AI and insurance: Everything changes

Artificial intelligence is reshaping the insurance industry and the way it engages with customers. While it has been used for many years in fraud detection, now a raft of insurance innovators are applying the technology to speed up their operations and differentiate their products.

Perhaps the best example of how technology is used by large insurers to improve operational efficiency is Chinese insurer Ping An. Almost 90% of the nearly 40 million online life insurance policy administration cases handled by Ping An in 2018 were automatically processed using AI, achieving turnaround times as short as three minutes.1

But most innovators are so-called insurtech startups. Some of them are insurance companies themselves. New York-based insurance startup Lemonade is one such company. It uses AI to evaluate claims, and in 2017, the company declared that it paid out the fastest claim in the history of the insurance industry: It only took three seconds.2

Then there are other insurtechs that are developing technology to enable the big insurance companies. The U.S.-based Cape Analytics uses AI and geospatial imagery to provide valuable property attributes with the accuracy of an on-site inspection but the speed of an online application. It has partnered with several property insurers; in August 2019 it announced a partnership with U.S. insurer The Hartford, providing the company with AI-based property information to be used for generating quotes for home insurance.3

These AI-enabled innovations are very important because they are reinventing the value proposition of insurance in the customer’s mind, moving it toward a value-adding rather than “hygiene” service. The fact that people don’t like to think about the risks in their lives is one of the biggest barriers to buying insurance. Also, it’s hard to convince people to pay for something now that they may never need in the future. And insurance products are rarely designed to meet the specific needs of the customer — for instance, insuring personal objects or covering activities for short, specific periods of time.

By improving operational efficiency through AI, insurers can begin to improve personalization and to design and market-specific micro coverage services that are more cost-effective. Examples are insuring freelance workers for specific activities on an ad hoc basis, providing coverage as simple as insurance for a phone battery or offering insurance that better suits the “sharing economy,” so that you can be covered if you let a friend drive your car for an hour.

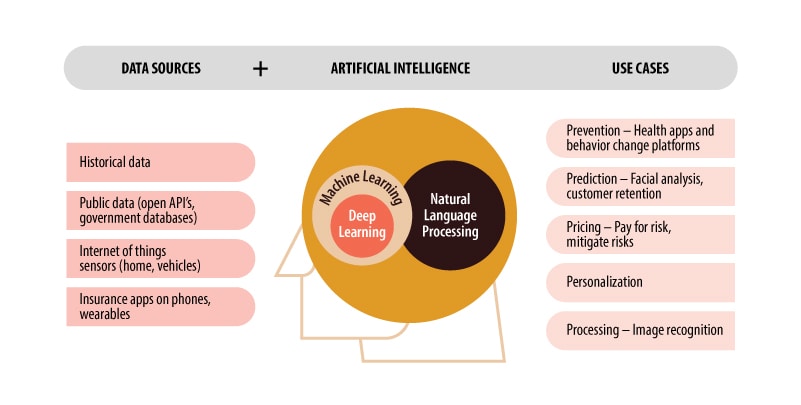

Insurance innovators are using AI along with other technological advancements, such as the Internet of things and telematics, to improve operational efficiencies and customer experiences (Figure 1).

Figure 1. AI and insurance — Innovative use cases

The following are a few examples of where AI, along with other technologies, are used in the insurance industry.

Faster claims processing

AI can be used to classify data and identify relationships. It can help in pattern recognition and prediction and can also be used to analyze data in both structured and unstructured formats. Insurance companies have used this capability innovatively to hasten claims processing and save costs. For example, physically sending adjusters to farms to verify that insured cows or pigs have died is a time-consuming and costly process. So Ping An implemented AI-driven facial recognition for cows and pigs. A farmer can upload the picture of the animal that has died using a smartphone and submit a claim remotely. Ping An saves on claims processing, and the farmer receives payment sooner.4

Lemonade, a New York-based insurance startup has claimed to have paid the fastest insurance claim ever in merely three seconds, all thanks to AI

UK-based Tractable uses AI techniques to automatically assess the damage level to a vehicle by having a customer upload an image of the damage, helping the insurer to hasten the claims process. Tractable works with leading insurers across nine countries.5

Prevention

Consumer health applications are using AI along with medical-grade sensors (Internet of things) to help people stay healthy. Health and life insurance companies have a huge incentive to prevent illness and manage population health, and their profits are significantly dependent on limiting the payouts.

Health insurance companies are shifting their focus to proactive care. For example, Aetna has teamed up with Apple for its Attain program; Aetna combines its health data with statistics from the Apple Watch, and the two companies design rewards for positive outcomes.6 The iPhone is now a health monitor too.

Similarly, life insurance companies are bundling life insurance policies with health platforms. For example, in September 2018, John Hancock life insurance announced that all its life insurance policies would come with Vitality behavior change platforms to reward customers for healthier choices in physical activity, nutrition and mindfulness, which are linked to living a longer, healthier life.7 The behavior change platforms were developed through an exclusive partnership with Vitality, a global leader in integrating wellness benefits with life insurance.8

Prediction

The insurance industry heavily depends on statistical predictions and probability theory. AI is used to develop new ways to predict life events in real time. In January 2017, Lapetus Solutions, a life insurance startup in the U.S., offered a way for people to buy life insurance using a selfie.9 Lapetus uses facial analysis to find out about habits, such as smoking, and to assign risk scores without the time-consuming medical examination.

AI is also used by insurers in nontraditional prediction to improve cost efficiencies. For example, Ping An used an AI-based model to screen more than 11 million potential agents, predicting with greater than 95% accuracy which ones would remain with the company for more than a year. Doing so reduced turnover and cut recruitment and training costs.

Pricing and personalization

Telematics and sophisticated sensors (Internet of things) for home, vehicles and wearables now provide insurers with real-time data about customers and enable insurers to create personalized products as well as price the premiums appropriately for the risk.

American International Group, Inc.’s award-winning On the Go app analyzes and scores a driver’s performance based on key driving parameters such as acceleration, speed, braking, and so forth. Based on that score, AIG now offers up to 15% off an AIG vehicle insurance premium.10 This has also changed the model of insurance companies using data from past events to assess future risks. AIG not only used the app to detect risk but also help customers mitigate risks. This app is available for the general population using gamification and contest strategies to motivate users. It helps AIG not only retain their existing customers but also reach out to potential customers and the public at large.

UK-based Neos Ventures provides smart home monitoring and emergency assistance with home insurance policies. The Neos app can alert users about potential problems — water starting to leak in the kitchen, gas leaks, smoke — and mitigate events with timely interventions. With the technology potentially reducing risks, Neos believes it can pass savings on in the form of lower premiums to its customers.11

Data advantage; data challenge

Of course, good decisions cannot be made with insufficient or low-quality information. As such, the benefits from AI, Internet of things and telematics technology are hugely dependent on the quality and volume of available data. That in itself creates a completely new set of challenges for an insurer.

Data strategy is critical in achieving success with AI and related technologies

While digital technologies can help gather a lot of private and public data on customers, managing the data and privacy in line with local and international regulations can become a headache. This is especially the case when a business is trying to move fast and innovate with digital technologies and new techniques.

To manage the complexity, insurance companies need to develop a data strategy that organizes the use of both internal data and data they will require from external sources. Securing data from external sources that can amplify and complement internal data will be very crucial. Data strategy will be significant if companies are to be successful in using AI and other allied technologies.

To mitigate some risks around using personal data, insurers can proactively collect data from customers by extending certain financial rewards. A survey in 2016 revealed that more than half of U.S. consumers are willing to share data for discounts on premiums.12

And in the public data space, interesting approaches are also emerging. For example, in 2017 Liberty Mutual Insurance and its innovation incubator introduced an open API developer portal to combine public data with proprietary insurance knowledge. The portal aggregates public data like auto theft and earlier crashes and uses the aggregated data to provide information such as safe driving routes.13

None of this, however, helps with the increased risk of ethical issues being created by those firms that rely too much on AI to manage their decisions. It has been well documented that AI, when left to its own devices, can often begin to reveal traits in its logic that are socially unpalatable. Managing this risk will be an ongoing concern for any business that gets involved in AI. For insurers, who deal with sensitive data and life issues, this will be an even bigger concern.

The future of insurance

The overarching impact of AI on the insurance industry will be to reduce costs and speed up operations. But that does not mean insurance will become a commodity. In fact, this opens the opportunity for insurers to invest more in differentiating their product and the way it engages with customers and provides them new, value-added experiences.

Once again, Ping An is a leading example here. The firm has incubated new businesses for ecosystems of data in different industries and services. It created Lufax, which it calls the world’s largest online-only wealth management platform; Ping An Good Doctor, a telemedicine platform; and Autohome, an online portal for car sales.

The adoption of AI truly represents a sea change in how insurance firms, and their talents, will be structured and focused. While algorithms churn data and make decisions in the background, insurers will need to refocus their talents on ecosystem partnerships, product design, customer experience, ethics and, of course, AI programming. Actuaries, while still important, will not define the future of insurance. Technologists and digital product owners will be at the forefront of this revolution.

References

- https://www1.hkexnews.hk/listedco/listconews/sehk/2019/0312/ltn20190312468.pdf

- https://www.lemonade.com/blog/lemonade-sets-new-world-record/

- https://www.businesswire.com/news/home/20190806005236/en/Hartford-Partners-Cape-Analytics-Geospatial-Property-Intelligence

- https://www.infosys.com/about/knowledge-institute/insights/Documents/chinas-insurance-innovator.pdf

- https://www.techworld.com/picture-gallery/startups/uk-insurtech-startups-watch-3645315/

- https://www.attainbyaetna.com/

- https://www.johnhancock.com/news/insurance/2018/09/john-hancock-leaves-traditional-life-insurance-model-behind-to-incentivize-longer--healthier-lives.html

- https://www.vitalitygroup.com/press-release/john-hancock-enters-exclusive-partnership-with-vitality/

- https://www.lapetussolutions.com/applied-ai-in-insurance/

- https://www.efma.com/article/detail/30774

- https://neos.co.uk/

- https://www.insurbyte.com/single-post/2016/06/02/Consumers-Ready-to-Give-Insurers-Biometric-Data-For-a-Price

- https://www.greencarcongress.com/2017/01/20170104-solaria.html