In October 2018, Verizon, an American telecommunications company, declared that the world’s first commercial 5G service had arrived, delivering gigabit service to residential customers. In March 2019, China conducted its first remote robotic surgery with the support of a 5G network deployed by telecoms operator China Mobile and supplied by Huawei Technologies, a silicon chip manufacturer1. But despite the fact that telcos are making such solid moves in the 5G market, is it possible that most of them will become just dumb pipe companies that pass along bits of data for others to take advantage of?

Why is 5G important?

5G will pump $12 trillion into the global economy by 2035, and will add 22 million jobs in the United States alone2.

5G is very fast — fifth-generation networks are as much as 100 times faster than today’s current wireless networks.

The real sell of 5G, however, is its ability to address a wide range of mission-critical use cases where the delay — or latency — between instructing a computer to perform a command and its execution has to be minimal.

5G will have more than 10 times lower latency than 4G3. Because of this unnerving response time, 5G won’t just be about instant gratification to Netflix and Hulu aficionados. From flying a fleet of army drones to enabling firefighters to talk to each other in real time over video chat (with feeds augmented by artificial intelligence), the low-latency, high-reliability networks that 5G provides will make meaningful services work in real time, ultimately saving lives. Remote robotic surgery could also become routine, and autonomous cars will respond at lightning speed to perilous obstacles, paving the way for increased road safety.

Because everything will be connected in real time using sensors, the amount of analysis that can be done on this data will give rise to further use cases, a flywheel effect that will massively optimize services. Today, Facebook uses existing 4G networks to provide viewpoint content, video, text and voice communications. Tomorrow, along with Google and Twitter, it will use sensors to target advertising toward specific users, making sure what users see is exactly what they want to see at that place and time. Facebook also bought Oculus Rift for $2 billion with a view to monetize 5G; with 5G’s endless bandwidth and low latency, virtual meetings and even virtual parties will become a reality. And to take advantage of this heightened data stream, Amazon, Google, Apple and China’s Xiaomi have ratcheted up their efforts to churn out more smart devices, including speakers, rice cookers and vacuum cleaners, remotely controlled via smartphone apps or voice assistants. Ultimately, this waterfall of new use cases will put internet giants on a pedestal from which to dictate the future of the economy itself.

What does this mean for telcos?

There is a chance that 5G will be too expensive for them, and that the data will be too sophisticated for them to utilize effectively. Also, chip manufacturers further down the value chain might find opportunity to cut out the middleman and simply talk to the tech firms that are providing these over-the-top use cases.

What exactly is 5G, and why might it be too expensive for telcos?

5G uses a range of the electromagnetic spectrum where the bands are big and wide, allowing data to flood through them. These 5G frequencies have high capacity — meaning that they can deal with many high-demand applications at once.

In the past, these high-frequency millimeter waves were not available for internet transmission, and were incredibly temperamental. They could travel only short distances — about a thousand feet — and were impeded by everything from walls to human bodies and even rain.

To overcome the limitations of these millimeter waves, recent advances in 5G cellular relays have resulted in antennas that can be installed inside buildings and on every city block to ensure that transmission of 5G is seamless.

That’s where the costs rise. In the U.S., to enable 5G for just half of the population (125 million people), these cellular relays will be mounted on more than 13 million utility poles, costing just under half a trillion dollars. It will also cost a lot to connect each cell site to the fiber optic network, along with significant costs of buying large swathes of the high-frequency spectrum (24-300 GHz range).

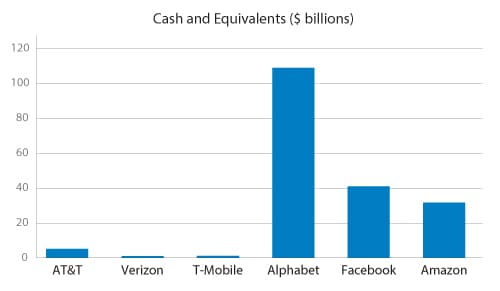

AT&T, the largest telecom business in the U.S., has $5.2 billion of cash 4, while Verizon, following closely behind, reported cash available at $1 billion in 20185. That’s quite a lot, but it’s small compared with Alphabet, Google’s parent company, which reported available cash of $109 billion6, and Facebook, which reported $41 billion7. Digital leaders are in a much stronger financial position to lay out the millions of high-density nodes and subsequent connections that will make up the 5G network. They also have made significant inroads into machine learning, artificial intelligence, virtual reality, augmented reality, robotics and other technologies that will piggyback on this network. This ultimately means that they sidestep the costs that telcos will incur as they service customers higher up the user experience stack.

Figure 1. Cash position of telcos dwarfed by that of digital leaders

What are some use cases for 5G?

If you believe the hype, 5G will lead to a whole new “internet of things” (IoT). Toasters and dialysis pumps will be connected to the network. Workers will be more easily able to work remotely, operate machinery from afar, and be more present through capabilities such as augmented reality, virtual reality and holographic calls (a very exciting thought). Remote monitoring of patients at home or work will be part of a new and seamless way of delivering cost-effective, direct-to-consumer health care. Emergency responders will be able to share a live video of a disaster site among team members, as well as receive video from drones, surveillance cameras, planes and satellites in real time. And taking advantage of ultra-low latency, autonomous vehicles will be able to dodge traffic at the speed of data, ensuring that collisions with pedestrians and other cars become a thing of the past.

5G’s low latency and high capacity will also enable the handling of advanced processing remotely rather than locally on mobile devices and headsets.

It’s all about the data…

Google’s self-driving car currently generates 3.6 TB of data per hour8. That’s more data than 300 people generate in an average day. 5G will collect this data so that it can provide superior customer experiences to passengers.

5G data will be accumulated on anything and everything, enabling those companies that have advanced analytics and machine learning solutions to reap the full benefits. This data will lead to an entire tech ecosystem that integrates a host of services, solutions and products seamlessly, so they work together in concert (think a smart home or smart farm) using semiconductor chips in smart “things.” This smart data will also lead to superior interactive experiences, based on what a person likes, what product they are using and where they are in the world. And as for the mission-critical use cases mentioned before, companies that already understand their users’ preferences and dislikes will be far more innovative in creating products and services that businesses and customers actually want to use.

Put simply, the laurels will go to those companies that can quickly accumulate specific data sets from 5G and use them intelligently to evolve their products and services, taking advantage of the low latency, speed and capacity that 5G provides in a winner-takes-all scenario.

Why not telcos?

Telcos might be banking on the coming rollout of 5G, but most won’t be able to afford it. And even if they can, their experience is in simply shunting bits across a long pipe, with little insight into the user experience of products, services and applications. Getting the advanced machine learning and analytics that are necessary to properly understand the data coming through the pipe is difficult — otherwise, everyone would be doing it. Also, the low-powered sensors that will make objects and services interconnected in the IoT are not going to need much value-add from a telco — just a good signal and some software networking higher up the stack.

Because 5G and complementary technologies will change the DNA of the user experience, internet giants are best positioned to win the race to users’ hearts.

To fight against this, telcos could partner with others such as Facebook, Google and Amazon — but this begs the question: Why would these global behemoths, who already have streams of data about their customers, want to partner with a telco that doesn’t add insight into any of their services?

And the threat isn’t just coming from Google, Apple, Facebook and Amazon (GAFA). There are also inroads being made by the semiconductor firms that ply smart devices with the intelligence they need in order to make 5G profitable. Firms such as Qualcomm and Intel in the U.S. have made significant advancements in software services. These services take such companies further up the value chain, cutting out the need for the middleman and working directly with the services that run on top. Not only that, but they are copying internet firms in their assault on data processing and analysis — Qualcomm, for instance, has created Qualcomm Wireless Edge Services for just this purpose.

What can telcos do about this?

Unless telcos reinvent themselves beyond their traditional roots as telecommunications carriers, they may not survive the onslaught as 5G is rolled out. As Australian Telstra’s CMO, Joe Pollard, said in 2016, “We need to evolve from a telco to a techo — we need to be a world-class technology company empowering people to connect.”

Many telcos are seeing the light in this vision. But surviving the tech onslaught is fraught with challenges. In the U.S., Verizon’s strategy to become a big player led to the acquisitions of AOL and Yahoo for $9 billion9 — creating the fledgling Oath franchise that hasn’t done much to diversify the revenue stream. True, these companies weren’t exactly thriving when Verizon bought them in 2015, but with prices of $30 a month for dial-up internet, and content on Yahoo that was mediocre at best, customers went elsewhere. Instead, Facebook and Google vacuumed up 90% of growth in the digital advertising market that Oath was looking to disrupt.

Perhaps a telco can make headway as a telco entertainment corporation. Sprint, a telco based in Kansas, announced in 2019 a partnership with cloud gaming service provider Hatch, with promises to bring more than 100 premium games and cloud streaming of live games and tournaments.

Another alternative left for telcos is to build an everything-as-a-service arm by partnering with tech giants and smaller semiconductor businesses. This new business model will allow the telco operator to generate revenue from 5G without requiring a large upfront capital investment.

AT&T, the U.S. telecommunications company, is playing some great cards on its journey to tech diversification. It has invested heavily to deliver the seamless integration of wired and wireless, has an ecosystem of world-class technology and content partners (it bought Time Warner this year for $85 billion), and is constantly investing in business use cases. To take software-defined tech into wireless, it will virtualize 75% of its network by 202010. Additionally, it created ONAP, a network automation platform for which it wrote most of the code, that has members which represent nearly 70% of the world’s mobile subscribers. Together with GridRaster, it has invested in a software platform for enhanced augmented reality and virtual reality experiences on mobile devices. And most important, it has expanded the development of next-generation zero-touch edge cloud infrastructure for carrier and enterprise networks, which will accelerate the growth and expansion of 5G and IoT applications.

But, though not as big as Facebook or Google, AT&T still has a lot of money. Most telcos in the U.S. and abroad are not so fortunate.

In the short term, if 5G is all it’s cracked up to be, most telco businesses will survive 5G by radically changing their business models. One option is to get behind the idea of open source, providing their hardware so that software vendors can install their solutions and compete with internet giants. In this way, 5G base stations and antennas will be shared across numerous telcos and will resemble a cloud server that is shared by many. Telcos could also create an “edge app” economy by embedding radio chips in home appliances — a way of sidestepping the challenge of rolling out base stations every two houses. That way, apps such as Netflix will work “on the edge,” with disk space on things such as fridges sold for caching content — a very futurist vision, though technically viable. But again, internet giants are in a much better position to create ecosystems of edge apps, given their money, relationships and experience in building the app economy.

The other way in for telcos is to make things much simpler for their customers, introducing “all you can eat” data plans so that mission-critical use cases that need extra-low latency can piggyback on their networks for free.

Whether they are a dumb pipe company or not, the most important thing that telcos can do now is to create new value for customers as the masters of the digital universe go on the offensive.

References

- https://www.scmp.com/tech/big-tech/article/3008594/how-5g-will-unlock-industrial-internet-driving-another-dimension

- https://www.newyorker.com/news/annals-of-communications/the-terrifying-potential-of-the-5g-network

- https://www.ariasystems.com/blog/3-ways-telecoms-will-monetize-5g/

- https://investors.att.com/~/media/Files/A/ATT-IR/financial-reports/annual-reports/2018/complete-2018-annual-report.pdf

- https://www.verizon.com/about/sites/default/files/2018-Verizon-Annual-Report.pdf

- https://abc.xyz/investor/static/pdf/2018Q4_alphabet_earnings_release.pdf?cache=adc3b38

- https://s21.q4cdn.com/399680738/files/doc_financials/annual_reports/2018-Annual-Report.pdf

- https://www.washingtonpost.com/brand-studio/wp/2018/12/14/the-dawn-of-the-5g-world/?utm_term=.821eadc95a99

- http://nymag.com/intelligencer/2018/12/why-verizons-usd9-billion-bet-on-digital-content-failed.html

- https://www.washingtonpost.com/brand-studio/wp/2018/12/14/the-dawn-of-the-5g-world/?utm_term=.b58372d62dac