Physical retail stores are under strain. A quarter of U.S. malls are expected to close in the next five years,1 while in the U.K., store openings plummeted in 2018, meaning a net 1,123 stores disappeared from the top 500 High Streets in the nation. This reflects the findings of our own survey of 5,000 shoppers,2 which found that 31% of shoppers went to a store less than they did five years ago. To turn this around, retailers can take three important steps: better integrate with digital channels, change returns into an opportunity, and introduce service and technology innovations.

The $4 trillion-plus opportunity for physical retail

The rise of online retail is largely to blame for physical stores’ woes. But digital shopping is by no means perfect. On the one hand, cart abandonments impact sales significantly and provide proof that customer opportunities are being lost. According to data tracking from Domo, a cloud tech company, $7.6 million is abandoned in online carts every minute.

Extrapolated over a whole year, this represents $4 trillion of money left on the table in 2018 alone.3

On the other hand, digital retailers are also struggling with returns hitting their bottom lines — especially in the fast-fashion space.4

Research also says that 81% of online stores are very concerned about the rising impact of customer returns,5 totaling $600 billion per year across all retail.6 About 30% of online orders are returned, triple the rate of items bought in store.

Recently, online fashion giant ASOS toughened its returns policy and deactivated several accounts of serial returners. A number of retailers have also taken a tougher stance with returns in the past year. Even Amazon banned customers from its site for returning too many items.

What’s the total worth of the top and bottom lines being hit by online retail? The cumulative value of cart abandonments and returns stands north of $4 trillion. To put it in perspective, this is comparable to the $4.4 trillion of revenue generated by the world’s top 250 retailers in 2016.7

Harmonizing physical and digital retail

Of course, the $4 trillion is just illustrative. It is not possible to realize this entire figure into revenue. There will always be returns in some form, and many abandoned carts were never going to be true sales opportunities in the first place. But it’s worth understanding why shoppers are leaving so much money on the table so often. We believe that it is something that could be solved or improved by better integration and support from a physical store.

This stronger link between physical and digital retail is something that we call harmonization. It’s a key tenet of our belief that the future of retail has to incorporate both physical and digital properties, which are designed to fit the customer’s life and his or her needs and preferences. Steve Dennis, Forbes columnist and a top five global retail influencer, agrees.

“It turns out that when retailers see their stores as assets to be leveraged, rather than liabilities to be optimized — and -recognize that the customer is the channel — the combination of strong digital capabilities and reimagined brick and mortar is often pretty powerful,” Dennis told us in a recent conversation on the subject. “More and more it will seem like all the store’s a stage as brands create highly immersive and memorable experiences that can only be found in their brick-and-mortar locations.”

Physical retailers — especially traditional brick-and-mortar stores — that aren’t optimizing their websites will fail to capture shopper data and insights from online retail. To compete with pure-play online retailers such as Amazon, Etsy and Alibaba, physical retailers must look at their stores as assets to organize, keeping customers central to their reinvention.

Pragmatically speaking, though, where should a retailer start its journey toward harmonization? A good starting point is to target two areas where online retail is struggling: cart abandonment and product returns.

Where digital retail falls short

Online retail may be the biggest threat to struggling physical stores, but there are chinks in the armor that can be exploited. The global average online cart abandonment rate is 69.2%.8

When cart abandonment is high, it’s a clear indicator that there are unexploited sales to be targeted. It’s the textbook definition of money being left on the table and represents an enormous opportunity for physical retailers if they can design their propositions around solving the frustrations that lead to abandoned carts.

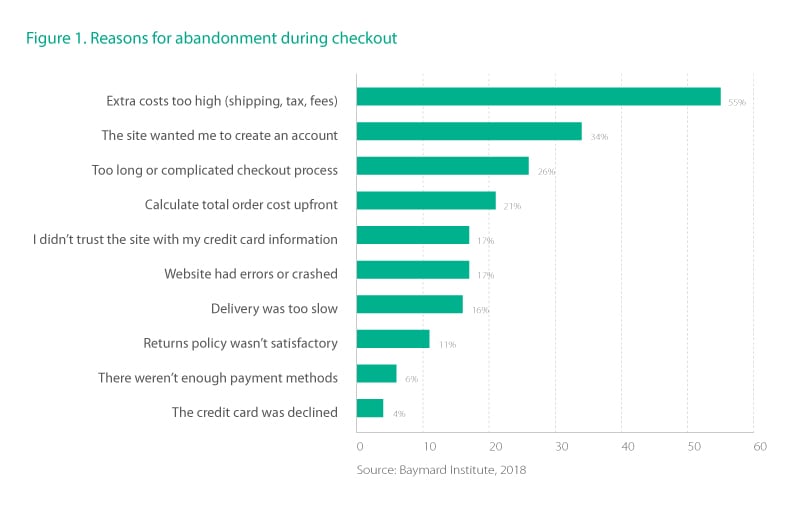

So why do people abandon carts at such a high rate? Research from the Baymard Institute (Figure 1) shows that the top seven reasons are almost exclusively related to the online experience and can be solved by better integration with physical stores.

Shipping costs seem to be the biggest barrier to online purchases. This is an easy win for physical stores to gain, given their closer locations to customers. The key is to connect the buying process online with a customer’s and store’s actual location.

Account creation is another area where online is failing. Many people find it frustrating and sometimes a privacy concern. Physical stores offer the benefit of not having to do this — however, the retailer loses the ability to track customers. Some stores are experimenting with new technologies and processes to get around this, however. We describe several of these below.

Time taken for online checkouts is also a reason for more than a quarter of cart abandonments. The convenience of physical retail is attractive to a lot of people — as long as the experience is connected to the online purchase journey.

Three steps to harmonize the friction points

1. Activate offers across channels

Physical retail must optimize its logistical network of stores either to improve the delivery experience or help customers pick up merchandise from neighborhood stores and avoid charging shipping fees. Traditional physical retailers like Target and Walmart are competing with Amazon through same-day deliveries.

Target offers certain customers a store discount, specifically targeting the ones who ditched online shopping carts. When customers receive personalized messages on low prices that are tied to their shopping history, it provides opportunities for new sales. It’s interesting to see how this drives harmonized retail.

Harmonization activates the retail ecosystem to tap new opportunities so that physical feeds digital and digital feeds physical.

In Target’s case, it serves as a gateway for pre-shopping online customer data analysis. Target understood cart abandonment as an opportunity to draw customers into the store at a time when research explains a host of factors for cart abandonment.

Buy online, pickup in store execution is central to maintaining a deeper customer connect, but retailers have struggled with this option due to operational logistics and employee training. On-site promotions must be available to bring customers to a stage of awareness when they know through their early browsing experience that this option is available to them. Best Buy is a classic example: The company doesn’t keep customers hanging until the point of purchase consideration and ensures it promotes BOPIS early in a customer’s site navigation.

2. Partner with pure-play online retailers for returns

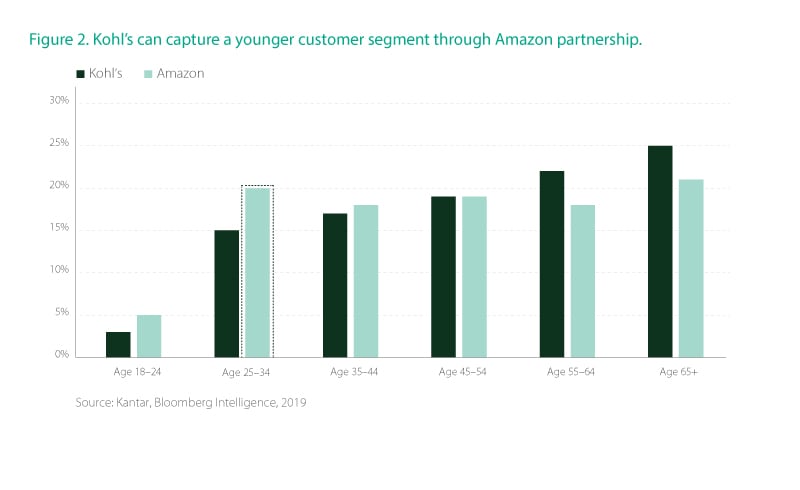

Returns are also eating into retailer profit margins and losses are amplified due to mass return scenarios. Even as retailers — more than three-fifths of U.S. retailers and 45% of U.K. retailers9 — said they are banning serial return customers, all that a majority of shoppers (around 60%) want, according to our research, are grab-and-go stores (like Amazon Go) with self-checkout on their own smartphones. Amazon launched a number of experiments in the brick-and-mortar space with kiosks, convenience stores and bookstores that didn’t hold much promise. But an unlikely partnership with Kohl’s allowed Amazon customers to return packages to stores in Chicago and Los Angeles, which is expected to touch 1,150 stores.

Online returns are one of the toughest challenges for e-commerce, as more than 30% of all online orders are returned.10 Kohl’s has made it convenient for Amazon customers to return a purchase through detached stores that are easily accessible, unlike bigger retailers such as Macy’s and J.C. Penny placed at huge shopping malls. Kohl’s actively incentivizes this by handing out 25% discount coupons to some customers, helping drive up to 1,000 returns a day at one of its stores in Chicago. A Chicago employee says one Kohl’s store accepts more than 1,000 Amazon returns a day. Kohl’s stores that accepted Amazon returns witnessed a 9% increase in new customers against a paltry 1% in other locations.11 Other traditional retailers must look at partnerships with online pure-play retailers as a strategic move to bring in new customers.

3. Establish innovative service hubs

The second most important reason for cart abandonment is identification, cited by 34% of shoppers (Figure 1). Identification efforts are lagging even on the physical front, with retailers identifying only 13% of customers who enter the store and another 10% before checkout.12 Physical retailers can differentiate on the services they offer at the store with innovative retail service hubs. Such service hubs will have facial recognition systems, augmented reality/virtual reality, free Wi-Fi and so forth with trained store associates for a deeper connect with shoppers.

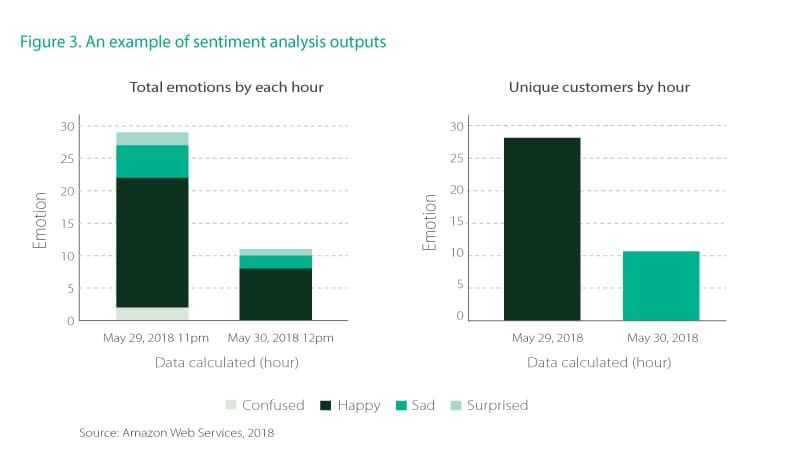

More important, this is a blended experience that tracks customer sentiment, which an online, virtual retailer on its own cannot provide. Unlike in online retail, where sentiment analysis is captured through reviews, at the store, advanced facial recognition can help map the total customer emotions per hour along with unique customers per hour (Figure 3). Analyzing how this can translate into augmented customer interactions and mapping them to customer lifetime value is what physical retailers need to think about.

Walmart is patenting facial recognition systems to capture shopper sentiment in store checkout lines so that dissatisfied customers are identified. Apart from identifying customers and tailoring offers, it would also help reduce fraud. Target has used facial recognition software to help prevent fraud and theft.

There are several privacy concerns about technology, such as facial recognition. However, retailers that experiment with the technology, are transparent with customers about its usage and can show customers value from it will be better placed to implement it successfully.

Service hubs can be great for personal services that have the potential to make physical retail a preferred channel of choice. Nordstrom experimented with Nordstrom Local as a “service-focused concept store.” If an order is given before 2 p.m. on Nordstrom.com, customers can pick up their purchases the same day. In addition, personal stylists can guide customers on merchandise and fashion. If a customer is satisfied with a given garment after a try-on but alterations are required, in-house tailors can take it up and then delivery is made to the customer’s home.

What next?

We’ve seen how the connection between digital and physical retail is failing and why harmonized retail has a big role to play in physical retail’s transformation. Over the next two companion papers in the series, we will look at what the building blocks are to solving this issue and how technology and store design can come together to reinvent the physical store.

References

- “‘THIS IS A DEATH SPIRAL’: The tsunami of store closures is doubling in size,” Business Insider, June 2017

- “Data Never Sleeps 6.0,” Domo, June 2018

- “Online returns to reach 5.6 billion pounds by 2023, fashion hit hardest,” Dec. 17, 2018

- “Retailers Reach the Point of No Returns,” ParcelHero, 2018

- “The High Cost of Retail Returns,” Retail Small Business, March 10, 2019

- “Global Powers of Retailing 2018,” Deloitte

- “Checkout UX,” Baymard Institute

- “Banned? A Returning Problem,” Brightpearl

- “The Plague of Ecommerce Return Rates and How to Maintain Profitability,” Shopify, Feb. 27, 2019,

- “Amazon Bets on Kohl’s As Its Own Brick-and-Mortar Efforts Falter,” Bloomberg, May 20, 2019

- “2018 Customer Experience/Unified Commerce Survey,” Boston Retail Partners, 2018