AI/Automation

Reinventing Capital Investments

As startups and corporates seek out partnerships that transcend monetary funding, we take an interesting, by the-numbers look at how the investment landscape has evolved over the years to become largely symbiotic.

In a recent report, titled ‘Finding and Developing Partners of the Future,’ Forrester Research had some compelling advice for corporate venture funds. It stated, “Considering the rate at which new tech accelerators keep cropping up — and the fact that small and medium-sized businesses (SMBs) have long been the engines driving economic growth — tech vendors would be remiss not to proactively recruit these new entrants into their partner ecosystems.”

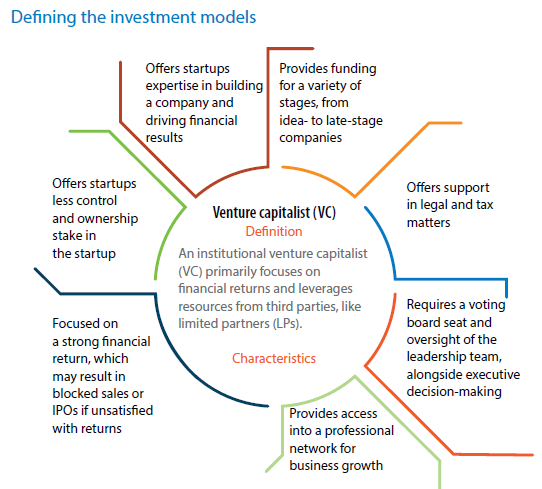

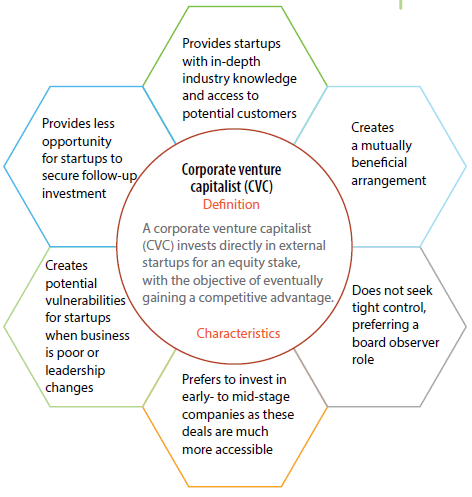

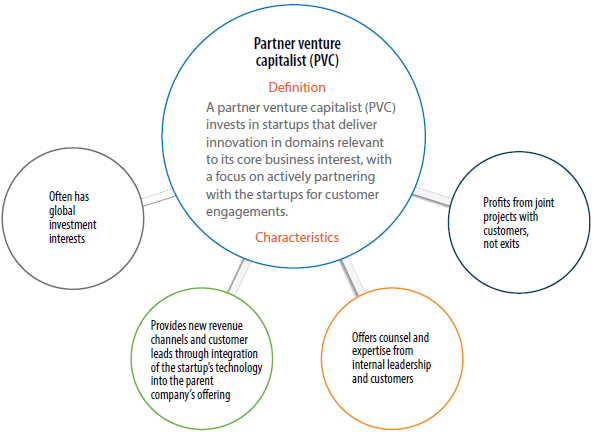

Still, several tech companies that make this investment, choose to buy an equity stake in a startup with the intent of selling it off, or use the smaller company’s technology to gain a competitive advantage in the future. However, another model called ‘Partner Venture Capital,’ in which the parent company invests in a startup with the intention of using the startup’s technology immediately to build out their own stable of offerings and within their existing work, is emerging as a partnership that has long-term benefits. With VC-backed funds slowing, compared to last year, startups in search of greater exposure and momentum with new, established customers are seeking out experienced technology partners that can go beyond funding and offer engagements with clients that can benefit from their solutions.

Still, several tech companies that make this investment, choose to buy an equity stake in a startup with the intent of selling it off, or use the smaller company’s technology to gain a competitive advantage in the future. However, another model called ‘Partner Venture Capital,’ in which the parent company invests in a startup with the intention of using the startup’s technology immediately to build out their own stable of offerings and within their existing work, is emerging as a partnership that has long-term benefits. With VC-backed funds slowing, compared to last year, startups in search of greater exposure and momentum with new, established customers are seeking out experienced technology partners that can go beyond funding and offer engagements with clients that can benefit from their solutions.

Data to tell the story

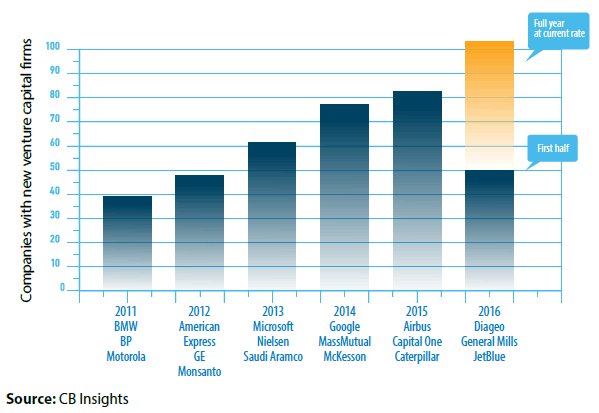

The new VCs

The number of new corporate venture capital units has steadily increased over the past five years.

Split opinion

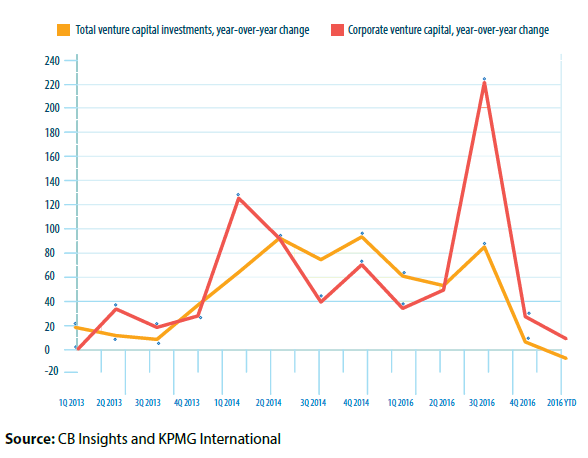

Investments in startups have slowed from 2015. But corporate money continues to flow into startups.

Corporate checkbooks

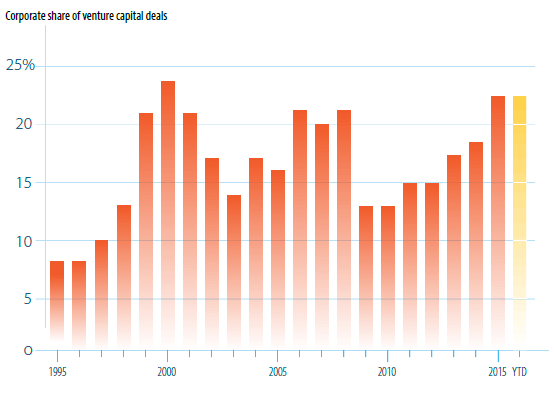

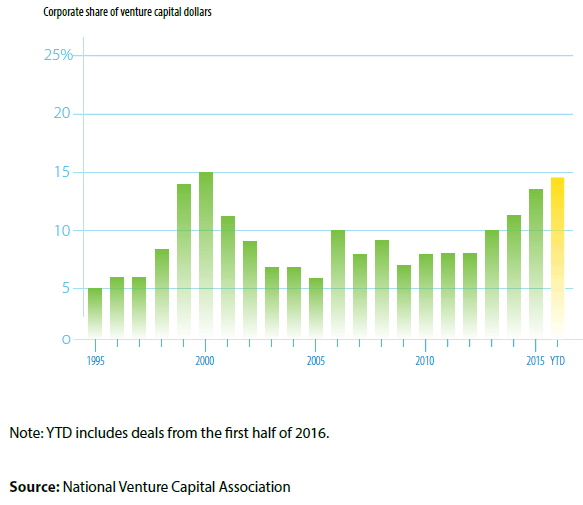

Not since the dotcom era have companies and their investment funds been such big participants in funding startups.

Source: https://www.bloomberg.com/

“As evidence of this shifting IPO climate, the total number of new stock debuts this year remains the lowest since 2009, according to data from the Wall Street Journal and Dealogic. Just 63 companies had gone public as of late August, raising a cumulative $12.9 billion. That’s a 50% drop from the year-todate volume in 2015 and a 73% drop over the first eight months of 2014. In fact, there have only been two slower years for IPOs since 1995 – in 2003 following the dot-com crash, and in 2009 right after the Great Recession.”

Source: http://venturebeat.com/

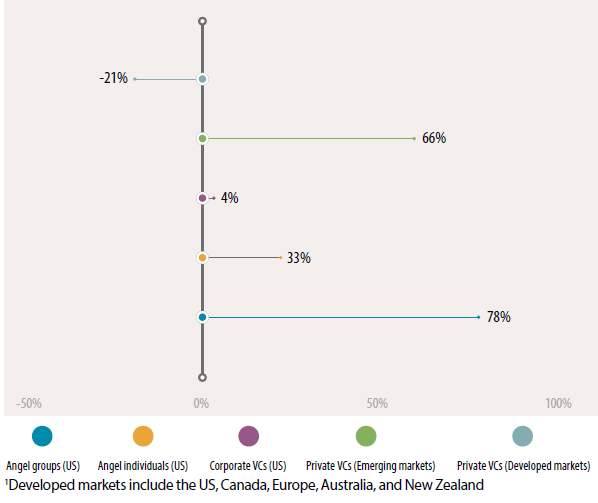

“While many startups used to rely exclusively on venture capital firms to providing funding, the amount of VC firms in existence today has dropped substantially in recent years. In fact, according to the study, private venture capital firms have fallen over the last decade, representing the only type of investor that has seen a decrease in that time.”

Most investor types have seen growth in numbers

Change in the number of investor startup companies from 2004-20131, %

1Developed markets includes the US, Canada, Europe, Australia, and New Zealand

Source: http://tech.co/

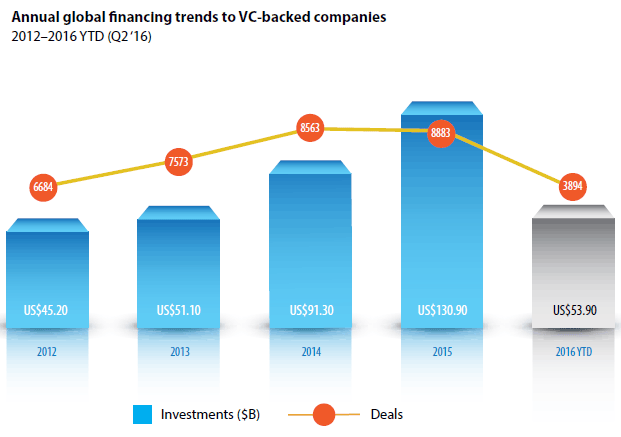

Annual global financing trends to VC-backed companies

2012-2016 YTD (Q2 ‘16)

Source: CB Insights

INFOSYS AND WATERLINE DATA DEMYSTIFY BIG DATA FOR COMPANIES

What’s in a data lake? Lots of data, to be sure, and lots of potential to make better decisions, increase sales, improve efficiency, and reduce risk.

Big data is only getting richer, which means enterprise data lakes are getting deeper and becoming more complex. Yet, if you ask a Chief Data Officer how easy it is to find a data set in a data lake, you may not get a satisfactory answer. That’s because, while big data assets are growing and are tremendously valuable, most organizations haven’t spent enough time or resources figuring out how to effectively catalog that data in order to make it easier to discover and analyze.

There’s a hard truth facing organizations: As data lakes grow, it gets harder to find, share, and trust the data they own.

Companies don’t know their own data. We recognized that this would be a growing pain point within enterprises when we formed our company, Waterline Data, based on a technology that helps companies to automate the cataloging and governance of their data. Our Smart Data Catalog automatically scans and categorizes millions of fields of data in the data lake, making it accessible so that any user can find the right data set to use for their analytics.

This problem of finding a data set has existed in enterprises for years. It often takes new analysts months, or even years, to understand whom to ask about what data, much less to know and understand all the data themselves.

There is simply no way to remember what millions of fields of data mean or to manually classify and document them. At Waterline Data, we believe applying automation and machine learning to the problem is the only viable solution.

Instead of leveraging ‘tribal knowledge’ and finding people to ask, Waterline Data’s Smart Data Catalog provides people a way to ‘shop’ for data, mirroring an online shopping experience.

Despite recognizing that automating and categorizing big data assets and bringing selfservice to data lakes is a critical need, many enterprises are simply not prepared to take on this challenge all by themselves. They look for trusted partners like Infosys for guidance, methodology, and implementation help. There is simply no way for Waterline Data to scale up quickly enough to provide this support to customers.

This represents a void between need and innovation.

I believe Infosys is ahead of the curve, in that it has identified this gap and is partnering with us to introduce our innovative data science solution to its clients. Infosys’ mature relationships and domain knowledge mean that the company has the ability and the trust to recognize when Waterline Data could help.

Our partnership means that Infosys clients themselves aren’t forced to search the vast data technology landscape for something that might fit their company’s requirements. Rather, they can rely on Infosys to integrate Waterline into their existing work and begin solving real problems immediately.

Working together, we help companies understand what’s possible in empowering their use of metadata and ushering in self-service to big data. While Infosys brings the value of experience in deploying the methodology, Waterline provides the unique, cutting-edge technology.

The end result of the relationship is a client that is much more capable of accessing and browsing big data for insights, alongside the elimination of the time and-resource gap between a need and the solution.

About the Author

Alex Gorelik

Founder and CEO, Waterline

Alex has worked with data for more than 30 years, helping companies around the world figure out where their data is and what it can tell them. His goal is to help companies understand that they don’t truly know their data, and then help solve that problem. At Waterline Data, he’s bringing automation of cataloging and governance to big data, which means companies can locate the data they need faster and spend time on bigger problems. Alex has spent his career building and bringing to market innovative data-related technologies and starting successful companies.