Welcome to the Future of Banking

As banking becomes embedded in consumers’ lifestyles, CMOs must lead the shift from transactional services to intelligent, personalized engagement. This point of view explores how AI is redefining retail banking—and what it means for marketing leaders.

Lifestyle Banking:

Where

AI

Meets Everyday Life with Trust and Ease

Meet Maya. Planning a trip to Japan, she receives proactive nudges from her banking app—budgeting tips, travel perks, currency conversion, and insurance—all tailored to her needs. Later, the same app helps her explore mortgage options and neighborhood insights for a new home. This is lifestyle banking in action: intuitive, anticipatory, and powered by AI.

Key Themes

The New Banking Consumer

Customers expect seamless recognition across channels, predictive engagement, and security that feels intuitive—not intrusive.

AI as the Bridge Between Legacy and Innovation

AI enables:

- Anticipatory Service

- Continuous Authentication

- Contextual Engagement

- Lifestyle Integration

The CMO’s Evolving Mandate

CMOs must shift from campaign execution to experience orchestration—crafting individualized journeys and real-time engagement.

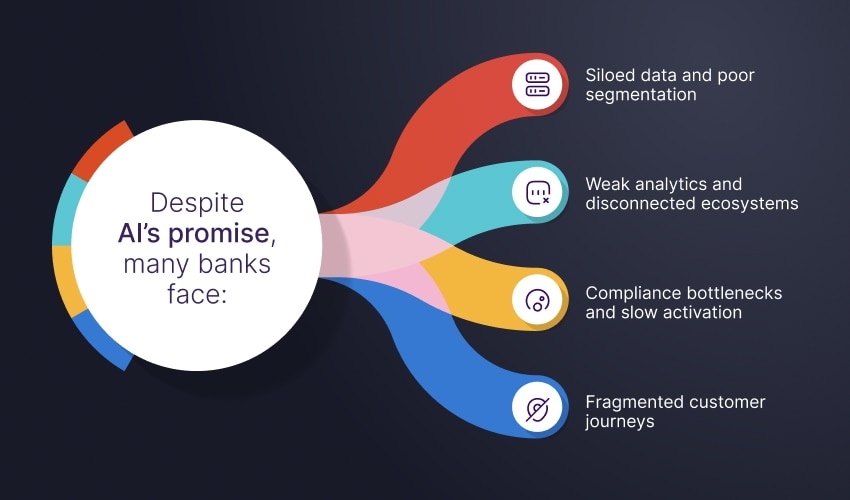

Challenges in the Current Landscape

Strategic Blueprint: Six Levers of Unified Innovation

Product Innovation

Channel Innovation

Marketing Innovation

Content Supply Chain Integration

Unified Customer Intelligence

Consent & Compliance Automation

Ready to lead the lifestyle banking revolution?

Explore how Infosys Aster and other orchestration platforms can help you deliver proactive, trust-led engagement at scale.