Insights

- QSRs operate in a highly competitive market where speed of expansion is critical.

- Traditional site management processes are fragmented, causing costly delays and inefficiencies.

- AI and digital twin technologies enable unified, transparent, and automated workflows that reduce risks and accelerate store launches.

- By modernizing site management, QSRs gain a decisive edge in scaling efficiently and sustainably.

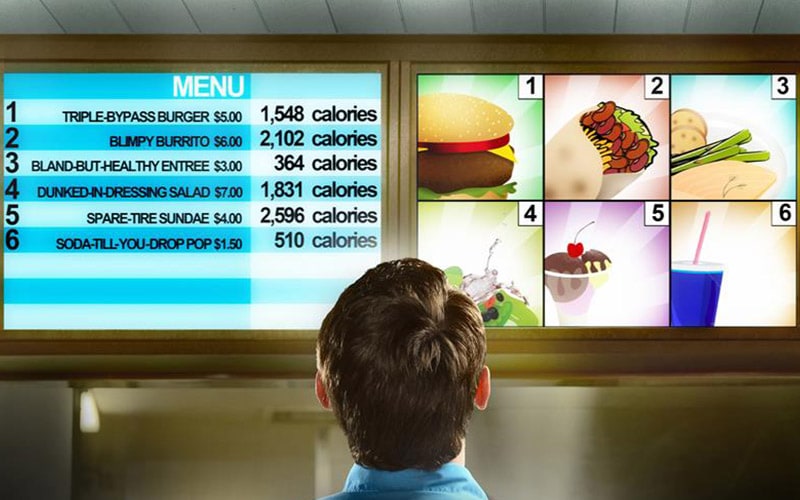

Retailers , especially quick service restaurants (QSRs), operate in one of the most competitive segments of the food industry, where speed and convenience drive customer loyalty. As consumer demand rises, they have to drive new store openings quickly to grow their physical presence, meet demand, and capture market share. There’s also a race to scale operations and open multiple outlets in a short period.

Apart from new openings, managing existing restaurants in terms of shutdowns or renovations also involves multiple stakeholders to execute efficiently. However, from vendor coordination to equipment installation and compliance checks, site management is a web of interdependent processes. Each delay has a ripple effect: postponed openings, increased costs, and lost revenue potential. For QSRs, the challenge is no longer just about expanding fast but about ensuring operational excellence in scaling. It calls for redesigning how site management is orchestrated, using artificial intelligence (AI).

Pain points in site management

The global fast food and QSR market was valued at $266 billion in 2024 and is projected to reach $382 billion by 2033, at a compound annual growth rate of almost 4% between 2025 and 2033. This steady growth shows the QSR sector’s resilience, fueled by shifting consumer preferences toward convenience, menu innovation, and the increasing role of digital technologies in enhancing speed, personalization, and efficiency. Against this background, it is no wonder that QSRs are expanding. Jimmy John’s is set to make its international debut, beyond the US, as its parent Inspire Brands signs new franchise agreements in Canada and Latin America, opening the door to global growth. McDonald's has announced plans to expand its global footprint to 50,000 restaurants by 2027.

But rapid expansion creates both opportunity and complexity for QSRs and retailers in general. Success doesn’t depend only on quality of the products or brand presence, it also depends on how efficiently new sites can be identified, built, and launched.

Success doesn’t depend only on quality of the products or brand presence, it also depends on how efficiently new sites can be identified, built, and launched.

Historically, these activities have involved manual co-ordination between departments and orchestration of the workflow. While some restaurants do this better than others, there has always been a lot of room for improvement. Despite their scale and ambition, many businesses can struggle with fragmented site management practices. The root cause lies in the patchwork of systems, tools, and manual processes including separate spreadsheets and physical documents, and disparate means such as email, and document portals, that are still widely used to coordinate between different functions and manage expansion. As new store openings and site management involves coordination across multiple stakeholders – such as legal, IT, compliance officers, store managers, real estate teams, construction vendors, contractors, and equipment suppliers – these traditional processes make it challenging to monitor the actions involving all. This creates blind spots, as no one has a unified view of progress across all stages of site development.

Systems used by stakeholders are siloed and built for in-department use cases leading to process breakdowns. For example, in a typical store opening cycle, the real estate team might finalize the lease, but construction delays due to uncoordinated vendor scheduling can push back timelines. Meanwhile, operations staff might be left waiting for compliance approvals or equipment delivery, without visibility into bottlenecks. Manual record-keeping compounds the problem, creating scope for human error. Data discrepancies or miscommunication can cause tasks to be duplicated, or worse, missed altogether.

As the number of sites grows, these inefficiencies multiply. A single oversight in scheduling or reporting can result in weeks of delay, costing not just in terms of missed sales opportunities but also reputational damage, as brands fail to deliver on planned openings. Visibility, co-ordination, and approvals remain a challenge, leading to longer lead times, higher expenses, and poor franchisee experience. Also, with sustainability and compliance now central to corporate agendas, QSRs cannot afford to have outdated processes that lack transparency and traceability.

A single oversight in scheduling or reporting can result in weeks of delay, costing not just in terms of missed sales opportunities but also reputational damage, as brands fail to deliver on planned openings.

Rapid growth puts enormous strain on traditional site management systems. Without a more intelligent, integrated approach, QSRs risk falling behind competitors who are able to roll out at new locations faster, more smoothly, and at lower cost.

Drivers of efficient site management

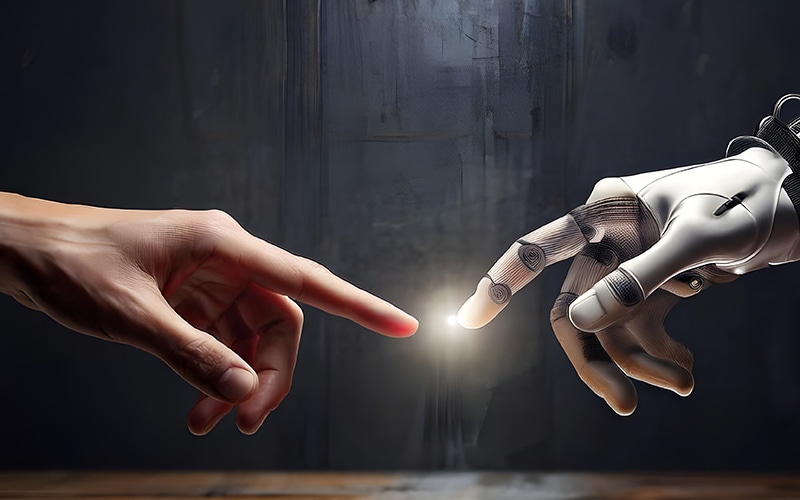

The solution lies in reducing manual coordination and automating the orchestration of the process by adopting a unified agentic AI platform, automation, and digital twin technology. This approach transforms site management into a more streamlined transparent, and data-driven process. By consolidating all stakeholders and workflows into a single ecosystem, it bridges silos in people, processes, data, and technology to drive transformation in business operations. QSRs can gain end-to-end visibility into every stage of site development, right from site selection to grand opening.

AI algorithms in restaurants can analyze vendor performance, predict risks, and flag potential delays before they escalate. Automation streamlines repetitive tasks such as status updates, compliance checklists, and communication workflows, reducing manual effort and minimizing errors. For example, vendor options will be automated through a common portal. The vendor selections are graded against criteria such as quality, integration, capabilities, and feedback is then delivered. The progress on selection, delivery and implementation is reported through the portal, visible to all relevant users. The risks and issues are recorded and reported through automation.

The integration of digital twin technology takes this further. Research shows that across industries, 86% of leaders see digital twins as relevant and valuable for their organizations. Using digital twin technology means that every site can be represented virtually, providing a dynamic mirror of physical progress. Store managers and leadership teams can simulate scenarios, anticipate challenges, and test solutions before they affect real-world operations.

With the advances in AI capabilities, QSRs can model a digital twin of the processes and apply process orchestration and AI-driven automation capabilities to reduce the manual co-ordination effort. Using a digital twin of the physical process, businesses can train the AI model to learn contract review, approvals, follow-ups, training, and external stakeholder management tasks that can otherwise become bottlenecks in the new store opening process. The conservative estimate of benefit – driven by reduced costs, and easier coordination – is the increase in the number of new store openings by 20%, as per the Infosys Consulting framework.

Though the restaurant industry has been a bit slow to adopt these technologies, global restaurant chains are beginning to change their posture. There is interest in adopting platforms that will support workflow orchestration and automation using agents. Retailers such as Walmart and Lowe’s are using digital twins of physical stores to mirror floor plans and site infrastructure, and to improve ways of working for their associates. There are also instances of QSRs using this technology to simulate customer traffic, informing operational and layout decisions.

The impact of this shift is huge. Vendor information, timelines, and workflows will no longer be scattered across silos. Instead, managers can access a dashboard showing exactly where each store stands in its journey to launch. This transparency speeds up decision-making, minimizes errors, reduces communication lags, reduces overall delays and ensures accountability across all stakeholders. Most importantly, it enables QSRs to shorten the time between signing a lease and serving the first customer, while controlling costs, reducing risk, and increasing capacity for new store opening.

By bridging the gap between ambition and execution, an integrated platform becomes more than a technological upgrade. It helps brands with growth that’s strategic and sustainable.

Roadmap to success

Implementing an advanced site management platform is not just about adopting new technology, it is about ensuring that the deployment delivers measurable business impact. To ensure success, QSRs should focus on these critical actions:

- Get the business case right: Before implementation, leaders must clearly define why they are adopting the technology and what outcomes they seek – whether it is faster site openings, reduced operational costs, improved vendor accountability, or enhanced compliance. A well-articulated business use case creates alignment across the organization and sets measurable benchmarks for success.

- Prioritize key site management challenges: Rather than attempting to overhaul every process at once, QSRs should identify the areas causing the most delays or inefficiencies and address them first. For example, some chains might choose to focus on vendor coordination, while others could prioritize compliance workflows or real-time communication. Taking a phased approach ensures smoother adoption and quicker wins, while building momentum for broader transformation. Businesses should also adopt a minimum viable product (MVP) approach to deliver quick-win use cases first. They should get related budgets aligned to support the roadmap of between 12 and 18 months to avoid delays due to budget issues.

- Invest in training and adoption: Technology is only as effective as the people using it. Comprehensive training for store managers, vendor partners, and operational teams ensures they understand how to maximize the platform’s features. Beyond technical training, change management is crucial. Leaders must communicate the value of the platform and encourage new ways of working. When staff are confident and engaged, adoption accelerates.

- Businesses should tie implementation phases to the process areas that will give quick wins – these include areas such as contract review, training content creation and so on, that are mature and can be stood up quickly, building user confidence in AI.

- Integrate with existing systems: QSRs typically operate a range of IT systems such as supply chain platforms, human resource systems, financial tools, and more. Integration with these systems is critical to avoid duplication and ensure data flows freely across the organization. Planning integration before rollout minimizes disruptions and maximizes the platform’s impact.

When these principles are followed, QSRs gain greater visibility into risks, faster turnaround on communications, and smoother vendor coordination. Ultimately, this translates into reduced delays in store openings and stronger market presence. In a sector defined by speed and scale, an intelligent, integrated approach to site management is imperative for future growth.

For QSRs, the ability to scale at speed without sacrificing quality or efficiency is the competitive advantage that will define the winners in the years ahead. And using AI technology in restaurants can be the difference between simply expanding and truly scaling with precision, agility, and sustained profitability.