Ping An: China’s insurance innovator

Ping An is the largest insurance company in China, with 184 million retail customers and 538 million registered internet users as of the end of 2018. Although it ranks seventh in the Forbes Global 2000, when it comes to innovation, it acts more like a startup than a traditional financial services firm.

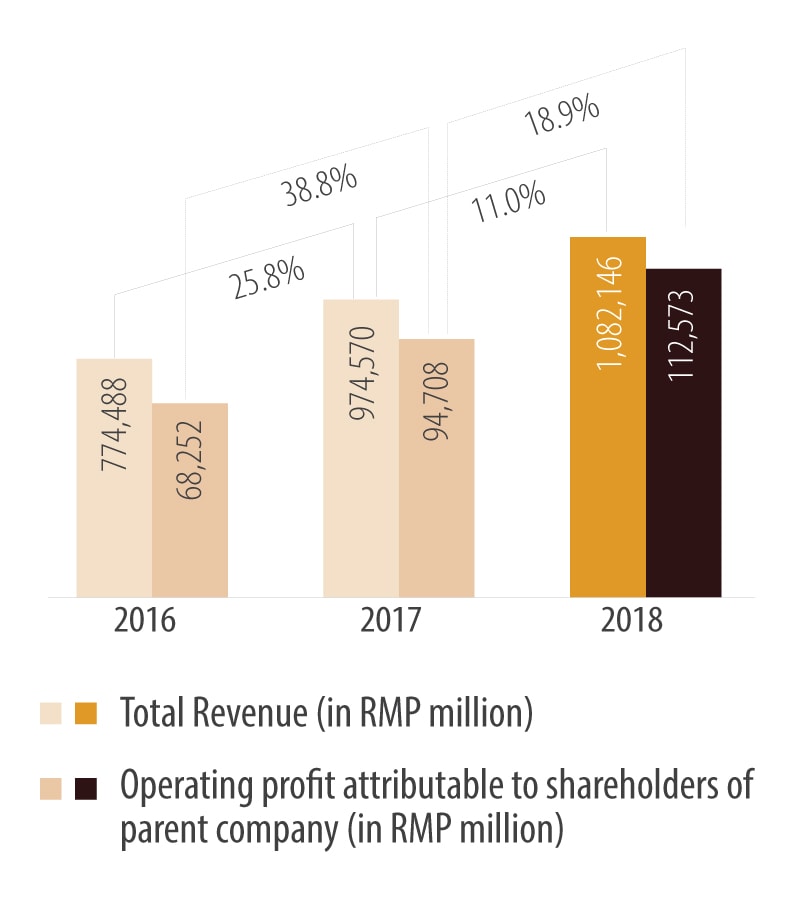

Rather than waiting for competitors to get between it and its customers, Ping An uses its deep pockets and intimate understanding of customer needs to provide them with more and better services and capture a greater share of their wallets. In 2018, its operating profit grew almost 19%, and more than 63 million of its retail customers bought services from more than one subsidiary, a 35% increase over the prior year.1

Founded in 1989 as a marine insurer in Shenzhen, Ping An has the largest market capitalization of any insurer in the world, with 1.8 million employees and agents.

But it gives equal prominence to the words “finance” and “technology” on its logo, drawing on its patents in artificial intelligence, blockchain and cloud computing to offer everything from disease screening to medical portals. Of the approximately 128,000 employees in the parent company, about 29,000 are in research and development, refining everything from facial and micro-expression recognition to voiceprint and speech recognition and speech synthesis.

Figure 1. Ping An’s revenue and operating profit* (in RMB Million)

Source: Ping An Annual Report 2018

Technology brings both operational and competitive edges

Ping An uses some of these technologies to improve its own core business. For example, it used an AI- based model to screen more than 11 million potential agents, predicting with greater than 95% accuracy which ones would remain with the company for more than a year. This reduced turnover, and cut recruitment and training costs.

Of the nearly 40 million online life insurance policy administration cases handled via Ping An, 90% were automatically processed using AI, achieving turnaround times as short as three minutes.

The insurer also uses its deep pool of technology to incubate new businesses that form ecosystems of data, services and customers in health care, automotive services, real estate services, and smart-city services. These businesses include Lufax, which Ping An calls the world’s largest online- only wealth management platform; Ping An Good Doctor, which it claims is the world’s largest telemedicine platform, with more than 250 million registered users; and Autohome, an online portal for car sales that has captured about 40% of the Chinese market. Among other health care services, Ping An has developed more than 40 disease models, 20 of which have been deployed at 200 hospitals to read over 15 million images with an accuracy rate above 90%.

Other services range from data analytics to smart-city initiatives that help more than 100 Chinese cities improve everything from education to transportation and fiscal management.

Innovating beyond the core business

Why go to such lengths to move so far beyond its core business? “If we just stayed a traditional financial services company, we would have only a limited number of touchpoints with our customers,” says Donald Lacey, chief operating officer and managing director at Ping An Global Voyager, a venture fund focused on fintech and healthtech formed by Ping An in 2017.

That would leave the company vulnerable, he says, because “whoever is closest to the customer in a retail financial services transaction extracts the bulk of the profit from that transaction. What happens when Amazon knows way more about your prospective life insurance customer than your agent does? What happens when Alibaba knows way more about your customer who might be a health insurance customer or banking customer than you do?”

Ping An’s answer is the creation of digital ecosystems in various industries, where each company can tap and share detailed data about individual customers to tailor new, lower-cost and higher-quality products and services for them.

An insurer that does not control such an ecosystem is “probably looking at a future of declining premiums,” Lacey says.

While some observers think established financial services players are vulnerable to smaller, supposedly more nimble startups, Lacey says Ping An has two key advantages. The first is its sizable core of researchers and the 1% of revenue it devotes to research. In 2018, it applied for more than 12,000 patents and won international technology awards in fields including fintech, medical imaging and smart-city services. The second is that, as a financial services player, “we have built in use cases,” Lacey says. “Things occur to us that might not naturally occur to say, Microsoft.”

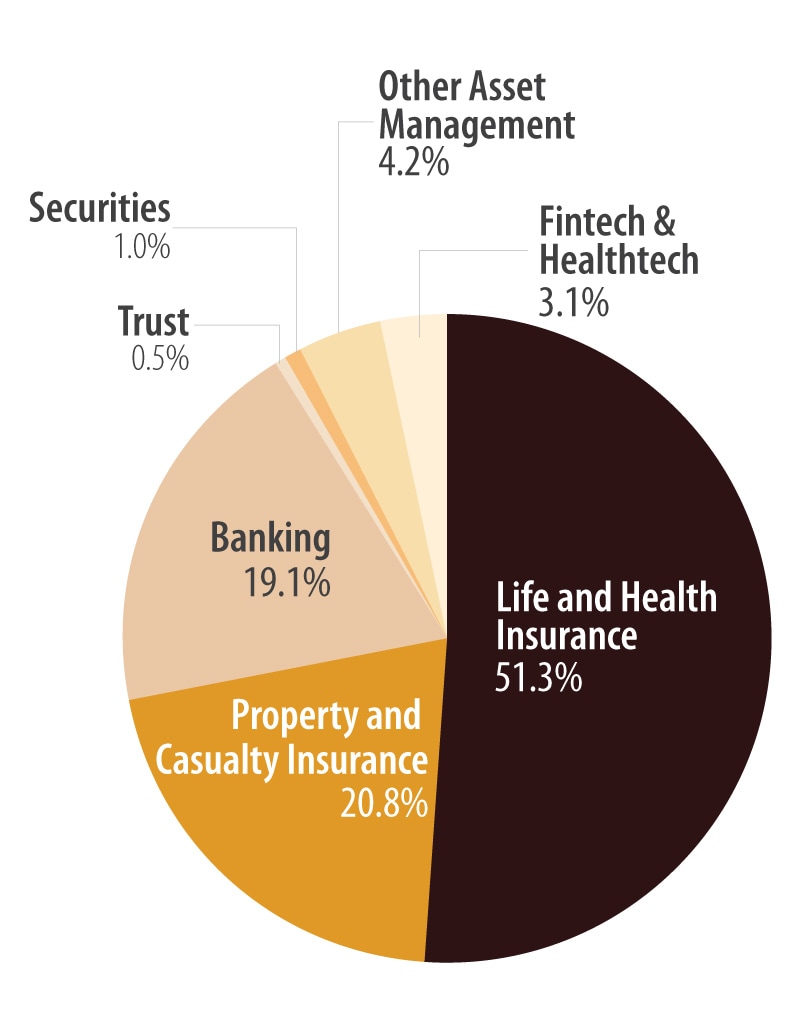

Figure 2. Ping An’s business mix

Note: Percentages have been calculated based on total revenues, excluding “Other business and eliminations” Source: Ping An Annual Report 2018

Bovine face recognition

One example is the business of insuring cows, an important asset for many rural Chinese. Sending an adjuster to the farm to verify that a cow that died was covered by insurance can be a time-consuming and costly process. The answer: Ping An built the world’s leading bovine facial recognition capability. Using a smartphone, the farmer can verify the identity of the cow and submit a claim remotely. Ping An saves on claims processing, and the farmer receives his or her payment sooner. “That sort of thing is a good example of a use case that you wouldn’t necessarily think of unless you had a big financial services business to begin with and were aware of the pain points of your customers,” Lacey says.

Even if smaller competitors don’t disrupt a business, new technology might. One example Lacey cites is the use of high bandwidth 5G networks collecting data from the internet of things that can be used to predict and prevent equipment failures. “You’re going to know that machine 35 in your factory is about to explode, and you need to take it off-line,” he says. “As a result, the machine will not explode and the factory will not burn down. That’s good for the factory owner and for society, but not for the factory’s insurer, because a lower risk of loss means lower premiums.

“If you just stay stuck in the old way of thinking about insurance, then you probably are not looking at a great future,” Lacey says. “You must reimagine the relationship with your insured, and that is what Ping An spends a lot of time doing. That might mean charging policyholders for detailed advice to prevent failures based on AI applications analyzing data Ping An has generated about the factory’s operation.”

Reinventing the customer proposition

The same thinking applies to its telemedicine portal, which can reduce insurance payouts by keeping customers healthier. Even more importantly, Ping An wants to become more useful to customers so it doesn’t get stuck in the position of just selling insurance to a lead provided by another company and “watching that ‘someone else’ take a lot of the profit of that introduction away from us, and then not add much to the life of that customer beyond paying a claim for a catastrophic event,” Lacey says. “We want a more holistic relationship with our customers, and technology gives us the means to do that.”

Financial institutions face a dual challenge. The first is transforming their existing technology stack to make it more efficient, reliable and secure. The second is to “embrace radically different business models as part of your core ethos,” Lacey says. “If you insist on just conducting your insurance business and banking business like you did in the 1980s, only faster, you’re probably going to miss the boat.”

This article is based on a series of ‘In Conversation’ discussions between Mohit Joshi, president of Infosys Limited, and Donald Lacey, managing director and chief operating officer at Ping An Voyager Fund, in May 2019.2

References

- Ping An 2018 annual report

- Mohit Joshi and Donald Lacey, ’In Conversation’