Following the agrarian, industrial, and service-based waves is the ‘experience-based’ economy,1 which is predominantly digital. Businesses cannot just add a technology wrapper around a traditional service to realize the full benefits of this new economy.

Instead, leaders need to design processes to develop experiences that meet customer needs and increase their ability to charge fees and improve loyalty.

The experience-based economy

Experts differ in their opinions on the size and growth of the experience economy, but it is a segment that cannot be ignored. In a recent World Economic Forum article,2 the authors discuss the importance of designing experiences so that that they are inclusive for all segments of society.

In a study the authors refer to, 78 percent of millennials prefer to spend on a desirable experience rather than physical goods. The automotive sector is moving from a product-based business model to mobility as a service. The next wave in this transformation is the experience of customer engagement, both outside the vehicle and inside it during a journey. In order to assess and monetize the experience, it is important to map it from start to finish, covering all points of interaction with metrics for measurement. General Motors has a business goal to be the best in customer experience, not just in automotive, but across industries.

“We strive to earn customers for life by providing great customer experiences across journey maps.”

Digitizing the journey map

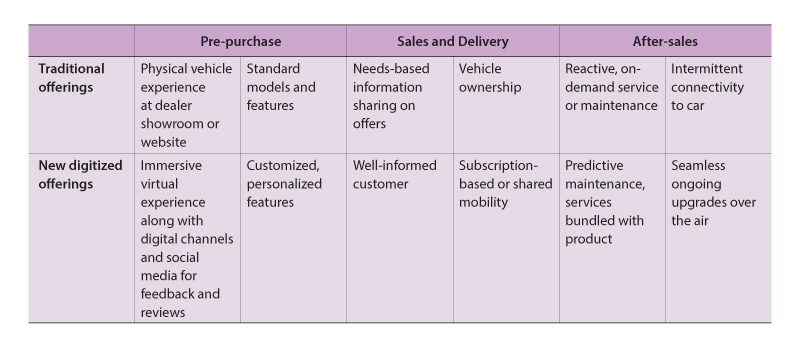

The journey map is the series of touch points or interactions the original equipment manufacturer has with the customer across the end-to-end life cycle: pre-purchase, sales and delivery, and after-sales. Original equipment manufacturers (OEMs) need a structured methodology to design and implement a successfully digitized journey map, with the right set of frameworks, tools, competencies, and partnerships.

The three players in the journey map are OEMs, dealers who fulfill vehicle sales and service, and end customers.

Figure 1 shows the shift of activities across the three stages in the life cycle from what was offered traditionally to the new offerings when digitized. OEM maturity in this customer engagement digitization journey can be assessed using well-defined parameters.

Figure 1. Transforming the journey map to new digital avenues for customer engagement

Customer engagement maturity model

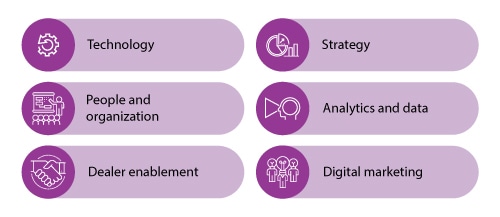

The maturity assessment model consists of six evaluation parameters to assess the OEMs’ digital readiness. Customer engagement agility and innovation are assessed and categorized on six parameters: technology, strategy, people and organization, analytics and data, dealer enablement, and digital marketing. These parameters are shown in Figure 2.

Innovation introduces new ideas, and agility is required to quickly help diverse stakeholders make decisions and launch feasible ideas in the market. Both innovation and agility are important to design and implement customer engagement.

Figure 2. Customer engagement model parameters

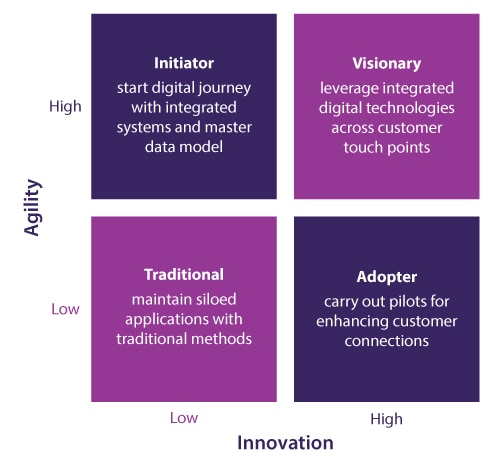

The parameters look beyond technology to the people aspect, along with the suitability of the initiative for the overall strategy of the organization and how well dealers are enabled. They also look at how effectively digital technologies and data are used for decision-making in specific areas such as marketing. OEMs can be categorized into one of the following maturity levels as shown in Figure 3, for each parameter individually and at an overall level:

- Visionary

- Initiator

- Adopter

- Traditional

Figure 3. Maturity model categories

To determine maturity level, questions are asked across the six digital maturity parameters. Using weighted scoring, a rating is determined for each parameter (1-5, 5 being highest). The overall score is used to identify maturity level for customer engagement. For example, a 2.2 Agility rating and 4.1 Innovation rating yields categorization as an Adopter.

Maturity model —Technology examples

Visionary

BMW has used immersive technologies such as augmented reality/virtual reality at all stages of car development, with customers involved as well. Virtual prototypes can be built to see what a specific set of components will look like when assembled together.

AR apps give an immersive experience to potential customers in a showroom, allowing them to interact with a full-scale virtual version of a car to try out different color combinations, features, and configurations. Customers can have a virtual driving experience wearing AR glasses. AR-enabled repair manuals provide virtual instructions for repair, superimposed on top of the physical part that needs attention when a smartphone is pointed at the place requiring work.

Initiator

Tata Motors has one of the largest user bases of customer relationship management applications for functions related to customer and dealer management.3 Deployment started in 2003, and by 2018, the company had included more than 15,000 dealers on this platform. This integrated system has helped Tata Motors consolidate customer and vehicle data into one system. It provides real-time information, enables analytics, and supports critical decision-making. Dealers are empowered, resulting in better sales and service as well as improved customer experiences.

Adopter

Automotive seating system supplier Adient demonstrated its ‘seating tomorrow’ concept where car seats can be converted from a comfortable and safe place for the passengers to a workstation, a relaxation zone or resting positions.

Features for the comfort and safety of the driver were included along with monitoring of their human functions and parameters during a drive.

Adient used its proprietary study of anticipated seating needs in 2030 and beyond to demonstrate how vehicle interiors will be affected by new forms of mobility. Its AI18 concept seating system offers flexibility to match a specific type of driving condition — communication mode with passengers facing each other for meetings, cargo mode with retractable seats, baby mode with seats that can turn 180 degrees for interaction and lounge mode for relaxation. Such seating systems are tried out in small trials and are examples for digital adopters.

Traditional

Dealerships have been a primary resource for new and used car sales, maintenance services, and replacement parts. Dealers across the globe have adapted to technology changes at varying paces. At a broad level, they rely on traditional means of lead management and customer experience. In terms of repair and maintenance, the focus has been on reactive and corrective maintenance. The use of online channels for retail, OEMs venturing into car subscriptions and rentals, and ride-sharing services have started to make a significant impact on retail business. Most dealers rely on OEMs to manage vehicle data. This limits their capabilities for predictive or proactive services.

Dealers are evaluating how to reinvent their business model through the adoption of digital technologies, and this includes scale considerations.

According to the National Automobile Dealers Association’s report,4 dealers without a chain of stores have experienced a significant financial decline in the United States, with around 18 percent closing between 2012 and 2018.

Economies of scale or a network of stores will play an important role to develop customer engagement capabilities.

Success through integrated customer journeys

A global leader in automobiles wanted to increase new car sales by improving customer experience and brand recall. The OEM undertook a digital transformation, with a customer-centric approach as a central component. The major challenges were the lack of a single view of a customer with multiple profiles in different systems, leakage of leads due to the absence of a dedicated system, lack of a single touch point for customer inquiries, no system to track customer journeys from inquiry to purchase and service, and minimal or no integration between systems for data flow.

Due diligence to understand as-is systems and processes was followed by tracking the customer journey at each touch point from presales to after-sales. Marketing budgets were optimized with targeted campaigns to reach specific customers. Workflows were redesigned and implemented to ensure a seamless information flow, to anticipate and eliminate the pain points of all stakeholders.

The automotive industry is experiencing several simultaneous disruptions. Customer engagement can be considered an innovation that needs not just new technologies but also a different way of looking at the product. For an industry that has pioneered traditional tools to understand customer requirements and product features, it will be an interesting opportunity where going forward all customer needs are not tangible. A maturity assessment model can assist car makers to objectively judge where they are, their competitive position, and their future trajectory.

References

- Pine, Joseph B. II, Gilmore James H., “Welcome to the Experience Economy,” Harvard Business Review, July-August 1998

- Yaffe, Jonathan; Moose, Andrew; Marquardt, Dana, “The experience economy is booming, but it must benefit everyone,” Jan. 2019

- Tata Motors Dealer Outlets Deploy Oracle Siebel CRM

- NADA Data 2018 — Annual Financial Profile of America’s Franchised New-Car Dealerships