Customer experience in the mortgage market is not as good as it could be — and banks are the worst performers. According to McKinsey & Co., only 42% of U.S. bank mortgage customers said they were extremely satisfied with the mortgage process, compared with 52% for non-depositary originators.1

This has a direct impact on a bank’s growth in a challenging market. U.S. residential mortgages outstandings have declined by 17% in real terms in the 10 years prior to 2018.2 But nonbank providers that have strong customer experience scores have bucked the trend.

For instance, the mortgage company Quicken Loans has had the highest satisfaction rating in the market for 10 years running and has grown its origination volume to $83 billion in 2018 from $29 billion in 2010.3 Examples like this are helping drive private investment in digital-first mortgage providers. Venture capitalists invested more than $6 billion in mortgages tech startups in 2017 and by October 2018 they had already invested $4 billion according to PitchBook.4 If we look beyond mortgages, the interest is even higher, with $16 billion of investments flowing into real estate related startups in 2019 alone.5 One of these investments was in Better Mortgage, which raised $160 million in 2019. Two of Better Mortgage’s differentiators are improved customer experience and transaction speed. Its loan processing times were 13 days faster than the industry average in 2019.6

This is where digital-first lenders can really threaten established banks. Obtaining a mortgage is not appealing for most consumers. An astonishing 97% of consumers state they are frustrated with the process of getting a mortgage,7 and 62% claim they suffer from mortgage-related stress.8 But mortgage fintechs average 20 days to close a mortgage versus 44 days for traditional mortgage providers. It’s not surprising, then, that venture capital money is backing the digital mortgage providers.

Customer complacency?

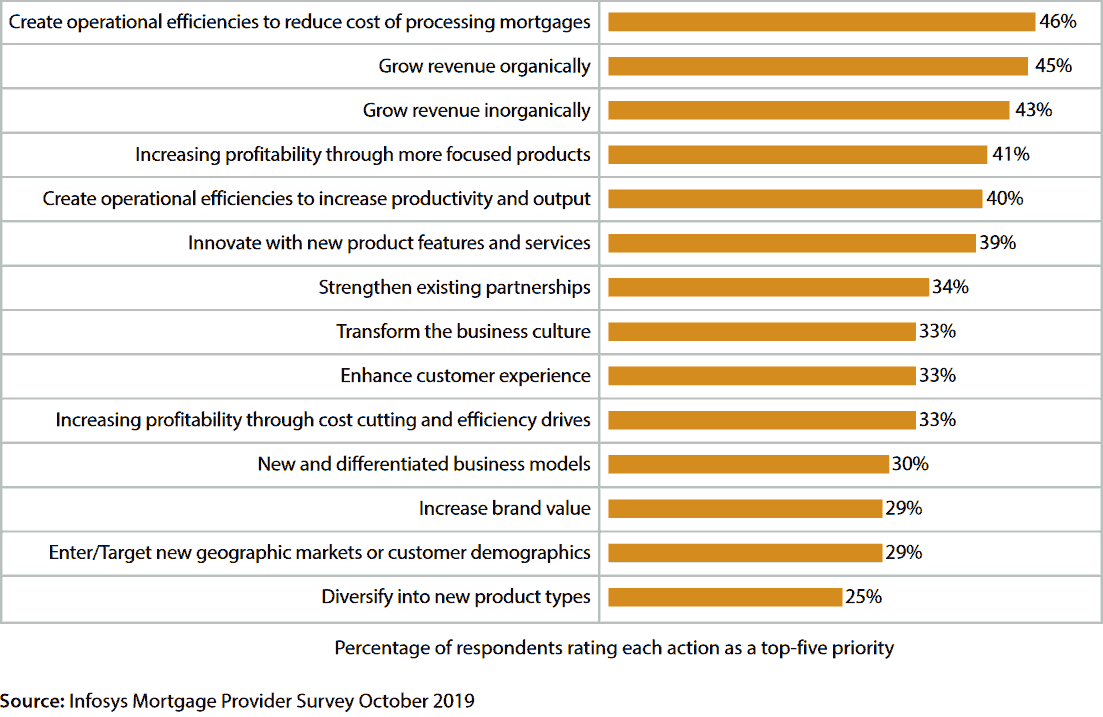

Yet traditional bank mortgage lenders are struggling to catch on to this new imperative, despite the clear evidence that customer experience has become the new battleground for mortgage market share. While some are innovating and investing, in our own recent survey of mortgage providers, the No. 1 priority was operational efficiency rather than customer experience.

In fact, customer experience was a top-five priority for only 33% of respondents (see Figure 1). This puts it in ninth place after other priorities to reduce costs/increase profits, increase productivity and innovation, and grow revenue.

The obvious irony is that in order to grow revenue, these players need to prioritize customer experience over everything else — or at least ensure that their other priorities are focused on delivering best-in-class customer experience. This is the lesson that should be learned from the performance of businesses such as Quicken Loans and the slew of fintech competitors rapidly growing their share of the mortgage market.

Figure 1. Only a third of mortgage providers think enhancing customer experience is a top-five priority

Delusions of digital grandeur

Another concern is that most mortgage executives think they are doing well on digital, and more generally. Respondents to our survey generally believed themselves to be ahead of the curve when it came to their performance versus their peers’ performance. A majority also considered themselves to be “mostly” or “completely” mature in the fundamentals of digital business.

Sixty-six percent of all mortgage executive respondents believed their performance to be “High” or “Very High” when compared with industry benchmarks. The sentiment was even stronger among senior executives and among the larger providers. When asked, 76% of C-suite mortgage executives believed their performance to be “High” or above.

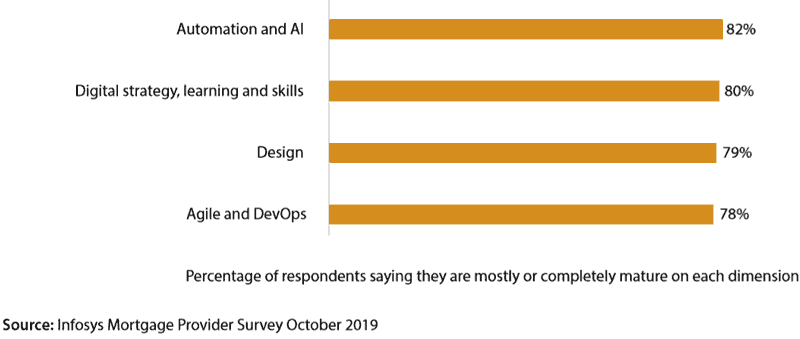

When asked about their abilities in specific aspects of digital development, there was a resoundingly positive outlook. On average, 80% of respondents believed their mortgage business to be “mostly” or “completely” mature in the following areas: Automation and Artificial Intelligence; Digital Strategy, Learning and Skills; Design; and Agile and DevOps (see Figure 2).

These strongly positive views may well be justified. After all, banks have spent much of the past decade increasing their investment in and focus on their digital capabilities. Yet there is an incongruity between this strength of capability and a lack of strategic focus on customer experience — not least because strong customer experience is a fundamental principle of Silicon Valley startups, whether in mortgages or elsewhere. The risk is that many mortgage providers have invested in digital processes but are forgetting to put the customer at the forefront of their operational and product design decisions.

Figure 2. Mortgage providers consider themselves mature in the fundamentals of digital development

Picking a priority

The truth is likely more complicated, however. Most large traditional mortgage companies are dealing with a significant legacy of loans and systems that they must manage in order to transition to digital. They do not have the luxury of starting from a clean slate, unlike most of their younger fintech competitors. The fact that customer experience is ranked so low as a priority is also a reflection of the many other middle- and back-office elements that most traditional lenders are still trying to modernize.

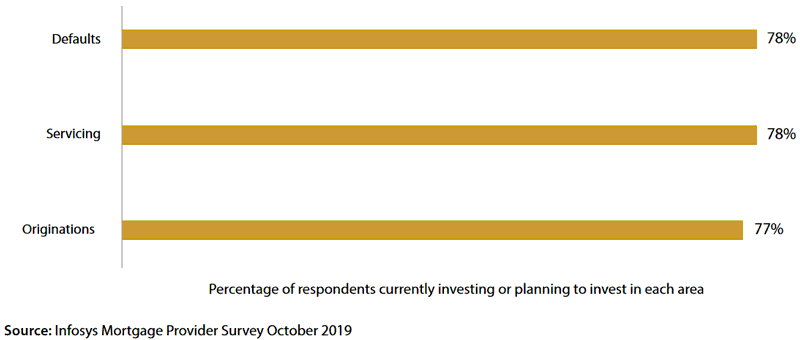

Indeed, our survey also looked at where providers are currently investing or planning to invest, and this revealed the dilemma that many in the industry face. We found that, on average, 77% were investing in originations processes (e.g., fulfillment), 78% were investing in servicing processes (e.g., payments) and 78% were investing in default processes (e.g., collections). This clearly highlights the three simultaneous demands on a traditional, established mortgage provider. These demands require the lender to invest across the whole value chain in order to keep its business balanced.

However, new technologies and business models may offer a solution to this challenge of how to prioritize investment. In particular, the use of open APIs make it more practical to disaggregate the value chain in mortgages and also connect to a range of related services. This will mean that providers can, in the future, focus their investments and resources on very specific areas where they feel they can create a competitive advantage, relying more on partners to provide noncore services.

This is not an entirely new idea. Discussions and debates about the disaggregation of the value chain have been floating around financial services for over 30 years. For example, specialist companies emerged for credit card processing and for mortgage processing in the 1980s and 1990s. There has already been disaggregation of the value chain in mortgages to a certain extent (particularly in the U.S.), with some mortgage originators passing on their loans to mortgage servicers.

Figure 3. Areas of current or planned investment

Now we are seeing the emergence of companies such as Blend, founded in 2012, which is providing front-end digital services to more than 150 lenders and processed $234 billion worth of mortgages in 2018.9 Blend merges data from trusted sources to streamline preapproval, reduce the need to scan paper documents, and simplify the home lending process.

Similarly, in Europe, ABN AMRO created a strategic partnership with Infosys in March 2019 around its Stater mortgages platform. Stater provides a digital origination, servicing and collection system that is already used by a significant portion of the Dutch mortgage industry as a processing platform. Together, the partners are boosting this platform and will explore opportunities to expand the service across Europe.

The reality is that the mortgage process is particularly complex compared with many other financial services and involves accessing data and documents from a variety of different sources, including account balances, employment information, credit scores, real estate appraisals and location information. The development of open APIs has provided the ability to access data from multiple parties to speed up the application and closing process. Open APIs also enable the creation of an ecosystem of services, such as real estate services and home insurance services, which ultimately should enhance the profitability of the core mortgage product.

Therefore, we can now see a future where the mortgage originator owns the customer relationship and focuses its resources on developing attractive products and services offered through a digital platform that seamlessly integrates all the other services needed to originate, close and service the mortgages and deal with defaults. The new digital capabilities enabled by open APIs and other technologies, such as artificial intelligence, will enhance the customer experience — faster processing of applications, greater transparency in the process and the addition of relevant services.

Mortgage providers should therefore use this opportunity to review their business models and consider radical alternatives. They must decide which parts of the value chain they want to focus on and then invest or pursue partnerships accordingly. Is it the front end and customer experience, or is it the processing activities? Investing across the whole value chain is no longer a viable approach.

Note on the Infosys Survey of Mortgage Providers

In October 2019, Infosys surveyed 251 senior executives from financial institutions across the U.S., the U.K., Germany, France and Australia. The survey attempted to capture the responses from large financial institutions with over $500 million in annual revenue. Respondents were executives that lead or were involved in any part of the mortgage function. The targeted institutions excluded digital natives.

References

- Competing on customer experience in US mortgage, Ayush Madan, Akshay Kapoor, Rohit Singh, December 10, 2019, McKinsey & Company.

- Mortgage Debt Outstanding, December 2019, Board of Governors of the Federal Reserve System.

- Mortgage Customer Satisfaction Improves but Loan Boom Reveals Foundation Cracks, November 14, 2019, J.D. Power.

- VC funding for mortgage tech stays strong after billion-dollar bump, Dana Olsen, October 25, 2018, Pitchbook.

- Where top VCs are investing in real estate and proptech, Arman Tabatabai, November 14, 2019, TechCrunch

- Bringing it home: 2019 in review, January 2020, Better Mortgage Corporation.

- The Future Is Digital Mortgages, October 12, 2018, Veri-Tax.

- Daniel Hegarty - Habito: How tech is taking the misery out of mortgages, Geoff Whitehouse, May 30, 2019, 11:FS.

- Blend Factsheet, January 2020, Blend.