The growth year

in close-up

Nilanjan Roy

Chief Financial Officer

“The Board of Directors has recommended a final dividend of ` 10.50 per share for fiscal 2019. Coupled with an interim dividend of ` 7 per share paid in October 2018 and a special dividend of ` 4 per share paid in January 2019, the Company will pay out a total dividend in excess of ` 11,200 crore (` 21.50 per share).”

Navigate your next, more than just a strategy, has now become a way of life at Infosys. As enterprises focus on reshaping their businesses to prepare for the digital era, we are helping them drive the transformation and sustain gains from their large-scale change efforts. Across the organization, I see our people engage with our clients in richer conversations born from deep insights and sound experience of having partnered with them across functions and departments. Helping these businesses grapple with the various dimensions of their digitization, during the year, has brought us strong revenue growth.

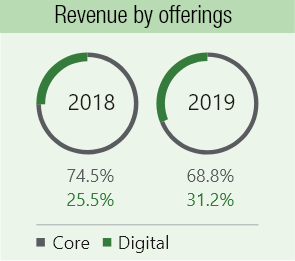

Our digital revenues, in constant currency terms, grew at 33.8% during fiscal 2019 and is now a third of our total revenues.

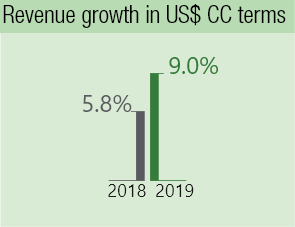

The overall revenue growth stood at 9.0% in fiscal 2019, in constant currency, up from 5.8% in fiscal 2018. In INR terms, revenue growth was even more robust, at 17.2%, on a year-on-year basis, making fiscal 2019 one of our strongest growth years in the recent past. This positive focus is also clearly visible in our strong deal momentum. The Total Contract Value (TCV) of large deals (deals of TCV greater than US$ 50 million) more than doubled during fiscal 2019 to US$ 6.3 billion from US$ 3.1 billion in fiscal 2018.

While managing profitability and controlling costs, we made strategic investments to execute on our four-pillared strategy of scaling agile digital, bringing intelligent automation to our core services, localizing our talent pools and reskilling our employees. These investments are crucial to future-proof our business and create growth capabilities for the coming years. Notwithstanding these investments, we had strong cash generation from business operations. Our operating cash flows were at 103% and free cash flows (net cash provided by operating activities less capital expenditure) were at 87% of our net profits for the year.

Reported EPS for the year was lower by 0.3% at ` 35.44 as against ` 35.53 in fiscal 2018. Normalized EPS* for the year was higher by 13% in INR terms compared to fiscal 2018. RoE for the year was 22.7% as compared to 24.1% in the previous year. Normalized RoE* increased to 24.2% from 22.5% in fiscal 2018.

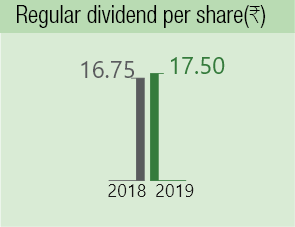

The Board of Directors has recommended a final dividend of ` 10.50 per share for fiscal 2019. Coupled with an interim dividend of ` 7 per share paid in October 2018 and a special dividend of ` 4 per share paid in January 2019, the Company will pay out a total dividend in excess of ` 11,200 crore (` 21.50 per share).

We took significant steps towards executing our Capital Allocation Policy, which was announced in April 2018, to return ` 13,000 crore to shareholders. Over two special dividends paid out in June 2018 and January 2019, we distributed ` 4,740 crore as special dividend (including dividend distribution tax). We commenced buyback of ` 8,260 crore on March 20, 2019 through the open market route at a maximum price of ` 800 per share. To celebrate 25 years of listing in India and to further increase the liquidity of shares, the Company issued bonus shares in the ratio of 1:1 in September 2018.

In sum, we generated 36% Total Shareholder Return (TSR) for fiscal 2019 – a mark of how we are creating shared prosperity even as we strive to make continued progress in the service of our vision to be the digital transformation partner our clients trust to navigate them towards the future.

*Normalized EPS / RoE – Non-IFRS measure – Reported net profit for fiscal 2019 is normalized by excluding the impact of reduction in the value of Panaya and Skava of ` 721 crore as against a benefit of ` 1,432 crore on account of a conclusion of an Advance Pricing Agreement and a reduction in the value of Panaya of ` 118 crore during fiscal 2018.