Other Insights

Coronavirus drills oil industry

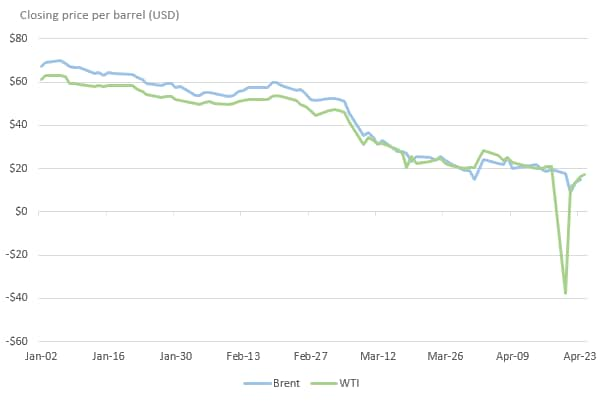

The COVID-19 pandemic has pushed the world in yet another unexpected direction. The price of a barrel of oil went negative (below -$35 per barrel) for the first time ever. Oil prices are often used as a rough gauge of total economic output since energy drives the global economy. But even the worst recessions didn’t create a crash this severe. A negative price should indicate that demand is historically low, however, there is a less obvious explanation.

The negative price in April was the result of several factors colliding at the worst possible moment. First, Saudi Arabia and Russia both increased oil production while feuding over planned cuts for OPEC and its allies. That led to overproduction just as the coronavirus pandemic was escalating. Second, production continued to be high even as countries started severely restricting travel. This combination led to a shortage in storage space for oil. Finally, as May contracts came due for West Texas Intermediate (WTI) crude, futures traders realized they had nowhere to store their oil. As a result, the price of the U.S. benchmark plummeted as they tried to sell — and eventually dump —their contracts.

It is important to note that this was a single benchmark price for just one month’s contract on the second-to-last day of trading. Also, due to the nature of commodity trading, the negative price is likely related to hedging and represents a small volume. Oil analysts said those negative May prices were not representative of the true value of a barrel of oil. Instead, they said to look at the June prices, which were then trading between $21 and $22 per barrel. A couple of days later, the price had fallen to $14 per barrel. Brent crude, the world’s other benchmark oil price, also saw a modest decline after Monday but was still trading near $20 per barrel (Figure 1).

Figure 1. Oil prices have been declining since January.

Source: www.marcotrends.net

Although the negative prices were a fluke and there have been some production cuts, oil producers are still in a grim spot. The coronavirus lockdowns have strangled demand for many crude oil-based products, and supply has not fallen nearly enough to relieve the surplus. Global demand for oil last year was roughly 100 million barrels per day. Some analysts expect that demand is now just 70 million barrels. The agreement between Saudi Arabia and most of the world’s other major oil producers was to reduce supply by only 10%, which still leaves a massive glut for a long time.

Low oil prices have global consequences. Most directly, there are job losses at companies that extract and refine the oil. Also, governments that rely on oil revenue often produce more to keep the same level of funding. In turn, this drives down oil prices and creates a vicious cycle. Eventually, these governments find it difficult to provide their citizens with basic needs, and that economic suffering ripples outward to the rest of the world.

We know all of this from previous economic crashes. And in a normal recession, economists could look at oil prices now and make educated guesses about a recovery.

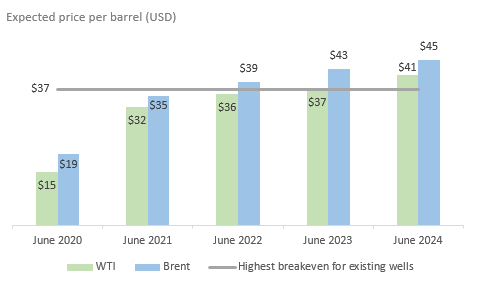

What can oil prices today tell us? In the short term, not much. The low price reflects a lack of demand. But this current shock is unlike those in other recessions because it is self-imposed and ultimately linked to infection and mortality rates. In the long run, the best that we can say is that oil traders seem to think that a modest recovery of oil consumption is likely two years away, or more (Figure 2). This coincides with a medical study that found social distancing may need to be in effect until 2022. That trader sentiment could change as we learn more about the coronavirus and its impact on society.

Figure 2. Oil prices are not expected to rise above breakeven prices for at least 3 years.

Source: CME Group

It is not all bad news in the oil and gas industry. In some places, such as in India, the demand for liquefied petroleum gas (propane or butane) has increased by almost 20% from this same period last year. The increase is due to so many people using these gases for cooking at home during the lockdowns. Also, the supply of liquid petroleum gas and natural gas is expected to decrease when producers finally cut back on crude oil drilling, according to Tom Hunt, senior consultant at oil and gas consulting firm capSpire.

Demand for these crude oil byproducts has been relatively unchanged by the decrease in travel worldwide. In two years, the price of natural gas may reach $4, and liquid petroleum gas prices may also double due to falling supply. And in that time transportation may recover. In the meantime, oil traders will continue making bets short term and long term on the true value of a barrel. Unfortunately, this involves making guesses far outside their realms of expertise, like when governments will reopen or when and where future lockdowns will happen.