Introduction

The world of banking is being disrupted at a staggering pace. As incumbent banks have largely been driven by the dynamics of regulatory controls, they lost focus on technology innovations. Now they are playing catch up, as new banking strategies have been established by the disruptive fintech firms, rapidly encroaching across financial boundaries to steal market share and profitable services. Whether distracted by the financial crisis and ensuring regulations, or simply too passive to adopt new technologies, traditional banks find themselves chasing the digital disruptors.

Have traditions of trust changed overnight? Did the typical banking customer choose convenience over relationships? Let’s look for answers by reviewing the evolution of banking over the past century.

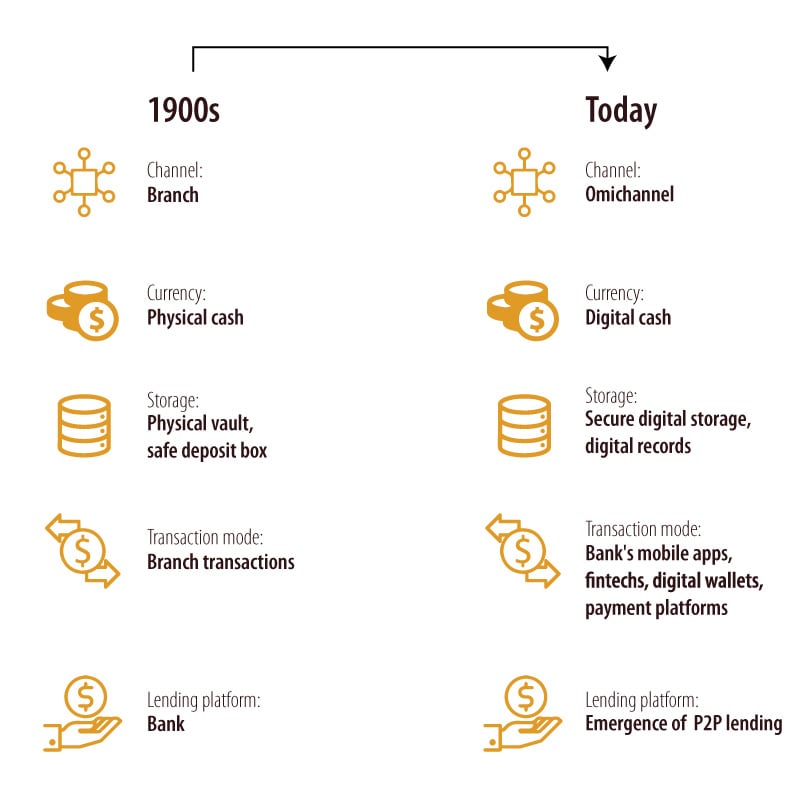

In the 1900s banks were primarily custodians for the safekeeping of cash and valuables. They started lending cash and providing facilities to make payments at the branch, driven by profit motives. Managing the risk between assets and liabilities became the fundamental banking code. This remains true today, despite changes in how banking is delivered. Physical cash has transformed into bits of data used for record keeping. Secure digital storage is replacing physical vaults and safe deposit boxes. Share certificates, stocks and other investments have become digital records. Payments are executed at the tap of a button through mobile applications, and these applications are no longer limited to banks. They are offered by fintechs, digital wallets and online payment systems like PayPal. We have even seen the emergence of peer to peer (P2P) lending with the rise of startups like LendingClub, backed by Google.

Banking in the digital age is now viewed as an on-the-move, lifestyle based activity that should make our daily lives convenient. The challenge for banks is to tap into those moments of truth in the customer journey and stay relevant to the customers’ current needs while helping secure their financial future.

“From fresh products and services to marketing automation, we’ll see a commitment to, and a budget for, adaptation,” explains John Waupsh, chief innovation officer at Kasasa, wholesale financial services provider to community financial institutions, and author of Bankruption. “Even the smallest institutions are understanding that the risk of inaction far exceeds the risk of trying new things.”

Fig. 1. Banking transformation from the 1900s

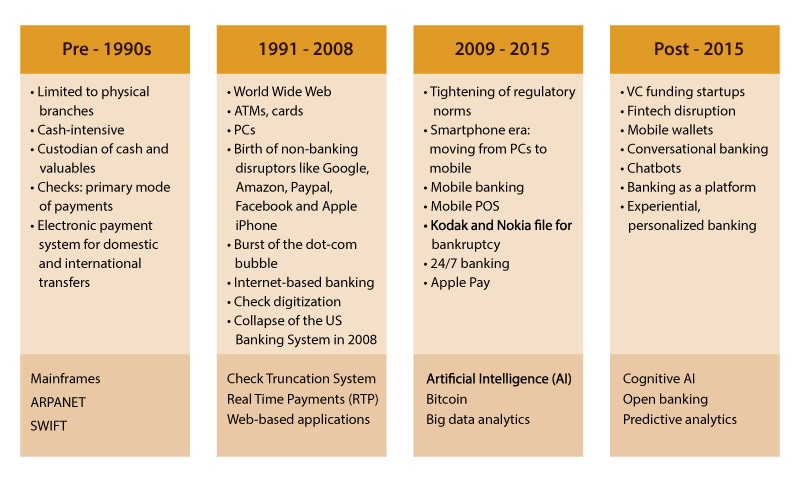

Banking’s evolving agenda: a technological timeline

Pre-1990s, banking was defined by the physical brick-and-mortar branch structure, by tradition and regulation. Cash was the basic mode of transaction, and the bank was seen as a trusted custodian of that cash, outfitted with secure, visible vaults. Checks were transported physically to locations to execute payments. Long lines of customers waiting to be serviced by the branch tellers were a common sight. There were several technological advancements, with the same regulated competitors, yet the pace was not enough to disrupt the way banking was fundamentally performed. Mainframe computers evolved as the secure banking operations hub.

ARPANET, which later transformed into the global internet, emerged into relevance in the early 1970s.1 Even the SWIFT system, which enables financial institutions to make secure transactions, was formed back in 1973.2 The base was being laid for the big leap.

Post-1990s, the whole world became accessible by computer with the emergence of the World Wide Web. The internet revolution, powered by high-speed internet available across the globe, led to the birth of breakthrough companies. Founded in 1998, Google changed the way users engage with the internet.3 The social networking giant Facebook, founded in 2004, eventually changed the way people lived and interacted.4

Banking also underwent a radical change to position itself integrally in the internet ecosystem. The check truncation system digitized the payment mechanism, eliminating the physical transport of checks. Real-time payments also expedited settlement timelines. Banking was served to customers on their personal computers as a web application on the internet. ATMs outnumbered bank branches globally, signaling the rise of 24/7 banking with plastic cards.

This phase of internet extreme adoption also had its share of pitfalls. The year 2000 saw the bursting of the dot-com bubble in the United States. The Nasdaq Composite stock market index, which included many internet based companies, peaked in value on March 10, 2000, before crashing. In the period of March 11, 2000, to October 9, 2002, the index dropped 78%, with the stocks losing $5 trillion in market capitalization.5

The ambitious growth in the U.S. banking sector stumbled again in 2007, through the subprime mortgage crisis, which ultimately developed into a full-blown international banking crisis with the collapse of investment bank Lehman Brothers on September 15, 2008.6 On October 9, 2007, the Dow Jones Index hit its pre-recession high and closed at 14,164. By March 5, 2009, it had dropped more than 50% to 6,594.44.7

Post-2008, the global financial crisis led to an onslaught of regulatory reforms globally. The Dodd-Frank Act was introduced in the U.S. in 2010.8 The Basel III norms increased minimum common equity Tier 1 capital from 4% to 4.5%, and minimum Tier 1 capital from 4% to 6%.9 During credit expansion, banks were required to set aside additional capital.

Additionally, Basel III introduced liquidity requirements to safeguard against excessive borrowing and to ensure that banks have sufficient liquidity during financial stress. To adhere to the regulatory norms, banks had to spend heavily on regulatory systems. The increase in reserve requirements restricted lending bandwidth for banks. This drove the banking system to change its delivery models in search of cost savings and to identify new avenues of revenue beyond lending.

The launch and massive sales of Apple iPhones paved the way for futuristic smartphone adoption. Apple Pay slowly established its reputation as a major mode of payment. Bitcoin also announced itself as an alternate form of currency. There was a steady shift from personal computers to mobile phones. Companies had to swiftly reposition themselves by optimizing their websites and products for mobile use. The banking sector saw mobile emerging as the primary mode of banking. Mobile banking diminished the transaction costs for the bank, empowering users with value and convenience. The mobility revolution brought point of sale machines to the customer’s doorstep.

In this age of rapidly changing customer preferences, the world also saw traditional leading companies falter. Kodak filed for bankruptcy in 2012 as its print photography became all but obsolete, and Nokia in 2013 after failing to switch to smartphones fast enough. This sent a clear message to the banking sector as well: innovate or perish. No bank could sit comfortably, counting on its large customer base to stay loyal. Banks began to use big data analytics and artificial intelligence to analyze terabytes and then petabytes of customer transactions to develop personalized banking.

Post-2015, a growing number of startups have disrupted multiple industries. With so many venture capitalists ready to fund ideas, and to mentor these upstarts, entry barriers have diminished. Traditional banks face challenges and threats from new fintechs. Banking as a service occupies the minds of customers, who expect their banks to play a larger role in their daily lives. Customers want to execute their banking transactions via conversations. Chatbots entered this area and have become a new way to converse with a bank.

Open banking developers around the world realize the possibility of distinct service providers coming together to offer a better, more seamless customer experience. Analyzing the past to predict today’s customer needs is outdated; banks now have to implement cognitive AI and predictive analytics to serve the customer’s future needs, including helping these customers secure their future financial well-being through financial education.

Fig. 2. Timeline of technological banking advancements

The Financial Brand, a digital publication covering marketing and strategy for retail banks and credit unions, conducted a global study asking financial services organizations about their top three strategic priorities for 2019. More than 80% of respondents cited improving the customer experience – close to a 10 percentage-point increase over last year.

According to Nicole Sturgill, principal executive advisor at Corporate Executive Board, (CEB, now Gartner), “In 2019, banks will be focused on two decisions that will be pivotal to their future business model: their level of autonomous banking and their degree of participation in or construction of an ecosystem model.”

What do customers want from banks?

Every bank is pondering this existential question. The world is moving to a cashless society, and the attitudes and preferences of customers are changing rapidly. In this brave new world, the role of a bank must be redefined. Institutions need to swiftly reposition their strategies to align with customer preferences.

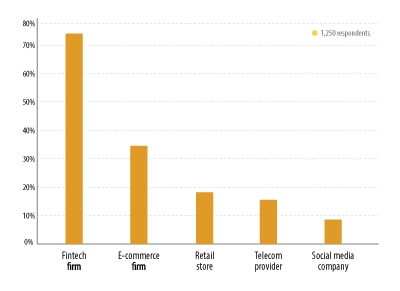

To address this question, Infosys Knowledge Institute and Financial Services consulting unit conducted a survey with 1,250 respondents from 26 countries, asking about their choices with respect to multiple elements in the banking sphere. The respondents were customers who used banking services actively in their day-to-day lives; the sample size was diverse in terms of demographics and psychographics. An analysis of their responses offers key takeaways on the driving forces behind the innovations of the future and what’s in store for the banking industry.

The need for platform based banking

As banking has evolved in recent years, lending has remained the core business and primary driver behind earning profits. In this digital age, however, banks can no longer be dependent on lending and financing alone for their businesses to grow. A radical shift in business models has occurred over the past few years as banks have become focused on increasing revenues via fee based income.

The disruption caused by digitization in banking has also led to the entry of fintech players that deliver innovative financial services at the swipe of a finger, and more cost-effectively than traditional banks. This disaggregation of the value chain poses a great risk to the banks as they lose their historical, comprehensive ownership of the loyal customers they once enjoyed. As our survey revealed, fintechs are increasingly accepted in the market: 75% of respondents (Fig. 3) said if they were to consider banking services from a non-banking entity, they would choose a fintech firm. Moreover, 60% expressed their likelihood of switching to a fintech firm for omnichannel customer experience in banking.

Fig. 3. Fintech rises above other potential non-banking service providers

Big technology enterprises have data for millions of customers, creating visibility to develop insights into customer behavior, perhaps the single largest threat for incumbent banks. Whether banks need to collaborate or compete with big tech is a question that is more relevant than ever before. Nearly 35% of our survey respondents (Fig. 3) look at digital commerce firms as potential banking service providers. We anticipate that a few online retailers will build services across various financial streams, and unbundle today’s bank. Their impetus to raise digital customer experience through the cloud computing advantage will force incumbent financial institutions to eventually relinquish control over costs, and ultimately data.

Fig. 4 shows Amazon’s foray into the financial sector with a host of services: Amazon Pay for payment functionalities, Amazon Lending for small business loans, Amazon Protect for insurance, Amazon Prime Visa card for credit card payments and so forth. Is Amazon creating a stand-alone ecosystem to own customer services — and consequently data — while they look at traditional banking institutions for support as an operational center? The risks for a bank to serve as that operational center loom large in this dynamic ecosystem

Fig. 4. Amazon is unbundling banking to create its own ecosystem

Unless banks control their own destiny, they could become operational centers to tech giants, and market drivers are increasing the likelihood of that potential future state. As the economy shifts to a new status quo, data may be the new oil but macro trends are headwinds against traditional banking as we know it. Since big tech providers can add another service or product without increasing marginal cost, operational economics do not favor current banking models. With legacy applications and current operating models, marginal costs are far higher for a bank to introduce a new service or product to the market. The banking industry should adapt to these changes with similar operating models and targeted cost structure, to reduce their disadvantage. This requires hard decisions about existing personal services that may no longer warrant the overhead associated with their delivery.

There is a clear need for banks to establish a services platform to make a meaningful impact in the lives of their customers. While the traditional pipeline banking model focused on delivering a bank’s own products through its own channels, the new-age platform bank will deliver value to its customers by aggregating products and services offered by multiple vendors on its platform. Open APIs empower the bank to facilitate the onboarding of fintech players in order to deliver innovative services for its customers, establish new revenue streams and stay relevant in the rapidly changing landscape.

Today, regulatory frameworks are requiring banks to publish their APIs for integration with multiple third parties. While Revised Payment Services Directive (PSD2) and the UK’s Open Banking standards were the main driving factors in Europe, the Farrell Review in Australia has mandated that the country’s four major banks (CommBank, ANZ, Westpac and NAB) make credit and debit card, transaction, and deposit data available under the open banking framework by July 2019, and make mortgage data a part of the open banking ecosystem by February 2020 (other banks can take advantage of a 12-month delay in the implementation).10

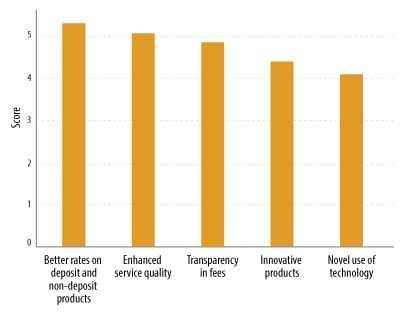

Our survey (Fig. 5) points to better rates on deposit/non-deposit products, enhanced service quality and transparency in fees emerging as the primary factors that customers would consider when banking with a non-banking services provider.

Fig. 5. Attractive rates, higher service quality and fee transparency are key considerations for alternative banking

With a host of fintech players providing innovative services, the customer is definitely the winner. Open banking allows a customer to view accounts, deposits, transactions and investments from financial service providers in a single, consolidated view. This aggregation enables tools to analyze the entire customer data to give real time insights and recommendations. The customer can compare products from multiple financial service providers in a single catalog. Complex services, like the exchange of crypto or international currencies, and cross border transactions can be simplified and brought to the customer’s fingertips by onboarding all the players on the open banking platform and sharing transaction records in real time through trusted services like blockchain.

Bank as platform for services

Banks should embrace this open banking revolution, and not rely only on third parties to integrate and provide innovative services. Banks should proactively come forward with APIs to integrate their banking with the customer’s application. Large corporate customers should be the target audience to start this initiative. Along with participation in the open banking ecosystem mandated by regulatory guidelines, banks should craft their own ecosystems according to market demands. A good example of this is the HSBC Connections Hub, a social network where business customers can connect with buyers and sellers worldwide. The business customers are clients of HSBC, which saves buyers and sellers the cost and effort involved to perform due diligence checks, which facilitates the ease of doing business.

Collaboration with fintech players to offer banking as a service is also an area with immense potential. RBL Bank from India collaborated with Indian fintech MoneyTap to provide rapid short-term loan service to its customers. MoneyTap finds customers, onboards them and uses underwriting tools to gather all the necessary information before the loan is fulfilled by the bank.

A superset of the same model, where a bank offers services to other banks, is also possible. China’s WeBank offers its real-time payment services to small consumer banks in a win-win scenario: The small consumer bank is able to provide services it does not offer, and WeBank earns fees for providing banking services for customers it does not directly serve. The future will see banks moving from being a sole sourced platform provider to becoming a platform service provider on behalf of other firms. For example, on its own platform, a bank can provide its own mortgage products, insurers’ insurance products, wealth management firms’ financial advisory and investment products, and even competitors’ high-interest-yielding deposit products.

Most important, the success of open banking lies in customers feeling secure about sharing financial data with third parties. Our survey pointed out that as customers interact with banks over multiple channels, including third-party platforms, a whopping 95% were concerned about the risks of privacy and personal data. To realize the full potential of open banking, the responsibility is on the banks to generate and maintain customer trust.

Bank as platform for conversations

Our survey found that 68% of customers were satisfied with their current banking services. Looking at the other side of the coin, however, a considerable 32% are dissatisfied and may defect to another firm that can better meet their digital banking needs. The time is now for banks to engage with their customer base more proactively and effectively. To hold on to customers, especially those digital natives, banks need to be always available in one of the most natural behaviors: conversation. Today’s customers want maximum ease and flexibility in their banking transactions. Gone are the days when the customer would be delighted with the bank providing basic account information on a call or in a text message. Customers’ demands have evolved rapidly with the digital disruptions around them. It is a lifestyle change, and banking cannot be seen as an isolated function, one that slows down the consumers’ digital and physical life.

The millennial generation is not the only customer segment to want more choice and better service, but they are the most visible driver for change. This generation is tech-savvy and demands personalized service. However, banks seem to be falling short of customer expectations. Around 60% of customers feel that their banks offer them products and services that are not relevant to them – an alarming discovery.

Multiple forward-looking banks have invested in chatbots to deliver the best-personalized conversational banking services to their customers across all channels. Yet an analysis of most bots today shows they are meant only to answer a static set of questions or perform standard repetitive tasks with no embedded intelligence.

Chatbots can help banks scale up to handle complex queries, to complement human interaction, and should adapt to mitigate cultural and language barriers. In customer service provided by humans, the representative sets the tone of the conversation based on the mood of the customer. For example, if an angry customer vents out words of dissatisfaction, the customer service agent calmly listens without interrupting and apologizes for the situation before starting to resolve the problem. If a customer is distraught over the loss of funds due to a fraudulent transaction, a few words of empathy and a strong assurance squarely set up the conversation before appropriate action is taken. A chatbot based on a fixed set of rules will not be able to replace this aspect of the human element. Cognitive capabilities have to be built into the AI algorithms, to address the problem of context understanding.

Current satisfaction levels with existing chatbots are understandably lower than expected by banks. Early adoption is a primary reason behind this dissatisfaction. As the technology and response data available for cognitive learning of the machine improve, customer satisfaction will improve as well. The recent dip in chatbot usage can be seen as a temporary phase. With the younger generation, who live on their mobile devices yet prefer quick texting over talking on the phone, these chatbots will find increased relevance and acceptance. As the chatbots mature over time, adoption will increase in a major way.

Going forward, chatbots should be designed to perform intelligent functions. Based on AI algorithms, they should be able to perform monetary transactions and answer intelligent questions, such as:

- What impact will today’s news have on my portfolio?

- Which individual will receive your funds transfer?

- How much money did I spend on entertainment last month?

- What is the best investment product, considering my earnings and risk profile?

The majority of banks have limited their chatbots to their banking channels, i.e., internet banking, public websites and mobile applications. In the future, chatbots will power conversational banking on social networks and messaging services. As deep learning and machine learning mature and integrate with chatbots, bots can be programmed for self-learning capabilities. Banks are a massive source of customer data, with the customer interacting at several touchpoints and channels. Future bots should have the capability to analyze both structured and unstructured customer data with little or no latency, to provide insights to both the bank and the customer.

The cognitive capabilities of bots can also provide a financial institution with insights and answers to important questions, such as:

- What is the product my customers are most interested in?

- What are the demographics of the customers investing in product X?

- What product has the highest dropout rate after customer inquiry?

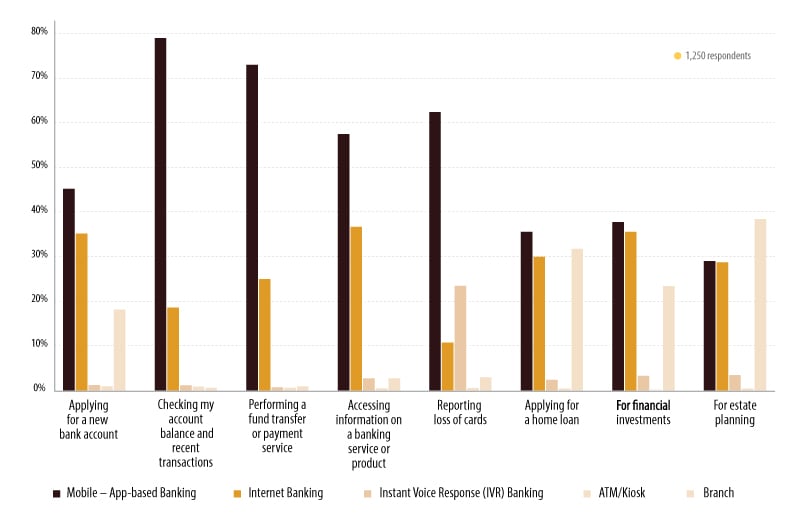

Whether chatbots should eliminate the human element in customer service is a fundamental, persistent question. The answer: rather than choose an extreme, the two modes can and should coexist to deliver effectively. Our survey (Fig. 6) indicated that more than 90% of customers prefer mobile banking and internet banking while performing basic banking transactions like checking account balance and transactions, performing a fund transfer, and accessing information on a banking service or product. However, when it comes to complex banking transactions like applying for a home loan and estate planning, a considerable percentage of customers (over 30%) still prefer visiting the branch.

Fig. 6. Preferred channel of choice: mobile for basic transactions and branch for complex banking

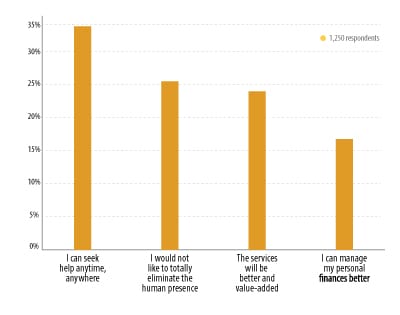

This decade has also seen the evolution of digital-only banks, with physical branches seen as an unnecessary cost center. Our survey (Fig. 7) posed the question whether customers will switch to a digital only banking experience, and 34% of customers said they prefer a digital only banking experience at a lower cost because they can seek help anytime, anywhere. Furthermore, 23% of customers feel that the services of digital-only banking would be better and value-added. However, 25% of customers still want to keep the human presence and do not want to switch to digital-only banking. These findings reinforce the assumption that a carefully considered mix of humans and bots is the right proposition for service delivery.

Fig. 7. Customers seek an optimal conversational mix of humanized digital-banking

With omnichannel banking, the customer might start filling out a credit card application on the website with assistance from a chatbot but may want to visit the branch to complete it. This is possible only through integration of the human element and the bots. A bot involved in decision making for tasks like cross-selling can assist a human bank employee. The employee can also monitor responses generated by the bots to analyze the scope of refinement. Constant monitoring of customer feedback about user experience can develop a fact base to decide the right mix of human and bot going forward.

Bank as platform for aggregation

We have heard all the analogies: Facebook and YouTube are two of the world’s most popular content sharing platforms, but they do not create any content. Uber is the world’s largest taxi company, but it owns no taxis. Airbnb, the largest accommodation provider, does not own any real estate. Amazon, the largest online marketplace, aggregates sellers from around the world on its platform. The new world belongs to the aggregators.

After attaining phenomenal success by aggregation, these players are now capitalizing on their massive customer base by offering new services and products as a line extension. Facebook is hosting third-party applications and games on its platform through a profit-sharing arrangement. Uber has extended into the food delivery business by acting as restaurant aggregator in the form of Uber Eats. Amazon diversified into payments by introducing its own wallet, Amazon Pay, apart from products like Kindle and Fire TV Stick and the Amazon Prime content platform.

A similar revolution is occurring in the banking industry. The time is ideal for banks to turn themselves into data aggregators. Banks need to leverage their rich data warehouses using analytics to churn out the right advice in terms of products and services for customers, even if those offerings are from a competitor. Majority of customers from our survey did exhibit reluctance in paying additional fees to avail value-added services from their bank, but only 10% of customers said they would be willing to pay additional fees for such services. The bank has to seek new revenue streams and save on existing expenses while delivering third-party services on its platform, even if that requires customers to incur monetary and non-monetary (time) costs when they reach out to service providers to select the right product. Financial institutions also bear huge costs to perform “know your customer” activities and credit checks and customer onboarding. The future path is for banks to be a single gateway for all customer needs. The benefits of know your customer actions and credit checks performed by a customer’s bank should hold valid for all services, across all types of institutions that a customer wants to access from the bank’s platform.

More than 75% of customers see the bank of the future as a marketplace to cater to all their financial needs. Historically, banks have owned the processes. For example, if a customer wanted a home, banks focused only on funding the loan or mortgage product that would enable a customer to buy a home. However, dealing with new trends based on the fulfillment of needs to enable aspirational dreams is a new model. Need-based banking is an Uber-like opportunity for banks, where they can become an end-to-end platform, not a simply a point service. Instead of simply funding a loan to buy a home, can a bank also directly deliver a home to its customer, based on the customer’s choice of location, priorities and budget?

Finding an answer amid these changing trends will push a bank to become a platform where multiple service providers can collaborate, so the bank becomes the “service delivery center” (Fig. 8) rather than a “service origination platform.” This is a paradigm shift. In this new era of “coopetition”, the bank has to forge a relationship with the real estate agent, home decorator, insurer, and title and deed register. Loans become a small component of the overall service portfolio. In the future, we will use our banking mobile application for tasks like booking a cab, filing our tax return, registering our own company, accessing notary services online, getting the keys of a new car delivered, making a dinner reservation, booking tickets for events happening in our city and more.

Fig. 8. The bank of the future: a service delivery center

Can a bank really do all this? While that question may weigh on decision-makers in the banking industry for some time, the seed has been planted. It requires banks to rethink their business model. It also requires forging new relationships with thousands of unrelated service providers.

Service delivery center through open banking

In a typical banking arrangement, the two master data sets are the service catalog, which has the list of products and services offered, and the customer catalog, which links back to the service catalog, mapping customers to the products and services they can use. The need of the hour is to introduce a third data element: service provider data. The bank has to work on building this new set of data by onboarding multiple third-party vendors that cater to all the customer’s non-banking needs.

Open banking is the revolutionary shift that is paving the way for such a development. Banks will have to provide secure access to customers for third-party vendors by enabling application programming interface-led integration. Customers can now access all types of services provided by multiple vendors by just logging into a single bank portal. With this, the bank can provide more value-added services to the customer, resulting in better customer experience, and create new revenue streams by offering products that it does not own.

To make all this possible, the bank must build a team that understands cross-industry trends, and also develop new talent pools of individuals who are comfortable working on evolving, ever-changing business models. Traditional banks have people and assets, both physical and intangible – including the experience to navigate the complexities to set up and operate the new models. “The banking organization of the future will interact in similar ways to Amazon and Google,” claims Jim Marous, co-publisher of the Financial Brand, “gaining insights and getting smarter with each interaction.”

Conclusion

New-age banking will solve the customer’s daily life problems with just a few swipes, and be tightly integrated within the customer journey. The service delivery center will enable emerging technologies to power business use cases and collaborate effectively with other service providers in the digital ecosystem. Traditional banks are still well-positioned, but they have to develop their roadmap swiftly.

In the race to transform banking as a marketplace, the core objective is to put the customer at the center of the value chain. While embarking on this journey, banks should do so ethically in the best interests of their customers. After all, no technological advancements and investments can earn or replace something earned over a period of decades: trust. The bank of the future should be seen as a trusted store that offers end-to-end services to its customers. The more services this trusted store can add to its catalog while building its financial reputation, the more engaging its prospective relationship with new customers will be. Banks can become banking leaders in the new digital financial landscape.

References

- “Timeline: 180 Years of banking technology”, Independent Banker, October 31, 2017

- “Society for Worldwide Interbank Financial Telecommunication,” Wikipedia, last modified February 28, 2019

- “History of Google”, Wikipedia, last modified March 18, 2019

- “History of Facebook”, Wikipedia, last modified March 18, 2019

- “Dot-com Bubble”, Wikipedia, last modified March 21, 2019

- “Financial crisis of 2007-2008”, Wikipedia, last modified March 11, 2019

- “Stock Market Crash of 2008”, the balance, November 6, 2018

- “Regulatory Responses to the Subprime Crisis”, Wikipedia, last modified April 14, 2019

- “Basel III”, Investopedia, May 30, 2018

- “Australia to force ‘big four’ to open banking data by July 2019”, ZDNet, May 18, 2018

- “Top 10 Retail Banking Trends and Predictions for 2019”, The Financial Brand

- “6 Strategies for Building A Platform Bank”, Finextra Research, June 4, 2018

- “Chatbot: The Intelligent Banking Assistant”, PwC

- “The battle is for the customer interface”, TechCrunch