The global spread of COVID-19 has created an unprecedented situation for the manufacturing sector, resulting from mandated lockdowns across the global ecosystem, not just local or regional ones as in previous disasters. Supply chains are disrupted, stopping the flow of materials, intermediate parts and finished goods. Assembly lines are forced to halt or curtail operations because of a lack of workforce and parts. Innovative adjacencies and health imperatives (like ventilator shortages) have driven product mix changes with alternative components. Even employee health is a serious concern, and physical interaction is risky. Governments and manufacturers should be quick to sense the situation and respond accordingly during such pandemics in the future.

While the immediate impact is challenging, if not brutal, manufacturers can take steps to ensure their survival and then, as conditions improve, relative prosperity. Leaders are already moving forward and implementing changes. Based on recent discussions with clients and updated research, the Infosys Knowledge Institute has identified five areas to plan and accelerate response. We offer these recommendations to assist manufacturers with their recovery and growth plans for the long term.

From crisis nerve center to digital brains

Corporations have moved fast in the fight against the new coronavirus. If they are so nimble in a crisis, why do so many seem slow to act in ordinary times? Perhaps drastic times spur heightened awareness, rapid analysis, and decisive response. This offers a blueprint for maintaining intelligent agility as the crisis subsides.

Manufacturers should evaluate their ability to know what is happening across the enterprise and externally, and to act upon it quickly. The sense-analyze-decide-respond function is a core capability for a live enterprise that exists in a connected, interdependent world. Create a nerve center that connects information collected with experts who can determine recommendations, leaders who can approve, and those who can act on the front line. While a central team in a single location is ideal, the realities of distributed expertise and mandated isolation require use of collaboration tools and adapting to individual circumstances.

When this crisis passes, the nerve center concept can be extended as a digital brain for the entire enterprise. Manufacturers have been on this path for some time (think supply chain network centers), but the pandemic has accelerated this trend along with others, like having a remote workforce.

Digital resilience and 3D printing speed

The COVID-19 pandemic has clearly emphasized the role of technology in business continuity. Digital technology has enabled businesses to retain a sense of normalcy by substituting the bits of online collaboration for the atoms of physical offices and interaction.

Our research has shown that digitally mature companies have greater resilience, and the pandemic has provided further evidence of that resilience, particularly in employee engagement and supply chain operations. Manufacturers that have moved critical applications to the cloud have been able to function more smoothly as their employees access what they need from their homes. Concerns about data security and performance have been either disproven or outweighed by the flexibility cloud applications provide. Enterprises that invested in advanced analytics make even better use of these capabilities. Rolls-Royce has started a global cross-industry alliance called EMER2GENT to consolidate data and harness the power of analytics.1 The purpose is to provide practical applications and new insights in response to COVID-19. One plan is to use the data to identify lead indicators that signal economic recovery cycles to build confidence for investments.

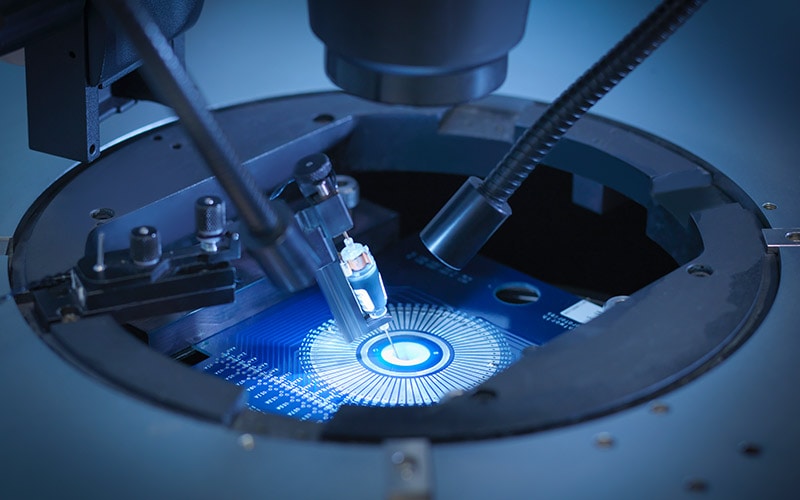

Not only has the pandemic changed norms for the remote workforce, but it will also accelerate the shift to digital manufacturing. Technologies like 3D printing can be pursued more aggressively now that additional use cases have emerged. 3D printing has proven to be a valuable technology to rapidly convert designs to finished products, even for challenging designs, such as ventilators. Regulatory bodies such as the U.S. Food and Drug Administration have helped repurpose 3D printers for lifesaving medical purposes. The FDA has been forthcoming in collaborating with 3D printing experts to set a path for the technology. Designs in clinical settings are validated by the agency and shared widely to achieve scale.

These initiatives depend upon a robust digital platform. For manufacturers who lack one, significant remediation may not be required, because commercially available platforms offer targeted functionality, flexibility and user experience.

Importantly, manufacturers should move their systems and data to the cloud as quickly as possible. Cloud-based solutions enable manufacturers to scale their costs to their revenues, achieving tighter demand-supply agility and financial health.

Secure and future-proof supply chains

Manufacturers can no longer depend upon price as the primary criterion to source components globally. Apple had to limit the online sale of its popular iPhones to two per customer, because of part shortages across Asia. To mitigate similar global supply disruptions in the future, regional supply sources need to be developed. Beyond price, additional materials will be considered national security priorities, creating yet another layer in the patchwork quilt of global trade compliance requirements.

This is imperative for better assessment of supply chain disruption risk, making trade-offs to optimize product cost while ensuring reliable supply. Supply chains have multiple layers, meaning some impacts may not be felt for months, requiring visibility beyond first-tier suppliers.

Manufacturers should accelerate development of local, lower-risk suppliers to supply critical parts in case of supply stoppage across borders. They can assist suppliers to move up the value chain by delegating work of increasing value in the product life cycle — for example, early involvement in design and transfer of proprietary or complex capabilities.

This is also an opportunity for fresh thinking on stakeholder capitalism, a sense of higher purpose as evidenced by medical-device firm Medtronic, which produces the popular PB 560 ventilator. Instead of protecting its intellectual property rights for competitive differentiation, Medtronic decided to share the specifications and let anyone use its design to make this critical product, for the benefit of broader society. According to Medtronic CEO Omar Ishrak, “An unprecedented human challenge requires an unprecedented response.”

New buying behaviors and servitization

Consumer buying behavior has shifted because of the pandemic, along with industrial buying decisions. Well after the stay-in-place orders are lifted, effects of social-distanced commerce will linger. Sales and marketing organizations will need to scramble to adapt to new buying behaviors. Awareness and triggers will change as customers develop different concerns and needs. Each product line should be reviewed in the new context, for affordability, relevance and potential new uses. Many products are traditionally sold face to face because they are high-touch (and high price), like automobiles. Marketers need to create rich, interactive online experiences that give prospective buyers compelling reasons to purchase.

The COVID-19 pandemic is forcing businesses to review all their product lines for potential new uses, affordability and relevance

Accelerate new commercial arrangements, such as SaaS recurring payment models. While hardly new — enterprise software and aircraft “power by the hour“ are examples — affordability is now a critical issue. The lockdown of the entire economy has resulted in loss of income for large population segments, especially those lower in the economic pyramid. When normalcy is restored, affordability will be a pervasive issue. Manufacturers should aggressively adopt commercial arrangements around value add services and subscription-based models, acknowledging new buying behaviors and locking in customers with predictable revenue streams.

The pandemic is helping manufacturers explore the potential flexibility in changing their product lines rapidly once the conditions improve

The pandemic has also demonstrated product mix as a value lever. Using the ventilator example above, healthcare manufacturers do not have the capacity to meet the surge in demand.2 Ford is working with GE Healthcare as part of a consortium to quickly simplify the ventilator design. The production plan calls for 50,000 ventilators in only 100 days. Luxury goods maker LVMH switched from making perfumes to hand sanitizers in only 72 hours, according to media reports. Apparel makers are producing personal protective equipment such as masks and gloves. A silver lining of the pandemic is to show manufacturers potential flexibility to rapidly change product lines when conditions improve, optimize new trends and manage cyclical demand drops.

Employees — protect, motivate, upskill

Whatever the advances in technology, it is humans (employees) who make decisions and perform the work — and are consumers and citizens themselves. The COVID-19 crisis has created personal health concerns, a historic spike in unemployment, and a deep apprehension about the future. To keep employees motivated, many organizations have announced a 90-day window of no layoffs. This period is an opportunity to reskill employees in preparation for post-COVID-19 needs, and online learning platforms have come of age to meet this need.

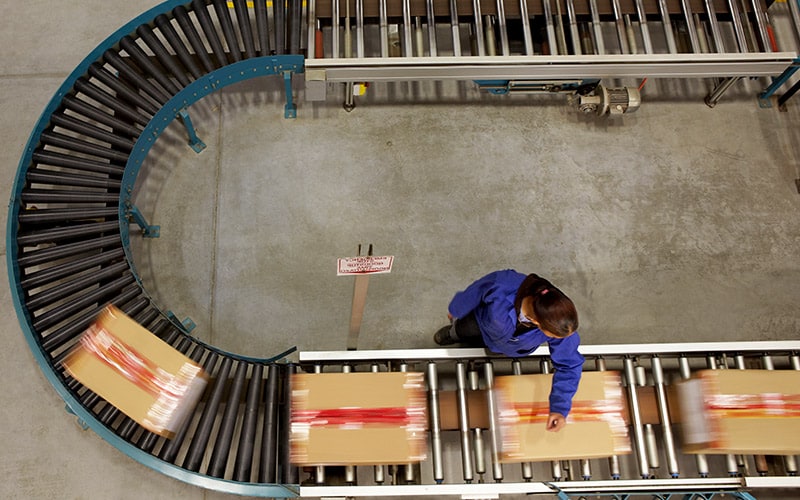

Large enterprises should protect both the health and employment of their employees. Use automation aggressively to reduce infection risk and also improve operations. Walmart’s robot-run warehouse in New Hampshire is an example for micro-fulfillment to reduce human handling of goods, and the concept can be extended to other industries. Communicate assurances on wages and benefits once financial liquidity is addressed.

With more people working remotely and digital becoming the primary mode of transaction and interaction, it is essential to cultivate a new operating environment that will ensure workforce health and productivity. This will also be critical to attract and retain the best employees as conditions improve.

The COVID-19 pandemic highlights the importance of supply chain management and remote work. It is also an opportunity for manufacturers to take a fresh look at their operations and take bold steps to convert these challenges into opportunities for diversification and growth.

References

- Data for good, April 7, 2020, Rolls-Royce

- A better answer to the ventilator shortage as the pandemic rages on, April 3, 2020, WEF