The supply chain is under assault, and supply-chain planning software has been pushed to breaking point. Solutions were not designed for such unprecedented times.

“This is the first crisis in the last 50 years where both demand and supply are the problem,” says Nikhil Balkundi, an SAP consultant at Infosys.

Demand forecasting has become close to impossible, with firms unable to use past data to predict future buying patterns. Outliers in the data have become the normal.

Supply-chain balancing algorithms, which match supply with demand across the supply chain, have never been met with a situation where factory demand “overflow” is up to 500% of available capacity. In normal times, a 50% surplus of demand could be met by an alternative sourcing plant, say in China. But such huge fluctuations are breaking the supply-planning optimizers inherent in most software.

An artificial jewelry and crystal manufacturer has faced a drop in demand of 70% as stores are closed across the world. When lockdown is eventually lifted, demand for wares may be based on a new culture of social distancing, affecting social gatherings and demand for fashion products. Who knows how buying patterns will emerge after the worst of the crisis is over – whether they will be ad hoc, V-shaped or more nuanced U- shaped curves? Such complexity is beyond even the cleverest machine-learning intelligence.

Then there’s the added problem of the bull-whip effect. Today customer stockpiling is leaving retailers with too many or too few products on their shelves. Such checkered demand used to get noticed at upstream nodes in the supply chain, such as distributor warehouses or regional hubs. However, this effect is now starting at the point of sale, with wild swings in demand as the whip travels through the supply chain. Algorithms can’t tell us how much stock to hold at different nodes given such uncharted levels of uncertainty.

For a pharma company selling over-the-counter products, the huge demand upside means that allocation algorithms are using prioritization rules that were built in a pre-COVID-19 era. Such rules were designed to assign most of the stock to the most profitable customer, say a retail chain such as Costco or Walmart. But ethics are the order of the day, and prioritizing customers on profit alone no longer holds.

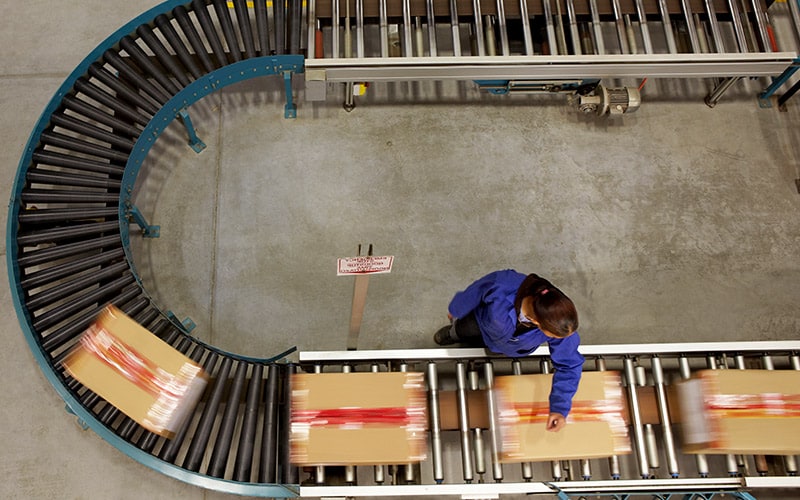

Supply chain “war rooms” have been set up to carry firms through the crisis

In all such situations, software is being turned off and firms are resorting to manual planning using spreadsheets. Supply-chain “war rooms” are being set up to carry firms through the crisis.

However, this solution is unsustainable given that the COVID-19 endgame is not in sight. Even by the most optimistic projections, global supply chains will remain under some sort of COVID-19 influence over the next 12 to 18 months. Manual planning for that long is not an option.

Software in the post-COVID-19 supply chain

There is no new “silver bullet” software planning system that can solve these problems across industries. What is sure, however, is that supply-chain planning solutions will need to be more resilient and flexible in the post-COVID-19 world. The danger of a second wave of restrictions is still very real, and firms will need to take what they’ve learned from this crisis into their future if they are to meet customer demand and stay afloat.

Future supply-chain planning software must have the following capabilities:

- Mapping the demand revival pattern: Almost 90% of enterprises experienced a drop in demand during the COVID-19 lockdown. As lockdowns are lifted and life limps back to a semblance of normalcy, demand will return. For some supply chains, demand will be restored immediately (V-shape recovery). For others, demand will resume more slowly (U-shape recovery), while some other supply chains will return to normal in a series of step changes (step recovery). Another possibility is that demand will not reach “normal” levels in the foreseeable future, which will force businesses to reset demand planning completely. Any resilient and flexible software solution should have algorithms to map all such patterns.

- Flexible rules for demand-and-supply matching: Factories will suffer from unpredictable supply capabilities in the foreseeable future. This trend surfaces due to the imminent threat of partial lockdowns, a restriction of imports from certain geographies, and the challenge of procuring raw materials. With this in mind, supply-chain software should feature multiple options that match demand and supply – going beyond the usual “make-or-buy” decisions inherent in strategic plans. These include more agile switching capabilities in software between various modes of make strategies (in-house, outsourced, hybrid) and buy strategies (multiple sourcing; switching the supplier based on demand patterns and optimal handling costs). Corporates should weigh up the level of resilience of the supply chain before making such decisions, going beyond decisions purely made around convenience and profit. Further, scenario planning for various supply-chain physical designs must become more regular and integrated within operational planning from the outset.

- Change in approach of inventory optimization: Current inventory optimization solutions reduce inventory by holding goods at a place in the supply chain that requires the lowest working capital investment for a given service level. In the post-COVID-19 era, firms must protect against disruption in supply, even if that means extra working capital investment. Inventory and safety stocks will need to be held closer to the point of consumption. Further, multiple safety stocks will need to be held at various nodes in the chain (for the same level of demand), in case one of the routes closes abruptly. All that said, firms will have to be flexible with optimizations and stock more products to avoid shortages; replenishment methods like “just in time” will be revisited and sophisticated algorithms to optimize cost should be developed to take into consideration the entire supply-chain network. However, within these constraints and developments, the inventory levels should be the lowest possible – a paradox that applies to the post-COVID-19 world.

- Options for allocation in case of demand shortage: The fact of this global pandemic means that firms must build the threat of unprecedented shortages and wild swings in demand into their working models. Demand reaching up to ten times available supply may become common, especially in industries such as pharmaceuticals that supply essential goods. In this future, today’s allocation rules – built for levels of demand at 50% more than supply – won’t work when demand hits 1000% more than supply. Like stock market circuit breakers, firms will need to have the ability in their supply-chain planning solutions to switch the rules depending on the level of shortage.

- Ability to handle flexible master data: “Flexible master data” sounds like an oxymoron, but such will need to be the reality in the post-COVID-19 era. Before the pandemic, assessing the lead time (time from placing to fulfilling an order) from a Chinese factory to a German warehouse was quite simple. Now, the lead time may change almost every month, depending on the regulatory environment. To get a handle on this situation, master data (lot sizes, reorder points, lead times, sourcing rules, means of transport, etc.) will need to become semi-variable, and supply-chain planning solutions will need to be capable of handling this.

- Shift in focus from forecasting to “sense-and-respond” mode: Post-COVID-19, traditional forecasting methods won’t work. This is because they tend to read history data and forecast future demands based on past data patterns, typically giving more weight to recent data and ignoring “outliers.” However, this data will no longer be representative of what future demand patterns will look like. An organization attempting to forecast data a year from today will find the task impossible. Instead, firms will have to build alternate ways of sensing demand and responding to it. In some industries, a “demand-driven” approach to planning will gain popularity. This will become especially important as e-commerce and online sales become more prevalent post-COVID-19. Software should have the ability to use telemetry to sense demand patterns and build forecast models based on “live” data. With that in mind, more and more AI/ML usage is expected to automate the forecast process.

- Attribute-based planning: Specific product features of software will be used more often than others in the post-COVID-19 era. Some leading supply-chain software products already have a “sense-and-demand” mode, which can be further developed to take into consideration the whole supply chain.

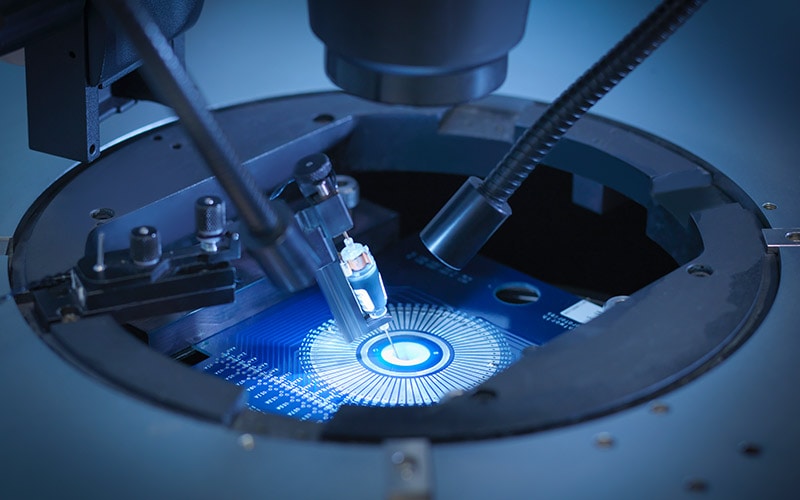

Telemetry can be used to sense demand patterns and build forecast models based on live data

These capabilities will need to be part of the post-2020 supply-chain planning solution. But they are not exhaustive. Every aspect of supply-chain planning will need to be redefined, and frequent adjustments to forecasting, demand management, inventory management and sales and operations planning will be the order of the day. Above all, supply-chain planning software will need to be flexible and account for variables in the supply-chain ecosystem.

Post-COVID-19 planning with enterprise software

All supply-chain software solutions have more or less similar capabilities and outscore one another in a very narrow field or specific industry context. None offer an all-encompassing solution to the COVID-19 crisis, nor are they set up for another cataclysmic event on a similar scale.

However, with some forethought, and by instilling new ways of working in the organization, supply-chain planning solutions such as SAP APO, SAP IBP, Oracle SCM Cloud, Oracle VCP and Kinaxis can be fine-tuned to work with a growing level of market uncertainty.

Eight factors should be considered in this optimization process:

- Custom outlier correction methods: Mapping demand revival patterns (U-shape, V-shape, etc.) is difficult. In this context, it’s not sufficient to use current outlier correction methods (for correcting data history) to predict the future. Instead, firms will have to come up with at least five demand revival patterns and create custom outlier correction methods to map them in the system. It will also be important to keep the solution flexible so that products can be switched from one pattern to another depending on how demand is getting restored.

- Planning solution as master and not slave: Conventional wisdom within supply-chain software is to use the ERP system for master data and the planning system as the “slave.” In this new era, this philosophy will be turned upside down. No longer can firms make frequent master data changes and updates in the ERP system and rely on this information appearing fast enough in planning software. Instead, the planning solution must be made flexible to accommodate new data uploaded on the fly, with the ERP system following its lead.

- Even Agile will be insufficient: In the post-COVID-19 era, change requests to projects must occur at an accelerated clip. Even the Agile methodology – seen as rapid and responsive pre-COVID-19 – slows things down with numerous sprints and testing cycles. One approach can be to work with multiple production environments, applying changes directly into one of the environments, and if it works, taking it “live.” Of course, every company will have to find its own solution, but quick change management will be crucial.

- Scenario planning at industrial scale: Current planning solutions are designed for the most part to offer two or three options to match demand and supply. In such scenarios, solutions assume different levels of demand and various levels of capacity, but rarely different physical supply chains. This scenario-planning capability must now be taken to the next level – at the industrial scale. Many CXOs will start to ask questions that in former times will have made no sense, such as: “Can we supply next month’s demand for a particular market by creating a new factory near-shore rather than the current one that is across the ocean?” Also, simulations can be developed that have “what-if” capabilities. Further, in-memory computing should be used for faster processing in “batch mode,” and firms can also look at high-capacity computing machines and in-memory computations for simulations and planning.

- Governance tuned to trial and error: “Fail early and learn quick” will be the new mantra for supply-chain planners post-COVID-19. With that in mind, solution governance has to throw out stringent management gates and become more lenient. New ways of working and innovation in supply-chain management will be highly sought after.

- Demand-driven planning: With the higher level of dynamic changes to demand-and-supply patterns, solutions such as SAP (and Oracle) DDMRP (Demand Driven MRP) can be adopted for critical products. DDMRP is an approach to plan buffer stock availability at strategic nodes in the supply chain and can help absorb unexpected shocks by responding to actual sales data instead of forecasts.

- Integration with other technology platforms to enhance planning ability: With uncertainty becoming the new normal, it is imperative to integrate planning solutions with related technology to address specific issues. Currently, most planning solutions already leverage machine learning and artificial intelligence, but these technologies need to be extended to sense global signals (for example, the utilization of GPS data to predict supply shortages due to transportation disruptions in certain geographies (as was the case with China in the initial phases of the outbreak), or IoT devices sensing factory activity data and predicting possible disruptions to enable a proactive response).

- Alternate manufacturing: Alternate sourcing will be warranted post-COVID. Companies should plan for disaster scenarios, performing simulations and scenario planning for the event that certain areas/locations halt manufacturing or if there is a supplier-wide stoppage. Firms now have COVID-19 and the Fukushima disaster to learn from.

“Fail early and learn quick” will be the new mantra for supply-chain planners post-COVID-19

The supply chain of the future will most likely be a game changer for most companies. Even the most profitable will compete based on how intelligently and ethically they can serve customers. This was true before the pandemic struck but is even more so now. Firms must understand how resilient their supply-chain ecosystem is and quickly stress test its vulnerability both upstream and downstream across geographies. Fully integrated software enables information to flow seamlessly between suppliers, manufacturers and customers, breaking silos and transforming planning into a continuous process. This ultimately creates trust, reduces costs and enables joint planning solutions between partners.1

Currently, no supply-chain planning software exists that solves the demand-supply conundrum posed by COVID-19. Supply-chain planning is an art, and with unforeseen hazards on the horizon, planners must look beyond inventory, cost-optimization and profit-prioritization models. Plans should factor in the resilience of the supply chain, flagging up areas where more resilience is needed and encouraging the use of certain tools and solutions that can be used to mitigate risk. Perhaps the zenith for any supply chain solution of the future will be purely cognitive and automatic, a subset feature of what we call a “live enterprise”. Here, the enterprise senses and responds to market conditions through the creation of a digital brain fueled by business data.2 Using artificial intelligence to predict, plan, control and collaborate with supply chain partners and customers, this organization responds resiliently to demand and supply shocks in real-time, cutting costs and shoring up customer sentiment.

The supply chain of the future will be purely cognitive and automatic – a “live enterprise”

Just like engineering and testing the vaccine that will in time destroy the plague, it will take time for software development to catch up with present-day pain points. Until that occurs, with a bit of tweaking around the edges, advanced supply planning solutions offer a way for firms to shore up customer sentiment and win big in the long run.

References

- Impact of industry 4.0 on supply chains – all you need to know, March 8, 2019, GEP

- Four steps to build a cognitive supply chain, Samad Masood, Arnab Banerjee & Vishwas Anand, 2019, Infosys Knowledge Institute