Other Insights

Flatten the curve, flatten the recession

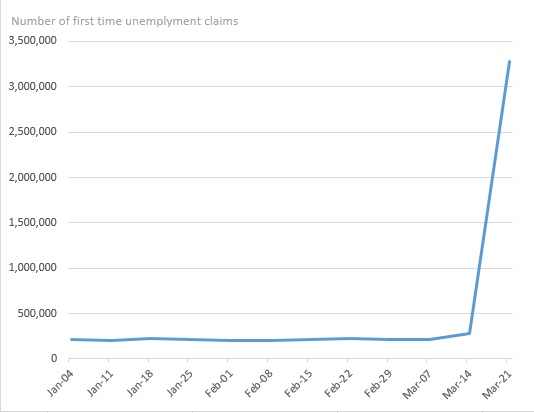

The economic impact of the coronavirus pandemic will be colossal. For comparison, during the 2007-09 global financial crisis, the U.S. economy lost hundreds of thousands of jobs per month. Now, U.S. employers are shedding millions of jobs per week (Figure 1), driven in part to government mandated (and appropriate) shutdowns. These measures are necessary to reduce the burden on healthcare services, or “flatten the curve,” a term a billion people have learned in the last few weeks. This shutdown scenario is playing out in countries across the world, which could develop into the largest global economic disruption since World War II. Governments and central banks are organizing responses to help ease the impacts of this disruption, but it is too early to know what is sufficient.

Figure 1. Over 3.2 million first-time unemployment claims in the U.S last week.

Source: St. Louis Federal Reserve

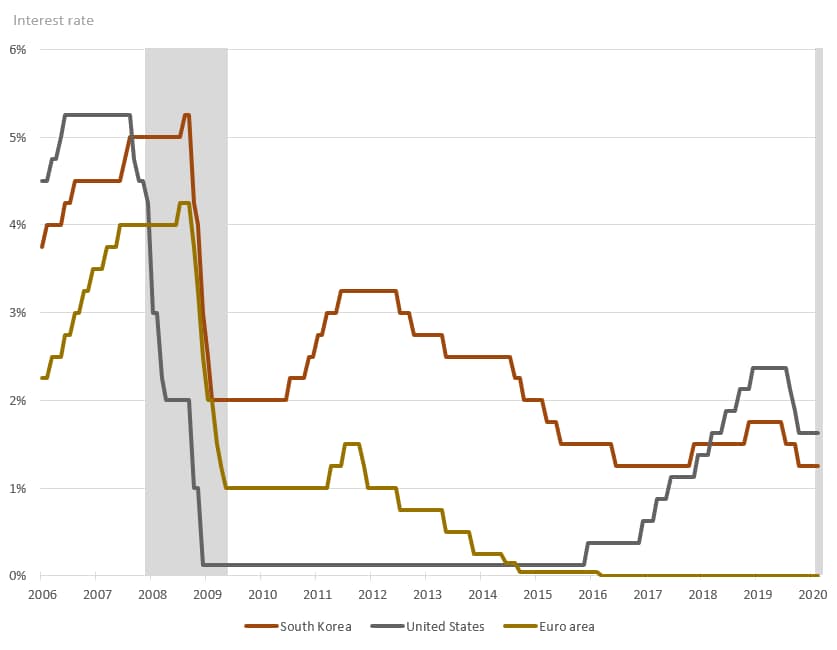

In macroeconomics, one person’s spending is another person’s income. During the global financial crisis, the macroeconomic solution was to find ways to get people to spend more. Central banks attempted to increase the money supply by reducing interest rates so that companies and individuals would have more to spend. The financial sector rebounded but workers grappled with stagnant wages and underwater mortgages. Additionally, there is evidence that prolonged low interest rates from the global financial crisis created a small stock price bubble. In contrast to those monetary policies to encourage spending, governments generally opted to cut government spending which is the opposite of the recommended action for these scenarios by prominent economists.

This time, governments of 17 of the world’s top 20 economies have indicated that they will increase their debts by $3.4 trillion in response to the coronavirus. The major central banks (e.g. U.S. Federal Reserve, European Central Bank, Bank of Japan, and Bank of England) have again attempted to lower interest rates, but rates were already very low (Figure 2). In most cases, government spending will take the form of direct payments to individuals instead of tax changes. This is important because tax changes tend to have a smaller impact on the economy since they only affect those working or drawing income.

Figure 2. Plenty of room then, nowhere to cut now.

Source: BIS policy rate statistics

Although lowering interest rates and increasing government spending are the correct responses, it will not be enough. Efforts to put more money into the economy will have a limited effect if shoppers have fewer places to spend it. Meanwhile, demand for many services is also declining. So, unless stimulus packages also pay for things like unfinished audits, canceled attorney’s visits, and unpurchased hotel rooms, there will still be a drastic downturn in overall income. Unlike other downturns, government action to mitigate one crisis (COVID-19) will create another (recession).

In addition to governments and central banks, companies and individuals need to take action to mitigate the recession’s impact. Companies should continue paying wages where possible during the lockdowns. This will encourage employees to spend more money once the lockdowns are lifted. Additionally, companies should advocate for policies that ensure their customers will have money to spend at the end of the lockdowns. Those beneficial government actions can include extended and larger unemployment benefits, or direct cash payments. If an organization’s customers are businesses, then enterprises should advocate for policies that enable their clients to purchase their goods and services. Once the lockdowns are lifted, companies should make an earnest effort to return to business at a pre-COVID-19 pace, even if operating at a loss for a short time.

Individuals should continue to spend on some items that are outside of essentials and have them delivered during the lockdown. Of course, this is dependent upon income and emergency savings, which is a significant risk for an uncomfortably high percentage of the population. Once authorities deem congregating safe again, individuals need to spend at establishments that could not be open during the lockdown. This demonstrates to companies that demand for their product still exists. This demand will make the companies more likely to be willing to operate normally at a loss for a short time. If everyone continues with the more cautious behavior of spending less, then everyone’s income falls. While individually prudent, it is collectively disastrous. Low income leads to lower spending, and the economy enters a vicious cycle that prolongs the recession.

Combatting the new coronavirus requires a coordinated global response, with tailored economic policies at the national level. The concept of social distancing gained credence as the compelling “Flatten the Curve” graphic circulated ahead of widespread COVID-19 outbreaks in the U.S. In the same way that health care systems will see their capacities tested, the economic impact of combatting the virus will test the capacities of governments and central banks. Enterprises and individuals around the world will be called upon once more to change their behaviors in order to flatten the recession.