The quorum for meetings is higher of two members or one-third of the total number of members of the committee.

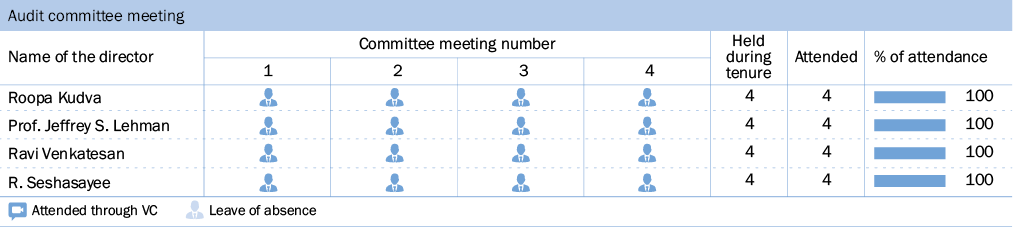

1. Audit committee

Our audit committee comprised four independent directors as on March 31, 2017 :

- Roopa Kudva, Chairperson and Financial Expert

- Prof. Jeffrey S. Lehman

- Ravi Venkatesan

- R. Seshasayee

There has been no change in the composition of the committee during the year. The Company Secretary acts as the secretary to the audit committee.

The primary objective of the audit committee is to monitor and provide an effective supervision of the Management’s financial reporting process, to ensure accurate and timely disclosures, with the highest levels of transparency, integrity and quality of financial reporting. The committee oversees the work carried out in the financial reporting process by the Management, the internal auditors and the independent auditors, and notes the processes and safeguards employed by each of them. The audit committee has the ultimate authority and responsibility to select, evaluate and, where appropriate, replace the independent auditors in accordance with the law. All possible measures are taken by the committee to ensure the objectivity and independence of the independent auditors.

In India, we are listed on the BSE Limited (BSE) and the National Stock Exchange of India Limited (NSE). We are also listed on the New York Stock Exchange (NYSE), Euronext Paris, and the Euronext London stock exchanges. In India, Regulation 18 of the Listing Regulations and in the U.S., the Blue Ribbon Committee set up by the U.S. Securities and Exchange Commission (SEC) mandate that listed companies adopt an appropriate audit committee charter. This recommendation has also been adopted by the NYSE. The audit committee charter containing exhaustive terms of reference is available on our website, at https://www.infosys.com/investors/corporate-governance/Documents/audit-committee-charter.pdf. The Board accepted all recommendations made by the audit committee during the year.

Audit committee attendance

The audit committee held four meetings during the year ended March 31, 2017. These were held on April 14, 2016, July 14, 2016, October 13, 2016 and January 12, 2017. The committee also held several meetings throughout the year over telephone calls for timely resolution of issues. The attendance details of the audit committee meetings are as follows :

Audit committee report for the year ended March 31, 2017

The audit committee is guided by the charter adopted by the Board that is available on the Company’s website, at https://www.infosys.com/investors/corporate-governance/Documents/audit-committee-charter.pdf. The charter is reviewed annually and was last amended on July 15, 2016 to keep it relevant to the current composition and functions of the committee.

The audit committee helps the Board monitor the Management’s financial reporting process, and ensure that the disclosures are not only accurate and timely, but follow the highest levels of transparency, integrity and quality of financial reporting. The committee also oversees the work of the internal and the independent auditors, and reviews the processes and safeguards employed by them. The audit committee has the ultimate authority and responsibility to select, evaluate and, where appropriate, replace the independent auditors in accordance with the law. It recommends to the Board the remuneration and terms of appointment of the internal, secretarial and independent auditors. All possible measures are taken by the committee to ensure the objectivity and independence of the independent auditors. In addition, the committee reviews the policies, processes and controls relating to the valuation of undertakings or assets of the Company that are carried out as and when required.

The committee is comprised solely of independent directors and fulfills the requirements of audit committee charter, as well as Section 149 of the Companies Act, 2013, Regulation 18 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, and NYSE guidelines. The committee complies with the SEBI Listing Regulations, NYSE, Euronext London and Euronext Paris exchange rules relating to its composition, independence of its members, disclosures relating to non-independent members, financial expertise of members and the audit committee charter.

To carry out its responsibilities efficiently and transparently, the committee relies on the Management’s financial expertise, and that of the internal and the independent auditors. The Management is responsible for the Company’s internal control over financial reporting and the financial reporting process. The independent auditors are responsible for performing an independent audit of the Company’s financial statements in accordance with the Generally Accepted Auditing Principles, and for issuing a report based on the audit.

The audit committee met four times and also held several meetings throughout the year over telephone calls for timely resolution of issues during fiscal 2017. The Management shared the Company’s financial statements, prepared in accordance with the Indian Accounting Standards (Ind AS) as specified under the Companies Act, 2013, read with the relevant rules thereunder, and International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board, with the committee. The committee held discussions with the auditors (whenever necessary, without any member of the Management being present) regarding the Company’s audited financial statements, including the auditors’ judgment about the quality and applicability of the accounting principles, the reasonableness of significant judgment and the adequacy of disclosures in the financial statements.

The committee also discussed with the auditors the matters required by Statement on Auditing Standards 1301 as amended, as adopted by the Public Company Accounting Oversight Board in Rule 3200.

Besides discussing the overall scope and plan for the internal audit, and requirements of SEC, SEBI and other regulatory bodies, the committee also reviewed with the independent auditors the adequacy and effectiveness of the Company’s legal, regulatory and ethical compliance programs. As part of continuous improvements, revisions to the Insider Trading Policy, Corporate Policy Statement on Investor Relations, Policy for determining the materiality of disclosures, Code of Conduct and Ethics and Whistleblower Policy were recommended to the Board and were duly approved. The committee also reviewed the other financial policies of the Company, including the Treasury Policy, covering instruments and foreign currency hedges.

With the auditors, the committee, on a periodic basis, reviewed the process adopted by the Management on impairment of assets including financial assets, goodwill and intangibles.

The committee granted omnibus approval for the related party transactions proposed to be entered into by the Company during fiscal 2017. On a periodic basis, the committee reviewed and approved related party transactions. The committee monitored and reviewed investigations of the whistleblower complaints received during the year.

During the year, the committee, upon recommendations from the nomination and remuneration committee, nominated certain employees of the Company as key managerial personnel under Ind AS 24, Related Party Disclosures.

Based on its discussion with the Management and the auditors, and a review of the representations of the Management and the report of the auditors, the committee has recommended the following to the Board :

- The audited financial statements prepared in accordance with Ind AS of Infosys Limited for the year ended March 31, 2017 be accepted by the Board as a true and fair statement of the financial status of the Company.

- The audited consolidated financial statements prepared in accordance with Ind AS of Infosys Limited and its subsidiaries for the year ended March 31, 2017 be accepted by the Board as a true and fair statement of the financial status of the Group.

- The audited consolidated financial statements prepared in Indian rupee in accordance with IFRS of Infosys Limited and its subsidiaries for the quarter and year ended March 31, 2017 be accepted by the Board as a true and fair statement of the financial status of the Group.

- The audited consolidated financial statements prepared in US dollar in accordance with IFRS of Infosys Limited and its subsidiaries for the year ended March 31, 2017, upon adoption by this committee, be accepted by the Board as a true and fair statement of the financial status of the Group and included in the Company’s Annual Report on Form 20-F, to be filed with the US Securities and Exchange Commission (SEC).

- The appointment of Deloitte Haskins & Sells, LLP, Chartered Accountants (Firm Registration No. 117366 W/W 100018) (‘Deloitte’) as the statutory auditors of the Company, in accordance with Section 139 of the Indian Companies Act, 2013 and the Rules made thereunder. Deloitte will hold office for a period of five consecutive years from the conclusion of the 36th AGM of the Company scheduled to be held in 2017 till the conclusion of the 41st AGM to be held in 2022, subject to the approval of the shareholders of the Company. The first year of audit will be of the financial statements for the year ending March 31, 2018 which will include audit of the quarterly financial statements for the year. To align with the above, the Board of Directors of the Company also approved the appointment of Deloitte as the independent registered public accounting firm of the Company, effective year ending March 31, 2018. As the independent registered public accounting firm, Deloitte will audit the annual financial statements of the Company to be included in the Company’s Annual Report on Form 20-F filed with the SEC. KPMG will continue as the Company’s independent registered public accounting firm through the completion of the audit for the year ending March 31, 2017 and for the purpose of filing such audited financial statements in the Form 20-F for the year ending March 31, 2017.

- The appointment of Ernst & Young as the internal auditors of the Company for the year ended March 31, 2018, to review various operations of the Company. The committee has issued a letter in line with Recommendation No. 9 of the Blue Ribbon Committee on audit committee effectiveness, to be provided in the financial statements prepared in accordance with IFRS in the Annual Report on Form 20-F.

- The appointment of Parameshwar G. Hegde of Hegde & Hegde, Company Secretaries, as secretarial auditor for the year ending March 31, 2018 to conduct the secretarial audit as prescribed under Section 204 and other applicable sections of the Companies Act, 2013.

Relying on its review and the discussions with the Management and the independent auditors, the committee believes that the Company’s financial statements are fairly presented in conformity with Ind AS and IFRS, and that there is no material discrepancy or weakness in the Company’s internal control over financial reporting.

In conclusion, the committee is sufficiently satisfied that it has complied with its responsibilities as outlined in the audit committee charter.

|

Sd/- |

|

|

Bengaluru April 12, 2017 |

Roopa Kudva Chairperson |

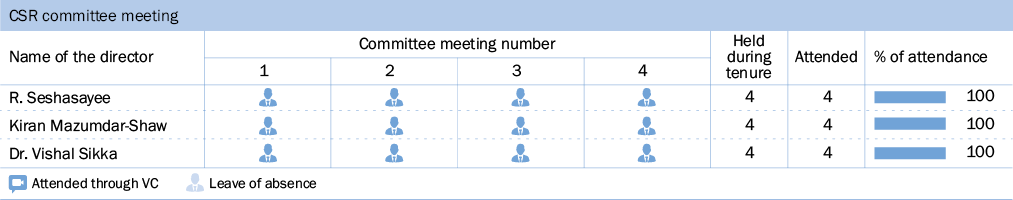

2. Corporate social responsibility (CSR) committee

Our CSR committee comprises two independent directors and the CEO & MD as members as on March 31, 2017 :

- R. Seshasayee, Chairperson

- Kiran Mazumdar-Shaw

- Dr. Vishal Sikka

There has been no change in the composition of the committee during the year.

While aiming to generate maximum profit for our shareholders through the year, we also focus on our social and environmental responsibilities to fulfill the needs and expectations of the communities around us. Our CSR is not limited to philanthropy, but encompasses holistic community development, institution-building and sustainability-related initiatives.

The CSR committee was set up to formulate and monitor the CSR policy of the Company. The CSR committee adopted a policy that outlines the Company’s objective of catalyzing economic development that positively improves the quality of life for the society, and aims to be a responsible corporate citizen and create positive impact through its activities on the environment, communities and stakeholders.

The CSR committee is also responsible for overseeing the activities / functioning of the Infosys Foundation in identifying the areas of CSR activities, programs and execution of initiatives as per pre-defined guidelines. The Foundation, in turn, guides the CSR committee in reporting the progress of deployed initiatives, and making appropriate disclosures (internal / external) on a periodic basis.

The CSR committee charter and the CSR policy of the Company are available on our website, at http://www.infosys.com/investors/corporate-governance/policies.html.

CSR committee attendance

The committee held four meetings during the year ended March 31, 2017. These were held on April 14, 2016, July 15, 2016, October 13, 2016 and January 12, 2017. The attendance details of the committee meetings are as follows :

CSR committee report for the year ended March 31, 2017

The CSR report, as required under the Companies Act, 2013 for the year ended March 31, 2017 is attached as Annexure 7 to the Board’s report.

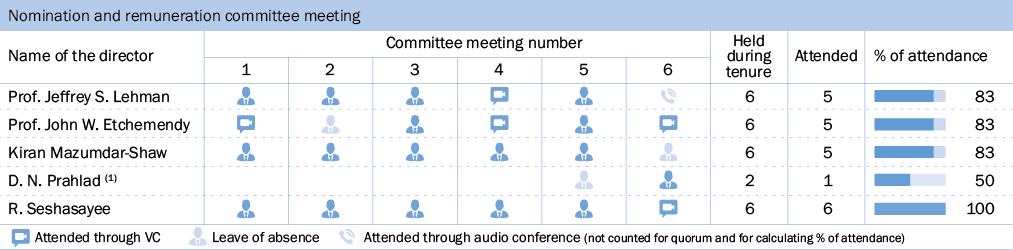

3. Nomination and remuneration committee

Our nomination and remuneration committee comprised five independent directors as on March 31, 2017 :

- Prof. Jeffrey S. Lehman, Chairperson

- Prof. John W. Etchemendy

- Kiran Mazumdar-Shaw

- D. N. Prahlad

- R. Seshasayee

D. N. Prahlad was appointed as a member of the nomination and remuneration committee effective January 13, 2017.

The purpose of the committee is to screen and review individuals qualified to serve as executive directors, non-executive directors and independent directors, consistent with criteria approved by the Board, and to recommend, for approval by the Board, nominees for election at the AGM. It also designs, benchmarks and continuously reviews the compensation program for the Board and the CEO & MD against the achievement of measurable performance goals. The committee also reviews and approves senior executive compensation to ensure it is competitive in the global markets in which we operate to attract and retain the best talent.

The committee makes recommendations to the Board on candidates for (i) nomination for election or re-election by the shareholders; and (ii) any Board vacancies that are to be filled. It may act on its own in identifying potential candidates, inside or outside the Company, or may act upon proposals submitted by the Chairman of the Board. The nomination and remuneration committee annually reviews and approves for the CEO & MD, the executive directors and executive officers : (a) the annual base salary; (b) the annual incentive bonus including the specific performance-based goals and amount; (c) equity compensation; (d) employment agreements, severance arrangements, and change in control agreements / provisions; and (e) any other benefits, compensation or arrangements.

It reviews and discusses all matters pertaining to candidates and evaluates the candidates. The nomination and remuneration committee coordinates and oversees the annual self-evaluation of the Board and of individual directors. It also reviews the performance of all the executive directors on a periodic basis or at such intervals as may be necessary on the basis of the detailed performance parameters set for each executive director at the beginning of the year. The nomination and remuneration committee may also regularly evaluate the usefulness of such performance parameters, and make necessary amendments.

The nomination and remuneration committee charter and policy are available on our website, at https://www.infosys.com/investors/corporate-governance/policies.html.

Nomination and remuneration committee attendance

The committee held six meetings during the year ended March 31, 2017. These were held on April 14, 2016, July 14, 2016, October 13, 2016, December 21, 2016, January 13, 2017 and February 23, 2017. The attendance details of the committee meetings are as follows :

(1) Appointed as member of the committee w.e.f. January 13, 2017

Nomination and remuneration committee report for the year ended March 31, 2017

The committee oversees key processes through which the Company recruits new members to its Board, and also the processes through which the Company recruits, motivates and retains outstanding senior management and oversees the Company’s overall approach to human resources management.

During the year, the committee nominated D. N. Prahlad as an independent director to the Board. D. N. Prahlad is the founder and former CEO of Surya Software Systems Private Limited, Bengaluru. Surya focusses on products for financial risk management of financial institutions in general and banks in particular. He is on the advisory board of the Computer Science and Automation Department of the Indian Institute of Science, Bengaluru. He served as an adjunct faculty member at the Indian Institute of Information Technology, Bengaluru, in its formative years. He serves as an advisory board member of PathShodh Healthcare, a company that uses nano-technology for diagnostic measurements related to diabetes.

Prahlad is a B.Sc. with honours in Mathematics from Bangalore University and B.E. (Electrical technology and Electronics) from the Indian Institute of Science, Bengaluru.

Prior to founding Surya, he played a key role in the rapid growth of Infosys Technologies, being associated with Infosys from its formative years. He brings with him a high level of experience of working with multiple Fortune 50 clients, creation of new services, products and strategies.

During the year, the committee proposed that the Board approve a revision of compensation of U. B. Pravin Rao based on his performance in fiscal 2016 and independent compensation benchmarks. The revised compensation reflects the Company’s philosophy of aligning senior management compensation to shareholders’ interests by increasing the variable component as a percentage of total compensation.

During the year, no independent directors were liable to retire by rotation and none will retire at the ensuing AGM. Following the provisions of the Companies Act, 2013, U. B. Pravin Rao will retire at the ensuing AGM. The committee considered his performance and recommended that shareholders approve the necessary resolutions for the reappointment of U. B. Pravin Rao.

During the year, the committee recommended to the Board to include certain employees of the Company as key managerial personnel. Stock incentive grants were approved and granted to approximately 8,300 employees during the year.

During the year, the committee undertook a review of the succession plans for key leadership positions, and helped to shape and monitor the development plans of key leadership personnel. Substantial focus was placed on improving the overall diversity of the workforce and enhancing employee engagement through real-time feedback from employees.

During the year, the committee received reports from the Company concerning efforts to ensure the safety, security and overall wellbeing of employees.

During the year, the committee, under the guidance of the Board, engaged a third-party board evaluation facilitator to formulate the criteria and framework for the performance evaluation of every director on the Board, including the executive and independent directors. The committee also identified ongoing training and education programs to ensure that the non-executive directors are provided with adequate information regarding the business, the industry, and their legal responsibilities and duties.

|

Sd/- |

|

|

Bengaluru April 12, 2017 |

Prof. Jeffrey S. Lehman Chairperson |

4. Risk and strategy committee

Our risk and strategy committee comprised six independent directors as on March 31, 2017 :

- Ravi Venkatesan, Chairperson

- Prof. John W. Etchemendy

- Kiran Mazumdar-Shaw

- D. N. Prahlad

- Dr. Punita Kumar-Sinha

- Roopa Kudva

Dr. Punita Kumar-Sinha and D. N. Prahlad were appointed as members of the risk and strategy committee effective April 15, 2016 and March 9, 2017 respectively. R. Seshasayee ceased to be a member effective April 15, 2016.

The purpose of the risk and strategy committee is to assist the Board in fulfilling its responsibilities with regard to the identification, evaluation and mitigation of operational, strategic and environmental risks. The risk and strategy committee has the overall responsibility of monitoring and approving the risk policies and associated practices of the Company. It is also responsible for reviewing and approving risk disclosure statements in public documents or disclosures.

The risk and strategy committee charter is available on our website, at https://www.infosys.com/investors/corporate-governance/Documents/risk-management-committee-charter.pdf. Further, the risk and strategy framework of the Company is part of the Risk Management Report section of the Annual Report.

Risk and strategy committee attendance

The risk and strategy committee held four meetings during the year ended March 31, 2017. These were held on April 14, 2016, July 14, 2016, October 13, 2016, and January 12, 2017. The attendance details of the risk and strategy committee meetings are as follows :

|

(1) Appointed as a member w.e.f. March 9, 2017 |

(2) Appointed as a member w.e.f. April 15, 2016 |

(3) Ceased to be a member w.e.f. April 15, 2016 |

Risk and strategy committee report for the year ended March 31, 2017

The committee reviewed the Company’s progress on strategy execution, its risk management practices and activities on a quarterly basis. This included a review of strategic programs for the achievement of short and long-term business objectives covering growth, profitability, business model, talent, leadership and operational excellence. The committee reviewed the top strategic, operational and compliance risks associated with achieving these business objectives, and the actions taken to address these risks. The committee performed these reviews using the Company’s strategy and enterprise risk management framework, the corporate strategy execution scorecard and trend lines of top risks.

In accordance with the scheduled annual calendar, the committee reviewed strategy and risk management in the areas of momentum of new services, automation, acquisition synergy realizations, cyber-security and network penetration, critical risk projects, leadership development, talent model, shareholder activism, Foreign Corrupt Practices Act (FCPA) and immigration regulation risk. The members of the committee conducted deep dive exercises in the areas of quality, talent, cyber-security, subsidiary performance and automation.

Further, the committee reviewed the Company’s enterprise risk management framework, findings from the risk survey, trend lines of top risks in terms of impact, likelihood of occurrence, potential exposure and progress of mitigation actions. The committee shared regular updates with the Board regarding all aspects of strategy and risk management. While acknowledging the competitive and dynamic nature of the business environment, and based on the information made available to it, the committee believes that the Infosys risk framework, along with risk assessment, monitoring, mitigation and reporting practices, is adequate to effectively manage the foreseeable material risks. In conclusion, the committee is sufficiently satisfied that it has complied with its responsibilities as outlined in the risk and strategy committee charter.

|

Sd/- |

|

|

Bengaluru April 12, 2017 |

Ravi Venkatesan Chairperson |

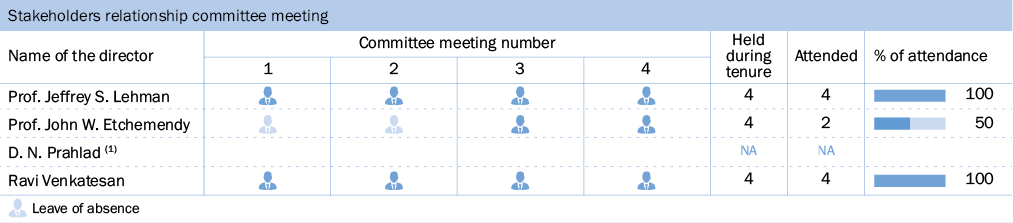

5. Stakeholders relationship committee

The stakeholders relationship committee has the mandate to review and redress stakeholder grievances.

Our stakeholders relationship committee comprised four independent directors as on March 31, 2017 :

- Prof. Jeffrey S. Lehman, Chairperson

- Prof. John W. Etchemendy

- D. N. Prahlad

- Ravi Venkatesan

D. N. Prahlad was appointed as a member of the committee effective January 13, 2017.

The Board has appointed A. G. S. Manikantha, Company Secretary, as the Compliance Officer for the Listing Regulations with effect from December 1, 2015.

Stakeholders relationship committee attendance

The stakeholders relationship committee held four meetings during the year ended March 31, 2017. These were held on April 14, 2016, July 14, 2016, October 13, 2016 and January 12, 2017. The attendance details of the stakeholders relationship committee meetings are as follows :

(1) Appointed as a member w.e.f. January 13, 2017

Stakeholders relationship committee report for the year ended March 31, 2017

The committee adopted its charter at its meeting held on January 12, 2017. The purpose of the committee is to assist the Board and the Company in maintaining healthy relationships with all stakeholders. The committee oversees the mechanisms for redressing grievances and complaints from stakeholders including shareholders, debenture holders, other security holders, vendors, customers, employees and others. Such mechanisms include the whistleblower mechanism, the Internal Committee, Hearing Employees and Resolving (HEAR), and the Grievance Redressal Board (GRB).

The committee receives reports from designated personnel for each of the above mechanisms and reviews the unresolved issues on a periodical basis. It has the authority to make recommendations to resolve any unresolved issues.

The committee reviews complaints related to transfer of shares, non-receipt of annual report and non-receipt of declared dividends. It also approves the issue of duplicate certificates and new certificates on split / consolidation / renewal etc., and approves transfer / transmission, dematerialization and rematerialization of equity shares in a timely manner. It oversees the performance of the registrar and share transfer agents, and recommends measures for overall improvement in the quality of investor services. It also reviews the Company’s attention to the environmental, health and safety interests of stakeholders.

The committee has the authority to consult with other committees of the Board, obtain advice and assistance from internal or external legal, accounting or other advisors.

The charter of the committee as adopted by the Board is available on our website, at https://www.infosys.com/investors/corporate-governance/Documents/stakeholders-relationship-committee.pdf.

The committee expresses satisfaction with the Company’s performance in dealing with investor grievances and its share transfer system.

The details of the complaints resolved during the fiscal ended March 31, 2017 are as follows :

|

Nature of complaints |

Received |

Resolved |

Closing |

|

Dividend / Annual Report related |

576 |

576 |

Nil |

It has also been noted that the shareholding in dematerialized mode as on March 31, 2017 was 99.81% (99.79% as of March 31, 2016).

|

Sd/- |

|

|

Bengaluru April 13, 2017 |

Prof. Jeffrey S. Lehman Chairperson |

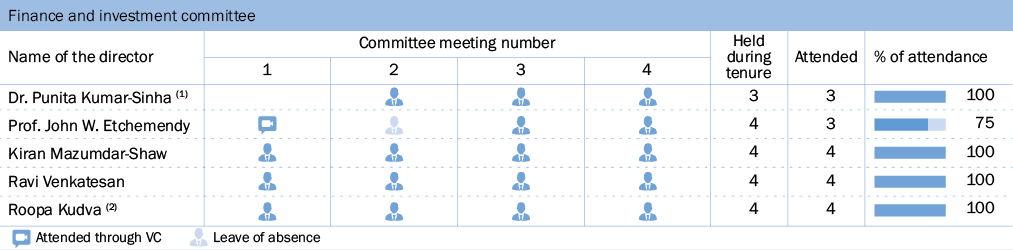

6. Finance and investment committee

The Board constituted the finance and investment committee to assist it in overseeing acquisitions and investments made by the Company and provide oversight on key investment policies of the Company.

The finance and investment committee comprises independent members of the Board and has a minimum of three members. The charter states that the chairperson, in consultation with other committee members, would set the agenda for, and preside at, the meetings. A quorum for the transaction of business at any meeting of the finance and investment committee comprises a majority of committee members, and decision is made by a majority of those present at the meeting. The charter of the committee is available on our website, at https://www.infosys.com/investors/corporate-governance/Documents/archives/finance-investment-committee-charter.pdf.

The finance and investment committee comprised five independent directors as on March 31, 2017 :

- Dr. Punita Kumar-Sinha, Chairperson

- Prof. John W. Etchemendy

- Kiran Mazumdar-Shaw

- Ravi Venkatesan

- Roopa Kudva

Dr. Punita Kumar-Sinha was appointed as a member of the committee effective April 15, 2016 and was named the chairperson from January 13, 2017. Roopa Kudva ceased to be the chairperson from January 13, 2017 and continued as a member of the committee.

Finance and investment committee attendance

The finance and investment committee held four meetings during the fiscal ended March 31, 2017. The meetings were held on April 14, 2016, July 14, 2016, October 13, 2016 and January 12, 2017. The attendance details of the finance and investment committee meetings are as follows :

(1) Appointed as a member of the committee w.e.f. April 15, 2016 and Chairperson of the committee effective January 13, 2017.

(2) Ceased to be Chairperson and continued as a member from January 13, 2017.

Finance and investment committee report for the year ended March 31, 2017

During the year, the committee discussed, reviewed and approved the overall acquisition and investment strategy of the Company in terms of business objectives, overall fund allocation and focus areas for investments and acquisitions. The committee was updated on the mergers and acquisitions that were in the pipeline, the evaluation framework for mergers and acquisitions, post-merger integration, risk mitigation, strategic benefits and financial returns. The committee also considered and approved the proposals for acquisitions and investments up to a certain threshold as approved by the Board.

Furthermore, the committee was briefed about the strategic progress of the Infosys Innovation Fund. The committee approved the Infosys Innovation Fund’s agenda of helping startups by providing early-stage capital, product validation, customer introductions and joint go-to-market scale. The committee reviewed the field engagement status, pipeline and the current returns of the Innovation Fund. The treasury policy was also discussed and approved.

The committee took stock of its overall effectiveness and updated the Board on the deliberations and decisions made during the year.

The committee had direct access and open communications with the senior leaders of the Company.

|

Sd/- |

|

|

Bengaluru April 12, 2017 |

Dr. Punita Kumar-Sinha Chairperson |

7. Committee of directors

The Board constituted a committee of directors to support and advise the Management in executing the Company’s strategy. The committee was constituted effective April 13, 2017.

The committee of directors comprised three independent directors :

- R. Seshasayee, Chairperson

- D. N. Prahlad

- Ravi Venkatesan

D. Management review and responsibility

Formal evaluation of officers

The nomination and remuneration committee of the Board approves the compensation and benefits for all executive Board members. A committee headed by our CEO & MD reviews, evaluates and decides the annual compensation of senior executives.

Board interaction with clients, employees, institutional investors, the government and the media

The Chairmen, the CEO & MD, the COO, the CFO, the Presidents, the Deputy CFO, and investors relations team represent the Company in interactions with investors, the media and various governments. In addition, the CEO & MD, the COO, the CFO and the Presidents manage interactions with clients and employees. The other authorized media spokespersons for business-specific matters include the Presidents and Heads of HR.

E. Shareholders

Disclosures regarding the appointment or reappointment of directors

As per the provisions of the Companies Act, 2013, U. B. Pravin Rao will retire at the ensuing AGM and being eligible, seek reappointment. The Board, based on its evaluation, has recommended his reappointment.

The Companies Act, 2013 provides for the appointment of independent directors. Sub-section (10) of Section 149 of the Companies Act, 2013 (effective April 1, 2014) provides that independent directors shall hold office for a term of up to five consecutive years on the board of a company, and shall be eligible for reappointment on the passing of a special resolution by the shareholders of the Company. Accordingly, all independent directors were appointed by the shareholders either at the general meeting or through a postal ballot as required under Section 149(10).

Further, Section 149(11) states that no independent director shall be eligible to serve on the Board for more than two consecutive terms of five years. Section 149(13) states that the provisions of retirement by rotation, as defined in sub-sections (6) and (7) of Section 152 of the Act, shall not apply to such independent directors. None of the independent directors will retire at the ensuing AGM.

Communication to the shareholders