Technology giants and startups are bringing data-driven and patient-centric services to the health care market, and are beginning to chip away at the dominance of the incumbent providers. In response, payers, pharma companies and health care providers are integrating vertically in order to compete. Whoever wins, the result will be a transformation of health care provision.

Technology is reshaping health care. But the companies driving this are not the traditional players. Google, Amazon, Apple and other digital leaders are making serious forays into the market. Apple launched its health record system in 2018, and the company has already signed partnerships with 140 health care providers and partners. In the same year, Amazon acquired Pill Pack, an online pharmaceutical startup.

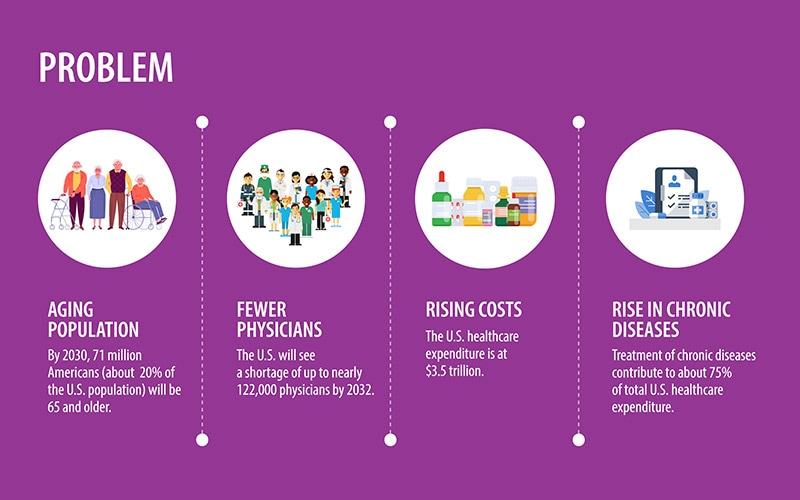

Being more than a trillion-dollar industry in the U.S. alone, health care is attracting several new entrants in the market

Meanwhile, Alphabet’s venture arm, Google Ventures, has backed more than 60 health-related companies ranging from genetics to telemedicine. In fact, it is the startup world that is providing much of the innovation, raising another challenge to incumbents. Digital health companies have raised a total of $ .2 billion across 180 deals through the first half of 2019.1

For these new entrants, health care is an attractive market with lots of opportunity. It is a trillion-dollar industry just in the U.S. alone, and is projected to grow at an average annual rate of 5.5%.2 Health care is also costly and often wasteful. Unnecessary care has been estimated in the past to have cost around $210 billion in the U.S. and £2.3 billion in the U.K.3

Targeting the health consumer

Digital players are using technology to target health care in many different ways. They are improving consumer experiences; increasing connectivity and data sharing; testing new business models, such as direct-to-consumer; and driving more analytical approaches, such as population health research.

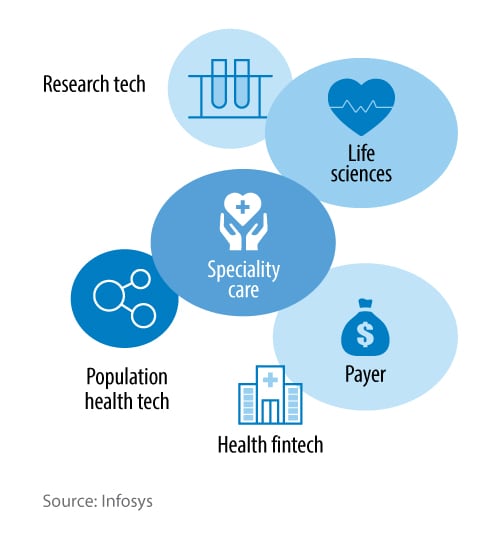

Some of these will complement the incumbent industry. Payers can benefit from fintech startup innovations. Life sciences businesses can benefit from the research and analytics approaches. And care providers can benefit from digital innovations around consumer interfaces and population health. All will benefit from increased connectivity and data management (Figure 1).

Figure 1. Startups will complement the incumbents

But some innovations threaten to cut out parts of the traditional health care ecosystem. For instance, in health insurance, the startup Oscar Health is changing the way consumers engage with payers, providing more transparency and utilizing telemedicine techniques. Indeed, telemedicine itself is threating to chip away at the demand for hospitals and clinics. For example, Teladoc and Babylon Health use telephone and videoconferencing technology to provide on-demand remote medical care via mobile devices, the internet, video and phone. Amazon’s Pill Pack acquisition aims to cut out inefficiencies in the medicine supply chain while improving customer experience and personalization.

In response, the incumbent health care payers, providers and life sciences firms are looking at how they can better integrate vertically — for example, the Aetna and CVS merger and the partnership between Humana and Walgreens. These efforts are all in some way related to improving synergies and offering a wide array of patient care and health services.

Health care disruption: The three forces

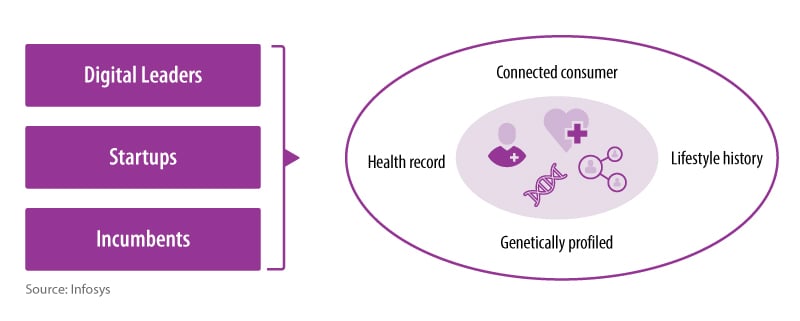

All these developments are fundamentally about developing more consumer-centric health care. This is where health outcomes and operational effectiveness can be improved by a more personalized and holistic approach to care provision. And the different players that are driving this can be categorized into three buckets, or forces, that are shaping the future of health care (Figure 2).

Figure 2. Three forces are shaping the health care industry

Source: Infosys

Digital leaders

Digital leaders such as Apple, Google and Amazon are venturing into health care through partnerships, acquisitions or developing platforms on their existing ecosystems. They all have access to consumer data and, through that, a deep understanding of consumer behavior, which can be used to derive insights into the health and wellness of individuals to create integrated services with hyperpersonalization.

Google is focused on research and the use of structured data and AI in areas of disease detection and data interoperability. Its algorithm can diagnose diabetic retinopathy in images at the level of accuracy of board-certified ophthalmologists. Google’s parent, Alphabet, is venturing into a wide range of health care projects across its companies. Examples are Verily, which is trying to eliminate the mosquitos that spread the Zika virus, and Calico, which is focused on anti-aging research.

Technology companies are also well positioned to leverage their active consumer distribution channels to disrupt multistep drug distribution processes. Amazon’s acquisition of Pill Pack is evolving direct contracting models and potentially changing the future of medical delivery. Amazon is also working on Alexa, its voice-activated digital assistant, to keep tabs on customers’ medicine and provide personal health updates. While it might seem farfetched for Amazon to take on the $370 billion pharma industry, a recent survey of C-level hospital executives and directors found that 62% are in support of Amazon entering the medical supply market.4

Apple has its focus on consumer-facing products. It’s also enabling medical researchers to study diseases such as Parkinson’s, through data on patients’ movements that are collected by the sensors in their smart watches. Dosages can be adjusted by measuring physical tremors. Apple’s health records platform is now available to all U.S. providers and is compatible with other electronic health platforms.

In fact, Apple is one of the nine companies selected in the FDA’s digital health software precertification program launched in 2017.5 Only two of the nine companies are traditional health care companies; the rest are technology companies. This just goes to show the influence that technology leaders are beginning to exert on the direction of health care.

Startups

The big technology companies back several of the startups. While digital leaders are solving problems at scale, the health tech startup ecosystem is looking to solve niche problems.

For startups, preventing and treating genetic disorders have made up a significant area of interest since the Human Genome Project. Google-backed 23andme provides genetic testing services directly to the consumer. A saliva sample is used to give consumers information on ancestry and genetic predisposition to any specific health issues. Editas Medicine is working toward using genome editing technology to potentially treat diseases at their source, at the DNA level.

Backed by venture capitalists, Grail aims to develop blood tests to detect cancer early, when treatment may be more successful. It is working on building intelligent data models to derive actionable insights from a vast amount of tumor genome data.

Drug discovery and development is a slow, resource-consuming process with low success rates. Organizations such as Benevolent AI and TwoXAR are transforming drug discovery using in-silico chemistry and molecular modeling for computer-aided drug design. Data democratization and computing power have the potential to accelerate new drug research with higher success rates.

Several startups are creating digital solutions for chronic disease management. For example, Propeller Health uses sophisticated sensors that attach to inhalers. The sensors track your medication patterns and update the information on an app. Over time, this data is used to understand patterns in your flare-ups and medication use and can help manage symptoms and identify triggers.

Companies such as Teladoc, Bright.md and Babylon Health are using technology to provide patients with remote consulting with doctors and other health care providers, which adds convenience and reduces costs. Then there is the Indonesian company Halodoc, which has an integrated health-tech platform that connects patients with doctors, insurance companies, labs and pharmacies all in one simple mobile application.

Health care incumbents

Digital leaders and start-ups are looking to disrupt the seemingly unmalleable health care industry. The incumbents are using their core data and deep domain understanding to innovate and create new business models and partnerships.

The incumbents are reorganizing themselves to deliver a full, integrated stack of services. The much-talked-about CVS-Aetna merger (pharma-insurance) provides a platform to integrate telemedicine applications such as Teladoc with CVS MinuteClinics. Insurance payment plans can include remote consulting models.

Walgreens’ new partnership with health insurer Humana exemplifies the trend. Together, they are setting up senior-focused primary care clinics in select Walgreen stores to focus on long-term relationships with patients living with chronic conditions.6

Incumbents are looking at partnerships and mergers to create new business models that offer a fully integrated stack of services

The pharma companies are setting up digital ventures for innovation. Novartis’ Biome innovation lab and Johnson & Johnson’s JLab are new digital labs set up by incumbents.

Incumbents are also partnering with digitally native companies in the discovery of new physical (gene editing/cell therapies) and digital (digital therapies) interventions that can deliver outcomes for patients. Novartis’ launch of the clinical software application ReSet in collaboration with Pear Therapeutics is a revolution. reSET-O is the first U.S. FDA-cleared prescription digital therapeutic for patients with opioid use disorder.7

Convergence, not competition

The battle for the future of health care is not a zero-sum game. These three forces are not competing. Rather, they are bringing a different perspective and approach to building elements of a more patient-centric health care model. Partnerships between players are going to be important. A recent example is the June 2019 partnership between Google and Sanofi to set up a lab focused on data-driven health service innovations.

This patient-centric future will more likely revolve around sustaining well-being rather than responding to illness, and will be around the consumer rather than around the organizations that drive the current health care systems. Incumbents must reinvent themselves to play a role in this future or risk being overtaken by those that can move faster in partnership with the digital disruptors.

References

- https://rockhealth.com/reports/2019-midyear-digital-health-market-update-exits-are-heating-up/

- https://www.healthaffairs.org/doi/abs/10.1377/hlthaff.2018.05499?journalCode=hlthaff

- https://www.theguardian.com/society/2014/nov/05/nhs-wastes-over-2-bn-on-unnecessary-treatment

- http://www.nationalacademies.org/hmd/Reports/2012/Best-Care-at-Lower-Cost-The-Path-to-Continuously-Learning-Health-Care-in-America.aspx

- https://www.reactiondata.com/wp-content/uploads/2018/05/ReactionDataAmazonAsMedical-Supplier.pdf

- https://www.fda.gov/medical-devices/digital-health/digital-health-software-precertification-pre-cert-program

- https://www.forbes.com/sites/brucejapsen/2019/02/07/humana-walgreens-clinic-venture-boosts-medicare-enrollment/#a7c579e3f39e

- https://www.novartis.com/news/media-releases/sandoz-and-pear-therapeutics-announce-us-launch-reset-otm-help-treat-opioid-use-disorder