Insights

- AI improves trade visibility and risk response - AI platforms pull real-time data from suppliers, logistics, and customs. This helps companies spot risks early and respond quickly to disruptions.

- Predictive analytics enables early planning - Machine learning models simulate tariff hikes, sanctions, or delays. This helps businesses prepare in advance and avoid losses.

- Smart sourcing cuts risk and cost - AI scores suppliers by region and risk. It also finds trade routes that avoid high tariffs and reduce shipping costs.

- Global Trade Systems (GTS) simplify compliance - Tools like SAP GTS automate customs data and documentation. When combined with AI, they improve accuracy and speed up global trade processes.

India’s Supply Chains in a World at War: Dr. Gautam Desiraju on Geopolitics & Resilience

Jeff Kavanaugh speaks with Dr. Gautam Desiraju—one of India’s most distinguished scientists and thought leaders—about how global conflict, economic volatility, and shifting alliances are redefining supply chains.

In today's interconnected world, global trade is more vulnerable than ever to geopolitical risks. Tariffs, trade restrictions, and regional policy shifts — such as those in North America, Europe, and Asia-Pacific — introduce complexity into supply chains and trade operations. Industries like manufacturing, retail, and semiconductors, which depend on raw materials and components from around the world, are particularly exposed.

Data analytics for supply chain insights

Even in the calmest times, global supply chains are complex systems, with challenges ranging from legal and financial to operational and compliance, requiring careful management.

A few key aspects of global trade that businesses need to navigate include:

Regulation and compliance: Adhering to import/export laws, tariffs, and trade agreements.

Customs and duties: Managing customs filings, duty optimization, and free trade agreements (FTAs).

Logistics and shipping: Coordinating global supply chains and transportation leveraging free trade zones.

Trade finance: Handling cross-border payments, mitigating currency exchange risks, and managing letters of credit.

Risk and security: Addressing geopolitical risks such as embargoes and sanctions, as well as safeguarding against cybersecurity threats.

Many companies also face challenges in managing global trade due to fragmented systems and outdated compliance processes. A lack of end-to-end visibility across suppliers, logistics partners, and customs regimes hampers their ability to respond and adapt effectively to shifting trade policies, geopolitical risks, and operational disruptions. Additionally, the absence of unified, high-quality trade data can result in costly errors, missed duty recovery opportunities, and weak strategic planning.

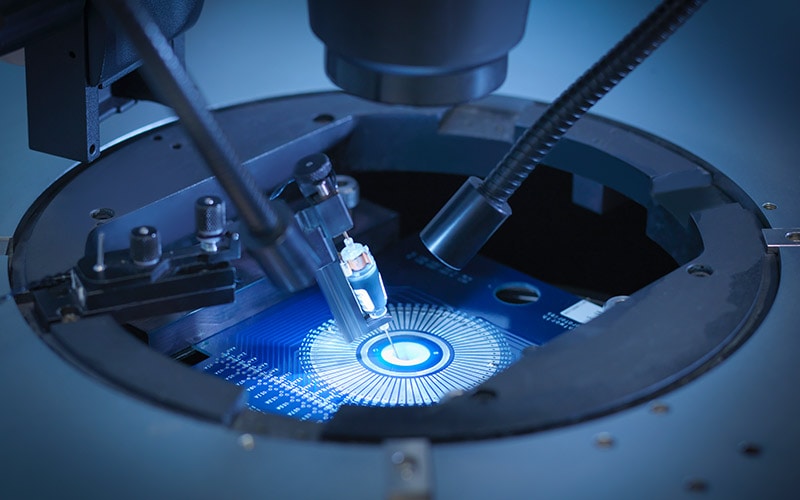

Data analytics and AI: reducing economic impact in global trade

A key application of analytics in global trade is linking key players such as manufacturers, suppliers, logistics providers, regulatory agencies, and third-party data sources (including local regulations, tariffs, and embargo lists). Each of these plays a part in the movement of goods and services, and any disruptions such as delays in customs clearance, port congestion, or geopolitical instability bring significant financial consequences. Data analytics platforms collect and integrate information from these sources to create a connected view of the entire trade ecosystem.

Powered by artificial intelligence (AI), machine learning (ML), and real-time data integration, these platforms use the data to simulate geopolitical risks, forecast disruptions, and help organizations to respond swiftly to changing trade policies.

Data analytics platforms collect and integrate information from these sources to create a connected view of the entire trade ecosystem.

Proactive risk management

Using predictive analytics for scenario modeling helps anticipate disruptions, assess potential impacts, and take timely action to safeguard operations. For example, predictive analytics can model the potential financial impacts of shocks such as tariff escalations or trade embargoes. AI and ML can also analyze global economic indicators, regulatory changes, and historical patterns to identify trade risks and plan mitigation strategies. Analytics can also take real-time data from governmental agencies, trade organizations, and economic reporting platforms to model and plan for rapid responses to evolving policy landscapes.

Supply chain resilience and optimization

AI-driven data analytics can also help businesses strengthen supply chain resilience by collecting real-time data from internet of things (IoT) devices — such as GPS trackers, RFID tags, and environmental sensors — embedded across shipments, warehouses, and transportation networks. This data provides continuous visibility into the location, condition, and movement of goods, enabling predictive modeling and faster, data-informed responses to potential disruptions.

AI-driven supplier risk scoring can help identify and onboard alternative suppliers in geographically diversified, low-risk regions, while analytics can determine cost-effective trade routes that minimize exposure to high-tariff jurisdictions. This boosts logistical efficiency and reduces financial vulnerabilities.

Dynamic pricing for tariff mitigation

In an evolving global trade environment, dynamic pricing and effective cost management are essential to maintaining profitability and staying competitive. Data analytics and AI technologies equip businesses with the agility and precision needed to respond to shifting conditions.

Advanced analytical models can assess the impact of tariff changes on production costs, enabling timely and informed adjustments to pricing strategies. AI-driven pricing algorithms go a step further, automatically adapting prices based on real-time factors such as tariff fluctuations, competitive dynamics, and customer demand. This dynamic pricing helps companies remain responsive without constant manual intervention.

Advanced analytical models can assess the impact of tariff changes on production costs, enabling timely and informed adjustments to pricing strategies.

At the same time, data analytics supports comprehensive cost forecasting, giving financial teams the insights needed to anticipate the long-term implications of trade policy changes and manage budgets more effectively.

Trade compliance and regulatory adherence

In today’s complex and rapidly evolving global trade environment, maintaining compliance with international regulations is not only a strategic priority but also essential for mitigating operational and reputational risks. Intelligent systems and advanced analytics play a critical role in helping organizations stay ahead of shifting regulatory landscapes.

AI-powered tools can continuously monitor global trade regulations, enabling businesses to detect changes early and maintain ongoing compliance. AI-enabled centralized platforms streamline regulatory reporting by generating audit-ready documentation, improving transparency, and reducing administrative burden. In addition, data analytics supports duty and customs optimization by identifying opportunities to leverage FTAs and apply more efficient tariff classification strategies.

Leveraging enterprise platforms for data-driven trade operations

Organizations looking to enhance trade, supply chain, and compliance management through data and AI can benefit from integrated enterprise platforms that enable consistent data governance, predictive analytics, and centralized visibility. SAP (Figure 1) is one such platform that offers these capabilities, though similar outcomes can be achieved with other enterprise resource planning (ERP) systems, depending on specific business needs and trade compliance requirements.

Figure 1. Analytics-driven supply chain management

Source: Infosys

Recommendations for adopting AI-enabled supply chain solutions

To effectively navigate today’s complex trade environment, organizations should begin by building a robust tariff sensitivity model — a framework that analyzes how changes in tariffs impact cost structures, supplier choices, and sourcing decisions. This model should continuously monitor exposure to tariff fluctuations and generate data-driven insights to support smarter, more agile procurement strategies as trade conditions evolve.

Equally important is investing in a centralized trade intelligence platform. Such a platform should unify global customs data, automate product classification, and enable rapid compliance with shifting regulatory frameworks. This not only reduces the risk of delays and penalties but also enhances operational efficiency across global trade operations.

Finally, organizations should establish a dynamic sourcing strategy playbook grounded in real-time data analytics. By integrating insights from supply chain operations, finance, compliance, and geopolitical risks, this playbook can guide more resilient and adaptive sourcing decisions, helping businesses stay ahead of disruptions and maintain continuity in uncertain markets.

From insight to strategic advantage

As global trade becomes increasingly complex and volatile, data analytics and AI are no longer optional — they are essential for building resilience, maintaining compliance, and unlocking strategic advantage. From predicting disruptions and managing tariffs to optimizing sourcing strategies and ensuring regulatory adherence, organizations that harness these technologies can respond to uncertainty with agility and confidence.

By adopting an integrated, intelligence-driven approach, businesses can move beyond reactive measures and proactively shape their trade and supply chain strategies. The future of global trade belongs to companies that are not only digitally enabled but also insight-driven — prepared to navigate challenges, seize opportunities, and lead in a shifting economic landscape.

Contributor: Sanjai Hayaran