IOT

Enhancing Asset Efficiency in the Process Industry

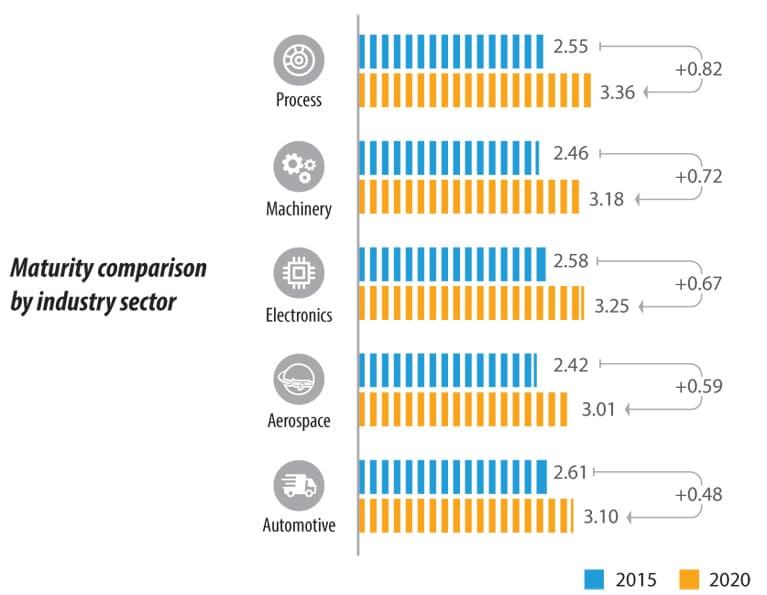

Companies in the process industry operate in a complex business landscape. A global survey commissioned by Infosys and the Institute for Industrial Management (FIR) at the RWTH Aachen University reveals that complexity presents opportunities to be more responsive with the right combination of technology and processes, resulting in enhanced production efficiency for process manufacturers. As part of the survey, an Industry 4.0 asset efficiency maturity mapping exercise was conducted. It assessed the process industry and found that companies in this industry planned more improvements, compared to all other industries, till 2020 to enhance their maturity.

This industry snapshot is the outcome of a global survey commissioned by Infosys and the Institute for Industrial Management (FIR) at the RWTH Aachen University, Germany, to gauge the readiness and maturity for Industry 4.0 enabled asset efficiency.

‘Industry 4.0’ traces its origins to the Industry 4.0 working group set up by the German government in January 2012. It is part of the hi-tech strategy action plan 2020 that provides strategic inputs to sustain Germany’s leadership in manufacturing and industrial automation.

Industry 4.0, smart manufacturing, or the industrial Internet of Things is the technological evolution from embedded systems to digital manufacturing and production systems powered by big data and advances in technology, such as artificial intelligence, rapid automation, robotics, and additive manufacturing. Industry 4.0 is therefore set to transform production by boosting efficiency and effectiveness across the value chain - productivity, ensuring consistency in quality, reducing costs, and optimizing inventory.

Early adopters ahead of the curve

The process industry today is among the most mature industries for several reasons:

- Seamless interaction between supply chain partners along the value chain with end-to-end supply chain planning that minimizes costs

- Focus on implementing standards for interoperability and harmonization between diverse applications

- Significant investments in innovation, specifically in-house R&D

- Focus on process simplification, complexity management, and risk management

- Sustainable approach to minimize environmental footprint in a resource-intensive industry

- Major shift in operations with a lower cost structure and higher degree of safety

- Significant technology implementation for process monitoring, with three-fourths of wireless sensor network revenue originating from the process industry

However, looking ahead, this industry is facing numerous and complex challenges that could mean an opportunity or a potential threat, in both the short and the long terms, illustrated as below.

While there is going to be no single remedy, a systematic strategy to address these key aspects can help companies outperform their peers.

Industry 4.0 and process manufacturing

In an Industry 4.0 process manufacturing landscape, cyber-physical systems create a smart network across the extended value chain. Digital manufacturing systems bring together physical assets, processes, and people for seamless interaction. Digital connectivity and sensors enable continuous monitoring of performance parameters and process variables from pressure vessels, mixers, pipelines, valves, and field equipment. Streaming data can be analyzed to harness useful insights on asset utilization, predicting failures, and improving asset lifetime.

Machine-to-data technologies and remote monitoring offer real-time visibility on the condition of individual assets. This, when combined with prescriptive analytics, builds a responsive production system. This new way of interaction between field devices and processes enables timely detection of issues, prompt repair and preventive maintenance to improve the safety of assets, and prevent expensive, unplanned outages and enable regulatory compliance. Significantly, insight on the health of assets is useful in increasing asset efficiency and effectiveness.

Survey Findings

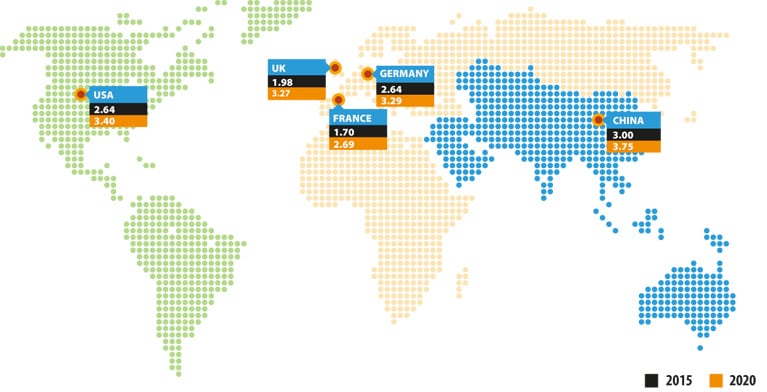

Infosys and FIR, RWTH Aachen, Germany, conducted an empirical study to assess the maturity of asset efficiency in industrial manufacturing. We surveyed more than 400 manufacturers across the aerospace, automotive, electronics, machinery, and process industries in the UK, the USA, China, France, and German-speaking countries. We partnered with Vanson Bourne, a specialist technology market research provider to conduct the survey outside Germany.

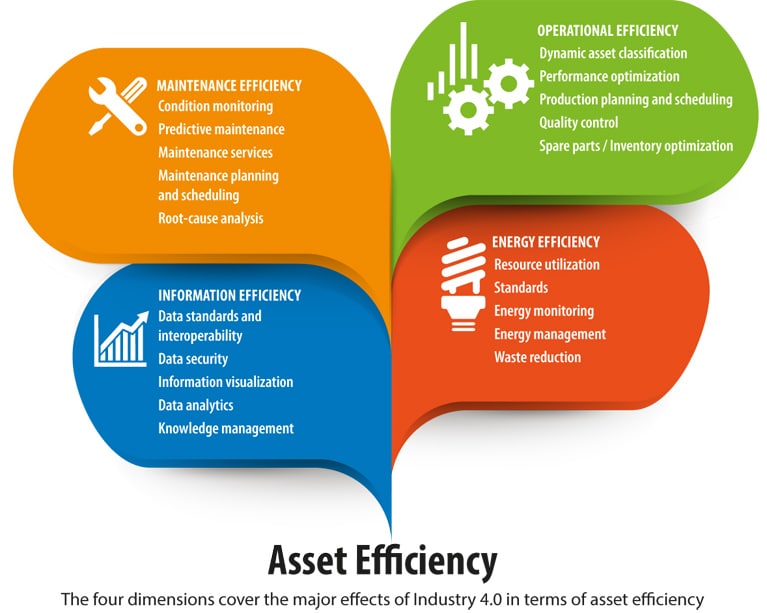

Our research focused on four key dimensions of asset efficiency – maintenance, operations, information, and energy management. Production managers, plant technical managers, COOs, asset efficiency consultants, and heads of R&D / manufacturing shared their strategies and goals for 2020 via online forums, telephone, and personal interviews.

We used the Industry 4.0 framework to assess the effectiveness of asset management processes on a four-point scale, which ranged from ‘Not Implemented (lowest maturity)’, ‘Potential Recognized’ and ‘Partially Implemented’ to ‘Systematically Implemented and Benefits Realized (highest maturity).’ Assets included equipment and machinery used for production, machines, and tools.

Asset efficiency

Asset efficiency is a key driver for competitiveness in the asset-intensive industries and also with process manufacturing. Although 85 percent of manufacturers recognize the role of digital technologies and the potential of Industry 4.0 in increasing asset efficiency, only 15 percent of companies have dedicated strategies for enhancing asset efficiency.

Our survey therefore clearly reveals that there are significant opportunities for the process industries to improve the efficiency of their assets by taking advantage of technologies – in turn leading to increased productivity and profitability.

This survey critically analyzed asset efficiency in four dimensions and provided key insights on how industrial enterprises can develop their roadmap for improving asset efficiency and effectiveness.

Maintenance efficiency

While 87 percent of companies are aware of the potential of preventive maintenance driven by real-time data and analytics, only 15 percent of companies implemented condition monitoring and 17 percent of companies incorporated machine status data in their maintenance workflow.

Maintenance is the single largest controllable cost in an asset-intensive enterprise. In fact, up to 90% of maintenance costs could be saved with the right maintenance strategy. The annual maintenance budget exceeds the net profit at several process plants. Asset reliability programs should therefore capitalize on technology advancements in industrial sensors and apply engineering expertise to accurately detect anomalies and predict equipment failure.

A robust maintenance strategy focused on predictive and reliability-oriented maintenance through condition monitoring, planning and scheduling, and root-cause analysis can increase the lifetime of equipment by 20 to 40 percent.

Operational efficiency

While 57% of companies optimize assets based on KPIs, only 13% use real-time data. Further, operational efficiency is systematically monitored and optimized at the asset level in only 16% of companies.

Among global manufacturers, one-half of equipment availability is lost in maintenance, upgrade, shutdown, and replacement activities. Global manufacturers can therefore significantly maximize asset performance and utilization to improve return on assets with real-time visibility into asset performance, production efficiency, and logistics processes.

Performance improvement programs that can gain vital real-time information to enhance performance can boost operational efficiency by 20%–25%.

Information efficiency

While 82% of enterprises recognize information interoperability, data security, and data standards as preconditions for achieving efficiency, it has been implemented by only 11% of companies. Significantly, 83% of companies plan to use data across the enterprise for a comprehensive analytics beyond specific purposes.

The process industry relies heavily on real-time data from sensors and process instruments to make intelligent decisions for efficient operations and uninterrupted production. Therefore, the complex interrelationships between asset life cycle stages, if intelligently integrated with operational data and business intelligence can address the information gap and help optimize asset performance. Poor asset information management increases the risk of safety, health, and environmental incidents, which can imperil an enterprise’s very survival.

An asset life cycle information management system based on a data quality framework and knowledge-based engineering delivers cost savings of 5%–10%.

Energy efficiency

While 88% of companies identified energy management as a key dimension of asset efficiency, it is planned and managed well only at 15% of companies. Further, while 53% of companies monitor resource and energy consumption, only 14% have systematically integrated energy efficiency to their overall asset efficiency strategy.

While asset-intensive industries are capital intensive, they are also energy intensive. Therefore, a well-maintained asset will consume less energy and improve its asset sustainability index. One of the major reasons for missed energy efficiency opportunities is the lack of data on energy use in asset industries. Energy management and sustainability programs are therefore key to track asset efficiency and can reduce energy consumption by up to 25% in these industries.

Summary

Inefficiency is a thing of the past for process manufacturers. Process manufacturers who dynamically respond with the right combination of technology, processes, and solutions can capitalize on business opportunities and seize the competitive advantage with Industry 4.0 to become industry leaders of the future.