Industry Stories

Evolving Digital Footprint with Lessons from the Financial Services Industry

The digitization of financial sector has given rise to increased customer interaction and other trends resulting in digital co-creation of products/services in today’s marketplace. This is leading organizations to rethink their approach to technology solutions in terms of changing their culture and architectural thinking, becoming more collaborative and expanding the scope of digital.

We have come a long way since the early 1980s when personal computers invaded our homes and offices, followed by web services and e-commerce during the 1990s and 2000s, and m-commerce at the turn of the century. These digital disruptions changed the face of almost every industry. This article includes a narration of a few remarkable transformation journeys that some of our financial services customers undertook, which can be of interest and relevance to every business leader in every industry.

New dimensions in a changing digital landscape

As more and more organizations incorporate “digital” in their vast canvas of business processes, the following new dimensions have come into play:

- Enhanced interactions with customers

- Blurred boundaries between traditional service providers and new age start-ups

- Provision of superior customer experience apart from core services

- Conversion of customer data into insight

Enhanced Customer Interactions

The ecosystem of businesses has shifted to include a wealth of relevant information through social media platforms such as Google, Twitter, and Facebook that organizations can utilize meaningfully. In addition, ecosystems have evolved from comprising only humans to housing a combination of humans and a variety of devices, systems, and robots.

This data is being utilized to offer proactive and innovative products. The coming years will see data analytics capabilities becoming more robust, and any organization not geared to use them will find it hard to exist.

Blurred Boundaries Between Traditional Service Providers and Start-ups

The ecosystem in most industries is increasingly becoming more homogeneous and accommodating of new players. In the financial services sector, the market offers various means of payment such as PayPal, mobile wallets, WhatsApp, etc. This increased competition implies that only those offering the best products/services along with the best customer experience would have a unique advantage.

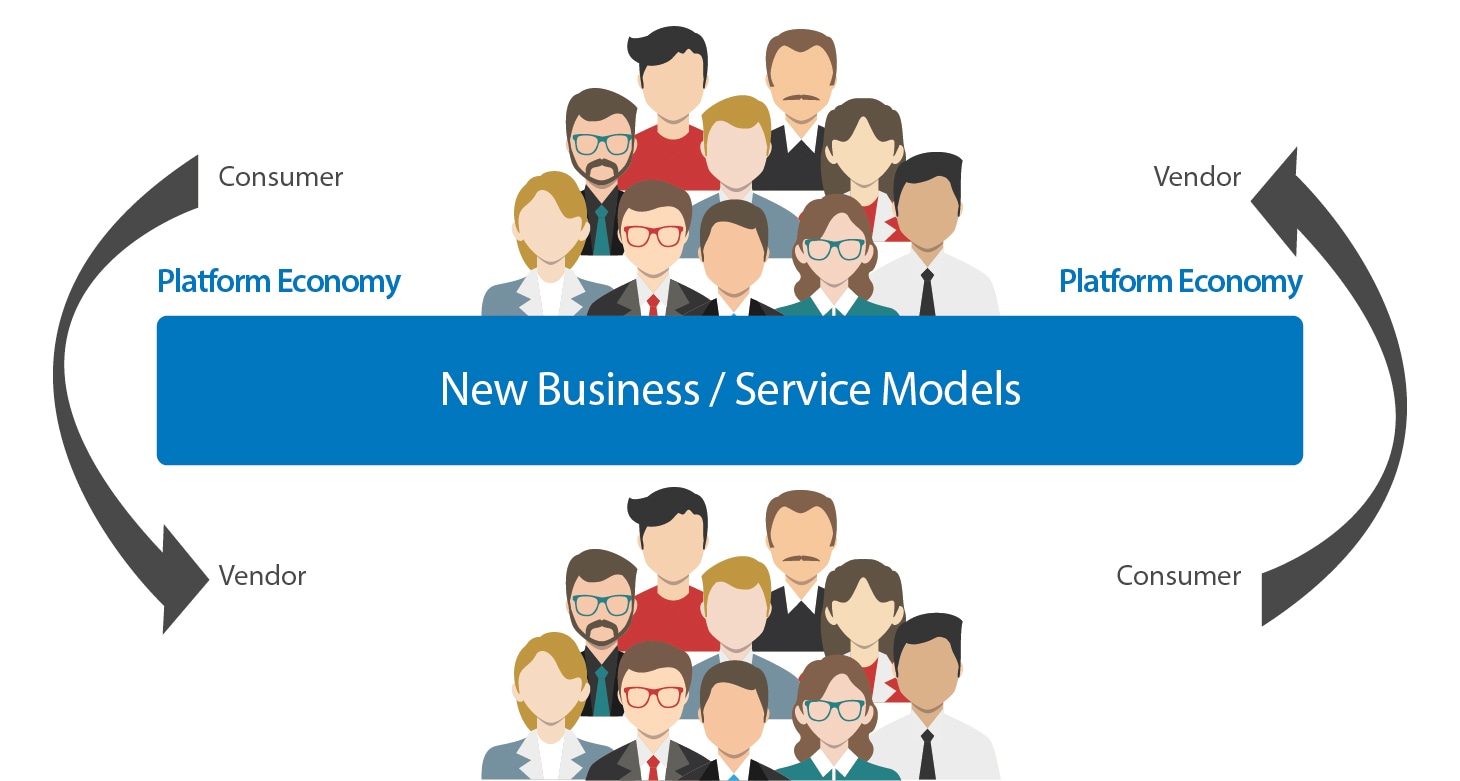

Provision of Customer Experience Apart from Core Service

The success of players such as Uber and Airbnb in the platform economy is primarily credited to their user-friendly open platform(s) enabling quality servicing and superior customer experience. This disruption (often called ‘Uberization’) is a wakeup call for financial services institutions. Today, the customer values an end-to-end experience rather than a fragmented solution. For example, consider the mortgage scenario. Customers assess different parameters, such as locality, infrastructure development, home renovation support, relocation support and more, before committing to a home loan. If an institution is able to facilitate the experience of buying a house rather than addressing only the home loan need of the customer, the greater value-add would drive customer loyalty.

Conversion of Customer Data into Insight

Many organizations are lagging behind when it comes to mining the customer data they possess. For example, banks still use physical forms to collect personal details such as customer name and contact. On the other hand, social media and internet giants, such as Google, Facebook, and Twitter, effectively use customer data to generate meaningful insights, and potentially pose a threat to banks in the financial services business. Financial services institutions have to either acquire equivalent capability or collaborate with social media platforms to leverage customer analytics and protect their business.

The above trends require that technology in financial services industry should be flexible and adaptive to accommodate the dynamic needs of the business.

Changed Approach to Financial Services Technology Solutions

Some of the key changes in the customers’ approach to digital and how technology solutions need to be arrived at include:

Changed Scope of Where Digital is Applied - Digital technologies have evolved from providing customer experience to becoming omni-channel solutions. There is a realization that unless the entire operation is ‘digital’, it is difficult to achieve customer centricity. Hence the purview of ‘digital’ has broadened to include customer operations, single customer view, analytics and data monetization, to name a few.

Changed Architectural Thinking in Technology Solutions - Mammoth, inflexible legacy systems are key impediments in achieving the desired level of agility. Banks have taken different approaches, from the ‘evolutionary’ to the ‘revolutionary’. Many are taking a hybrid approach of retaining the ‘core banking’ systems and building modular, nimble ‘cross-product’ layers that sit between the customer experience and core banking layers in the architecture. This layer is expected to provide the flexibility and quick response times that are often required to launch new features and functions, such as overlay products, product bundling, pricing, billing, etc.

Change in Culture - With increasing digitization in banking and need for greater agility in financial services, industry players are increasingly using an agile model of execution, such as ‘Spotify’ that leverages structure tribes, squads, chapters, etc. to achieve high autonomy with self-organizing teams without compromising the broader organizational objectives. The focus has shifted to agility in learning, engineering skills, and integration of IT and business.

Fintech Start-Ups - The financial services sector enjoyed a monopoly owing to high customer trust and a tough regulatory framework, making it challenging for small players to do business. However, after the global financial crisis, both these advantages took a hit and provided an opportunity for fintech firms to emerge. The advantages that these start-ups provided in terms of speed and personalization of services found an immediate market, putting the big banks at risk.

Regulatory environment changes that affect large banks negatively - Banks are forced to open up so that boutique firms can offer customer-centric value-added services to customers. API Economy concepts, such as Payment Services Directive 2 in Europe (PSD2), will force banks to publish APIs/services that can be consumed by challenger firms, causing banks to lose their monopoly.

Role of the Technology Service Provider

Let’s take a look at some of the digital transformation journeys of our financial services clients that bring forth valuable learning for technology service providers.

Agile Global Delivery Centers to Digital Banks

A state-of-the-art Global Delivery Center, using the latest technology stack, employing an Agile approach, and fostering effective collaboration between teams, created an innovative award-winning product for one of Australia’s largest banks.

Infosys is the technology partner of one of Australia’s largest banks and worked on its “Australia First” digital channel for mortgage origination, including online approvals. The product was named “The most innovative mortgage product of the year” at the Australian Retail Banking Awards.

Several other digital initiatives from Infosys using digital pathways, such as mobile, online and tablet, helped the Bank offer branchless banking and increase its customer base with a self on-boarding facility.

Most of these programs are executed in Agile or Scaled Agile methodology, making use of the latest technology stack like Angular JS, React JS, and RESTful API. Infosys has been involved in all the phases, starting from consulting in digital transformation to providing services such as User Experience, Visual Design Test, Automation etc. state-of-the-art Agile Global Delivery Center was established to foster collaboration among various teams involved in executing distributed Agile programs.

New Breed of Partners including Fintechs and Cloud Service Providers

Infosys serviced a large UK bank in collaboration with a fintech for an integrated cloud solution, dispelling concerns about unhealthy competitions and encouraging new partnership models

One of our large UK clients wanted to digitally disrupt its mortgage process by adopting cloud computing and was looking to partner with Fintech firms. Infosys offered not only the cloud solution, but was also involved in identifying the Fintech candidates with the necessary cloud capabilities and providing a collaborative partnership proposal.

While offering this disruptive and collaborative solution, the key question that arose was about the Fintech firms competing with our solution. Our view was that together with the identified Fintech partners, our collaborative solution became more compelling for the Bank. The platform Subject Matter Expertise and the enduring relationship Infosys has with the Bank will help to develop and deploy the integrated solutions faster than what the client could have done had it worked directly with the Fintech companies.

Applying Architectural Design Thinking for a Reduced Time to Market

Componentization, Data Democratisation, DevOps and Microservices – bring data centricity, analytics and a faster time to market success story for an American financial services and wealth advisory firm

An American financial services and wealth advisory firm aspires to move to the Amazon AWS cloud platform from its legacy architecture involving exchange of data feeds between internal applications to (external) Web/Data Services. To offer web services on legacy platforms, we are implementing API connectors to channels and third parties. We implemented microservices architecture to simplify the applications and help achieve shorter time to market. DevOps implementation along with microservices enabled changes to be implemented in production for smaller components without impacting the larger system landscape. Domain-based design is being considered for componentization and re-engineering.

In Wealth Management advisory, the data pertaining to customer wealth and investment is significant and customers want to store it in a form that lends itself to the generation of easy and quick insights. Infosys is partnering to build/implement tools around data governance, lineage, Meta Data Management (MDM), optimization for improved performance and higher volume processing, and better validation with improved interface.

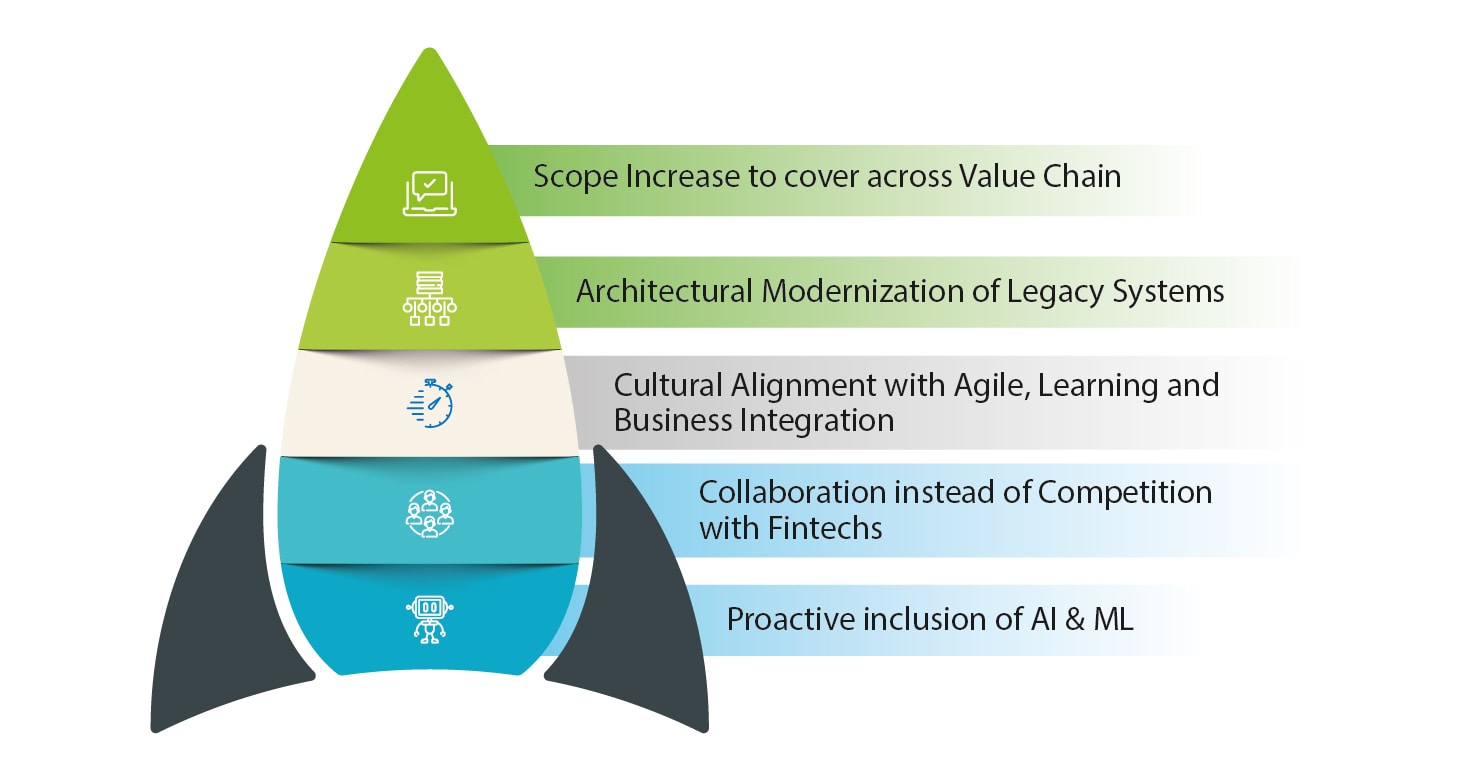

Our Approach as a Partner of Choice to our Clients

With increased customer interaction born out of digitization in banking, organizations are compelled to rethink their approach to technology solutions by:

- Expanding the scope of digital to make the impact of technology on financial services reach the entire customer value chain

- Changing architectural thinking in the way digital is applied

- Changing culture and working structures with Agile/DevOps

- Working with Fintech for collaborative solutions including Artificial Intelligence and Machine Learning

- Handling regulatory changes and open architecture requirements smoothly to minimize negative impact

Infosys is proactively embedding Artificial Intelligence and Machine Learning skills in our technical solution processes to identify specific opportunities and contextualize the solutions to help clients with their digital transformations. We understand our clients’ needs to operate in bimodal and multimodal IT and have been supporting them to operate in the digital landscape while maintaining/modernizing the mainframe and other legacy portions of the IT landscape.