Other Insights

Coronavirus Tapped the Brakes on the Internet

Coronavirus lockdowns have caused a huge surge in worldwide home internet usage. This has caused average internet speeds to decrease. Internet traffic that was going to office buildings is now going to residences. The increase in residential internet demand is likely larger than the decrease in enterprise demand as high bandwidth traffic to Netflix and other streaming sites is up 15%.

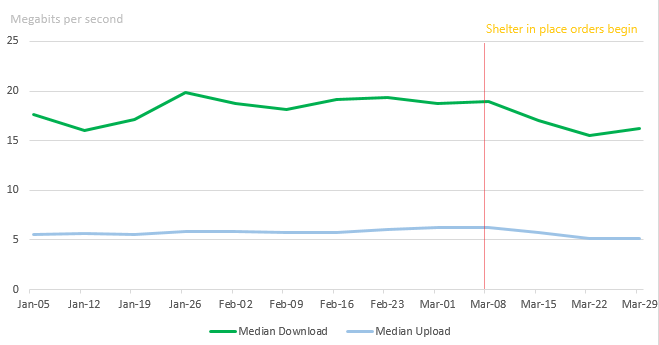

In the U.S., wireline internet service has shown a small slowdown nationally. Median download speeds remain statistically unchanged in more than half of the 200 most populous cities. Uploads speeds are more affected. Those are already typically lower for residential internet service because that is how cable companies structure their offerings. Only about 30% of those metropolitan areas have upload speeds similar to those experienced before governments enacted lockdowns in response to COVID-19. In rural areas, the upload and download speeds have declined by less than 20% (Figure 1).

Figure 1. U.S. rural internet speeds are only down slightly.

Source: BroadbandNow

This slowdown may not affect how many households previously used the internet, but it does change the dynamics. Video conferencing requires about 4 Mbps for both upload and download. Online gaming needs about 3 Mbps in both directions. Streaming HD video requires about 8 Mbps in download bandwidth and negligible upload speed. In rural areas, having more than one person participating in these activities will likely result in some quality loss. In the most affected cities, such as Baltimore, upload speed is down by almost 50% and download speed has slowed by 20%. However, they still have faster connections than in rural areas before the COVID-19 lockdowns. Some of the largest declines in speed appear to be in places with older infrastructure like the northeastern states. Even with these speed reductions, most Americans have not noticed a difference in their service.

However, some individual networks are showing significant increases in use. Facebook, Netflix, and YouTube have all experienced increases of more than 15% in their web traffic. Mobile app traffic for those same companies is relatively flat.

Internet usage in Europe has grown as much in the last few weeks as it was projected to grow for all of 2020. Wireline internet traffic in Europe has increased by more than 30%. Online gaming and video conferencing traffic more than doubled while messages over WhatsApp have increased by more than 300%. In Italy, home internet usage is up more than 90%.

The increased traffic in Europe seems to be producing a noticeable slowdown. Like in the northeastern United States, this European slowdown likely relates to old infrastructure. Installing networking cables and equipment in existing buildings is more expensive than in new construction. It is also likely that high-density areas received broadband technology first. Now much of that is outdated and is costly to upgrade or replace.

To combat these limitations, high bandwidth services, Netflix and YouTube, were asked to reduce their video quality in Europe. The request was made to ensure there is enough bandwidth for video conferencing and other business needs. Disney delayed the start of its Disney Plus streaming service in France by two weeks, and Microsoft is asking developers to push updates during off-peak hours according to the New York Times.

In India, the nationwide lockdown has put a great deal of pressure on the existing internet infrastructure. The president of the Broadband India Forum expressed concern that the industry does not have the resources to handle the spike in residential internet consumption. Indian internet was already not uniformly reliable, partially due to wireline services being less common than wireless access. Wireless connections are more likely to experience interference, which reduces reliability. In addition, average monthly data use is extremely low when compared to the U.S. and Europe (just 10.4 GB per month, compared to roughly 200GB in the U.S.).

For each of these countries, telecoms need to increase network capacity in residential areas, yet this can be problematic. Residential areas are more spread out than business centers, and this lack of density increases logistical support as well as the amount of infrastructure required, which together reduce return on investment.

To boost wireless capacity, telecom companies need to install additional equipment so each tower can receive more wireless connections. This is in addition to the other routing and switching equipment required to expand the capacity of their wireline networks. Another solution is to allow wireless internet providers more frequencies across available spectrum.

Additionally, 5G wireless technologies will likely ease future network strains as demand continues to increase. The massive multiple-input and multiple-output (MIMO) and beam forming technologies will especially help in places like India where mobile connectivity is more likely to be the only source of internet service. Massive MIMO is a configuration of wireless antennas that allow for more connections to a single tower. Beam forming is a technology that improves connection reliability by forming signal beams to go around objects rather than attempting to pass through them. These specific 5G technologies can be implemented using current 4G infrastructure and tower spacing, without requiring slices of the 25 GHz spectrum, which have much shorter ranges.

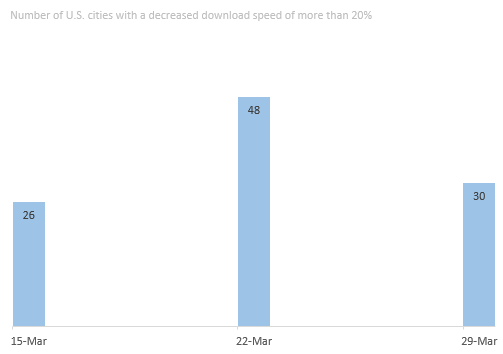

Each of these solutions requires time to implement, suggesting that network strains will persist in the short term. The most widespread declines seemed to occur the week of March 22, according to data from BroadbandNow (Figure 2).

Figure 2. Download speed slowdowns peaked during the week of March 22.

Source: BroadbandNow

Fortunately, for now networks are handling the new traffic loads with only moderate slowdowns. Now is the time to invest in upgrades to prepare networks for future demand spikes. It is likely that this is not the last time COVID-19, or another pandemic, will drive the imperative for remote, residence-based work.